The Reserve Bank of Australia's decision is coming! Will the rate cut expectation suppress the Australian dollar? We also need to pay attention to the US CPI.

2025-08-12 09:25:14

RBA prepares cautious 25 basis point rate cut

The market expects the Reserve Bank of Australia (RBA) to cut its cash rate by 25 basis points to 3.6% on Tuesday (August 12). Despite the year-on-year decline in the headline consumer price index (CPI) to 2.1%, within the RBA's target range of 2%-3%, and the rise in the unemployment rate to 4.3%, the bank is unlikely to slash interest rates significantly. The decision will be announced at 12:30 Beijing time. The monetary policy statement will be accompanied by quarterly economic forecasts. A press conference by RBA Governor Michelle Bullock will be held at 1:30 Beijing time.

RBA cash rate futures are pricing in a 51% probability of a larger 50 basis point rate cut – a scenario that appears unlikely given the bank’s gradualist approach. The updated monetary policy statement is expected to leave the medium-term inflation forecast unchanged at 2.6%, reinforcing the prudent policy path.

Wage and employment data in focus after RBA meeting

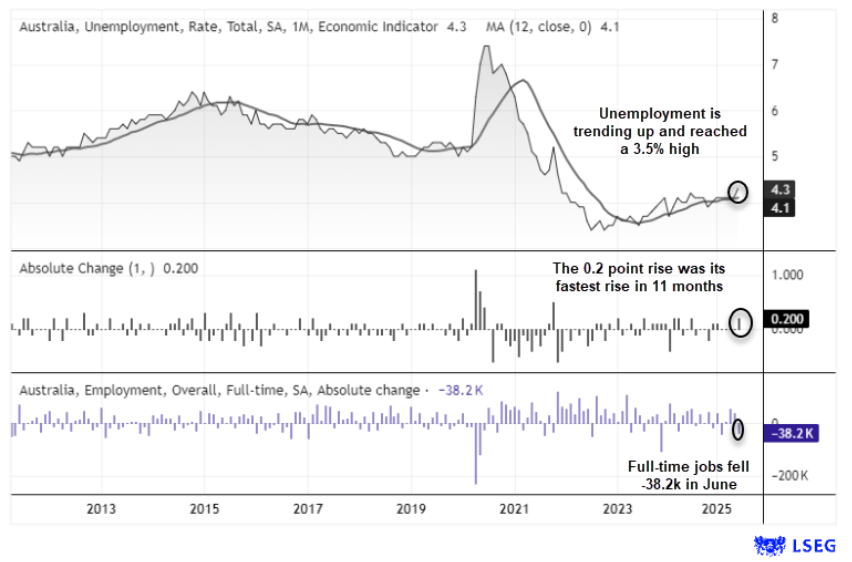

Following the RBA's decision, Wednesday's wage price index (WPI) and Thursday's employment report will follow. A cautious rate cut, coupled with weak employment data, could give the RBA the leeway to cut rates again in October or December. With full-time employment falling by 382,000, while the unemployment rate rose to 4.3% in June from 4.1% in May, according to the Australian Bureau of Statistics (ABS), Australian dollar bears will be watching closely for new downside catalysts. Other details from the employment report showed that employment increased by 2,000 in June, but full-time employment fell by 38,200. Markets predict the Reserve Bank of Australia will continue to cut its benchmark interest rate, reaching 3.10% or lower by early next year.

The picture shows Australia's unemployment rate statistics

However, updated economic forecasts and a possible split vote could provide new surprises for the central bank's future path on interest rates. Changes to the Monetary Policy Committee (MPB) led to an unexpected outcome in July, shocking markets. At the press conference following the July policy decision, RBA Governor Michelle Bullock explained that the bank could no longer provide guidance, as interest rate decisions were entirely at the discretion of the Board and could not be prejudged. However, Bullock did note that markets "can expect interest rates to fall if inflation slows as expected" and that policy decisions "will be based on our forecasts for future inflation."

Therefore, if the central bank lowers its inflation and growth forecasts, it could increase the likelihood of further rate cuts, triggering a new downtrend in the Australian dollar. Conversely, if Bullock downplays the risks to the economy from US tariffs and reiterates that "a modest and gradual approach to monetary policy easing is appropriate," Australian dollar buyers could regain control.

Traders need to pay attention to US CPI

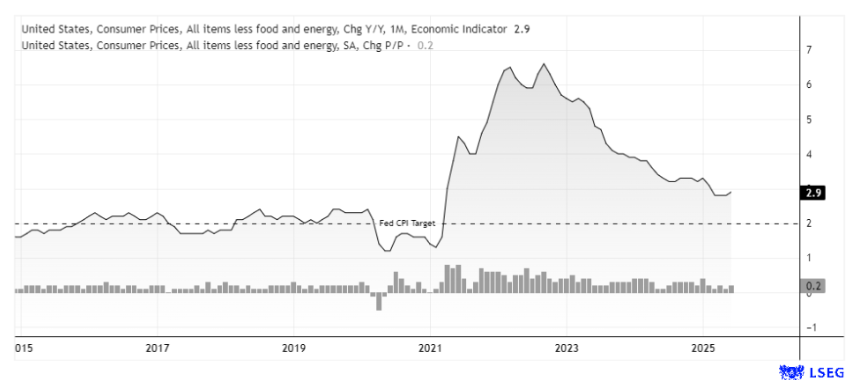

The US CPI data, released on Tuesday evening (August 12th), could be a decisive factor in the Federal Reserve's September policy decision. The core CPI rose 0.2% month-over-month in June, bringing the year-over-year figure to 2.9%, but a reading of 3% or higher could weaken expectations of an impending rate cut. Such a surprise could boost the US dollar and put pressure on the Australian dollar, especially given the currency's strong negative correlation with the US dollar index (-0.86 over the past 10 days).

The picture shows the trend of US CPI

Commitment of Interest (COT) AUD/USD Futures

Data from the U.S. Commodity Futures Trading Commission (CFTC) shows that net short positions in the Australian dollar against the U.S. dollar have climbed to a multi-month high, with large speculators and asset managers taking significant short positions. A recent bearish outside weekly pattern suggests sellers are in the driver's seat – but if AUD/USD stabilizes after the RBA meeting, short-covering could trigger a rally towards 0.66.

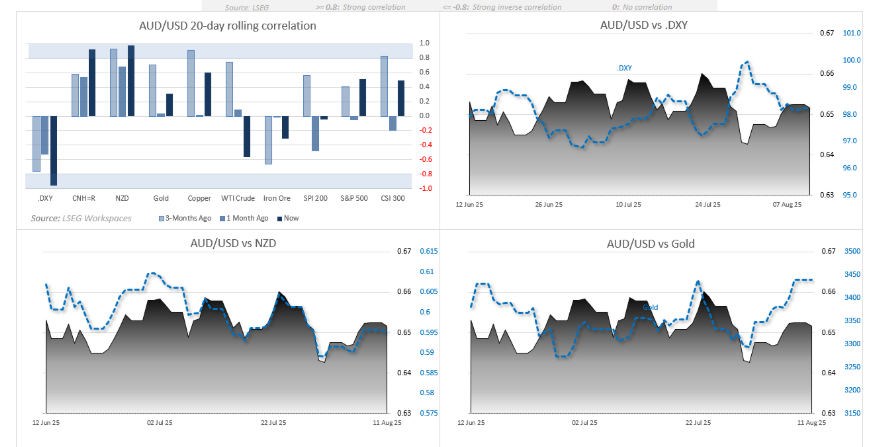

AUD/USD Correlation:

The Australian dollar has been most strongly correlated with the New Zealand dollar since July. Tuesday's Reserve Bank of Australia meeting (August 12) could be a catalyst for a divergence between the two currencies. While the inverse correlation between the Australian dollar and the US dollar index has weakened slightly over the past 10 days, it remains strong at -0.86.

The correlation between the Australian dollar and the Chinese yuan has fallen sharply over the 10-day period, but remains strong over the 20-day lookback period and has remained generally stable over the 60-day period. It would not be surprising to see a rebound in this short-term correlation over the coming week.

The figure shows the correlation statistics between the Australian dollar and other trading varieties

Technical Analysis

The Australian dollar has risen nearly 2% from its recent cycle low, but resistance lies at 0.6560 (the weekly opening level) and 0.6593 (near the July high volume zone). A bearish engulfing pattern on the weekly chart suggests a potential swing high, or right shoulder, is forming. Bearish targets a retest of the 200-day moving average support at 0.6452. AUD/USD faces increased downside risk ahead of the RBA showdown, having encountered resistance around the 0.6550 level on several occasions.

(AUD/USD weekly chart, source: Yihuitong)

The 21-day MA crossed below the 50-day moving average (MA) from above, confirming a bearish crossover on the daily chart. Despite this, the 14-day relative strength index (RSI) remains above its midline.

A dovish rate cut from the Reserve Bank of Australia (RBA) could help Australian dollar bears, pushing AUD/USD towards the August 5 low of 0.6450, which lies close to the 100-day moving average. Failure to hold this level could threaten the August low of 0.6419, with the psychological barrier of 0.6350 emerging below. Conversely, buyers would need to break through 0.6560 to resume the advance toward 0.6600. The next upside target is the July 24 high of 0.6625.

(AUD/USD daily chart, source: Yihuitong)

At 9:22 Beijing time, the Australian dollar was trading at 0.6510/11 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.