The final battle between the US and Japan: the ultimate game between the Fed's interest rate cut expectations and inflation data

2025-08-11 18:00:42

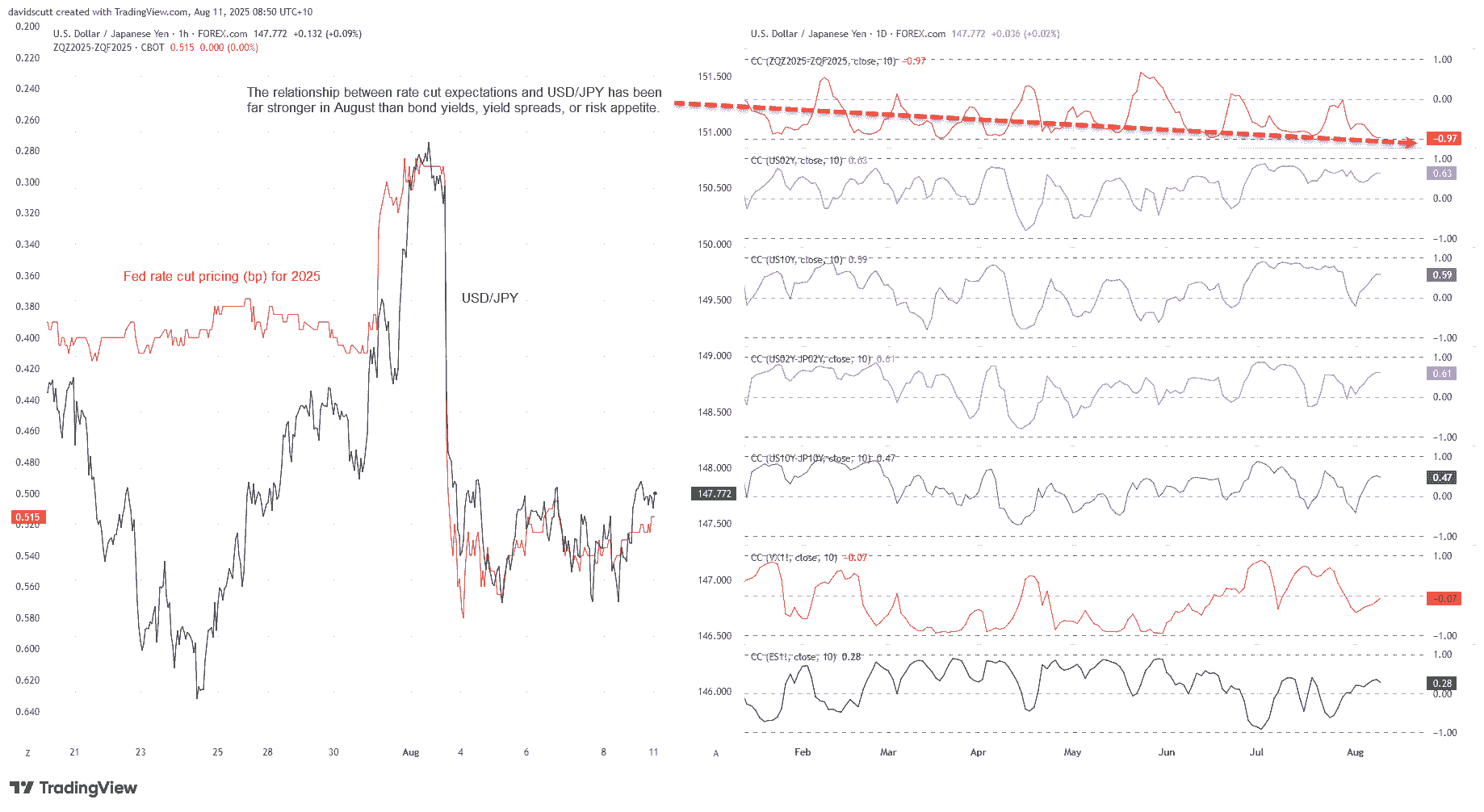

Fed rate pricing remains the main driver

Source: TradingView

Over the past two weeks, expectations of a 2025 Fed rate cut have shown a strikingly negative correlation with the USD/JPY exchange rate, with a coefficient as high as -0.97. When futures market expectations of rate cuts rise, USD/JPY tends to decline, and vice versa. Over the same period, the USD/JPY's correlation with US Treasury yields (both short-term and long-term) and the US-Japan interest rate differential has been far less pronounced. Its correlation with the VIX fear index or S&P 500 stock index futures is also limited, suggesting that the market is currently focusing more on changes in the US short-term interest rate outlook than on risk appetite.

If there is no major change in this trend or no unexpected volatility events, the guiding role of US inflation data on the USD/JPY trend this week will be more prominent.

The main economic data reports that will affect the trend of USD/JPY this week include the US Consumer Price Index (CPI), Producer Price Index (PPI), US import and export data, US retail data, Japan's PPI data, Japan's GDP data, etc. For more economic data and risk events that affect the market, please check the financial calendar .

Given the tendency of key economic and market events in the United States and Japan to trigger significant market volatility, Tuesday's release of the US Consumer Price Index for July is undoubtedly the most critical known risk event on this week's economic calendar. Market expectations call for a 0.2% month-over-month increase in the headline CPI, a slowdown from 0.3% in June. Barring revisions to the previous reading, the annual rate is projected to rise 0.1 percentage point to 2.8%. The core CPI, a key indicator (excluding food and energy prices), is projected to rise 0.3% month-over-month. If this holds true, the annual rate will rise to a disturbing 3% from 2.9% in June.

While commodity prices will be a focal point due to tariff increases, we should not overlook inflationary signals from the services sector—this indicator often better reflects the impact of broader macroeconomic conditions, particularly the labor market. Weak core services inflation, excluding housing and energy services, would help alleviate market concerns that the short-term inflationary effects of tariffs could linger. However, strong services inflation would suggest the opposite.

In addition to the CPI data, the PPI released on Thursday is equally important. This data not only reflects the upstream price pressure caused by tariffs, but also contains several components that directly affect the Federal Reserve's preferred inflation indicator - the core PCE price index.

U.S. import prices and retail sales data on Friday, along with Japan’s producer price index and GDP data on Wednesday and Friday, respectively, are other key events to watch on the economic calendar.

The Fed's public speaking schedule appears relatively light, but traders should still be wary of unplanned comments throughout the week, especially after the CPI report is released on Tuesday. Of the rate-setting members this year, the comments from Schmid and Goolsbee deserve special attention.

Friday's scheduled meeting between US President Trump and Russian President Vladimir Putin in Alaska is another key event risk, potentially triggering USD/JPY volatility later this week. Given the uncertainty surrounding Ukrainian President Volodymyr Zelensky's participation in the meeting, expectations for a lasting peace outcome are naturally cautious. This also suggests that if an acceptable peace agreement is reached between Russia and Ukraine, market risk appetite and the USD/JPY pair could face asymmetric risks, given its role as a funding currency for carry trades.

USD/JPY technical analysis

(Source: Yihuitong)

The USD/JPY pair remained range-bound last week as expectations of a Fed rate cut stabilized – the pair found buying support below 147.00 and selling pressure ahead of the 147.95 resistance level, with these two levels forming the primary focus for traders.

Friday's modest rebound resulted in a three-candlestick "Morning Star" pattern on the daily chart, suggesting that directional risk may be shifting to the upside. However, the pattern's occurrence within a narrow range weakens its technical significance. Momentum indicators such as the Relative Strength Index (RSI14) and MACD are also showing neutral signals, although they are currently tilted slightly towards bullish territory.

If the 147.95 resistance level is broken, the 149.00 and 151.00 levels will be watched. If the closing price (not a brief intraday dip) falls below the 147.00 support level, the bears may test the 146.00 or even 144.40 levels.

Market Outlook

USD/JPY is at a critical turning point, fluctuating significantly between 147.00 and 147.95. Expectations of a Fed rate cut (with a -0.97 correlation) have become the core driver, surpassing traditional factors like Treasury yields . US inflation faces dual pressures: import tariffs are driving up commodity prices, while service sector inflation remains influenced by the labor market. Friday's meeting between the US and Russian presidents could pose geopolitical risks.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.