The fog of the Fed’s interest rate cut: the “noise” of economic data is more difficult to resolve than political pressure!

2025-08-14 16:56:09

Expectations of interest rate cuts amidst political noise

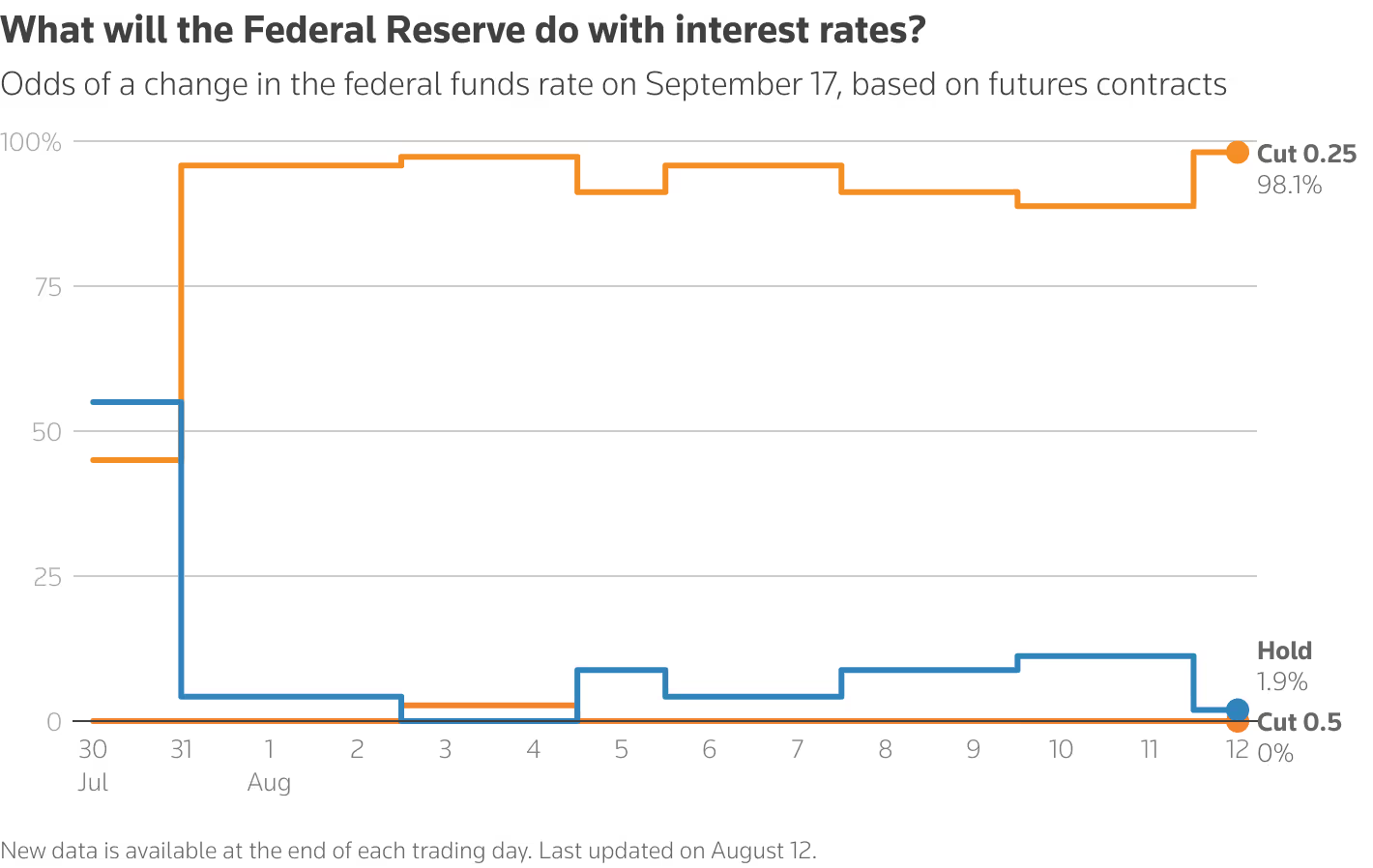

Trump's public criticism of the Federal Reserve is no longer news. His repeated calls for rate cuts, even threatening a "major lawsuit" against Powell, have led to widespread belief that political pressure is the Fed's biggest concern. However, the reality is more complex. Political factors aside, the Fed's internal stance on rate cuts has long been clear. The June "dot plot," a summary of economic projections, shows that Fed officials generally expect a 50 basis point rate cut by December 2025. Market traders are betting on the first rate cut in September, with the interest rate futures market pricing in a near 100% probability of a rate cut at the September 16-17 meeting.

This market enthusiasm seems unstoppable, but the question is whether the economic data truly supports such aggressive expectations. The answer is unclear. Powell has repeatedly emphasized that the Fed's decisions will be based on the "total data," but current indicators are a confusing mess: some call for early policy easing, while others warn of the high risks of rate cuts. In this tug-of-war between data and expectations, the Fed treads on thin ice every step of the way.

(A summary of the changes in the probability of a September Fed rate cut as shown by interest rate futures)

Inflation and employment: conflicting data signals

Inflation concerns: core CPI exceeds expectations

July's US inflation data added further uncertainty to the debate. The headline Consumer Price Index (CPI) rose 2.7% year-on-year, unchanged from the previous month, seemingly stabilizing on the surface. However, the core CPI (excluding food and energy prices) rose 3.1% year-on-year, the highest level since February and well above the Federal Reserve's 2% target. More worryingly, durable goods prices rose 1.7% in the first six months of this year, the largest six-month increase since 1987 (excluding the pandemic period). HSBC global economist James Pomeroy warned that upward pressure on commodity inflation could intensify as Trump's tariffs take effect.

These data suggest that inflation is not fully under control. The stubborn performance of the core CPI and the upward trend in commodity prices make it difficult for the Federal Reserve to justify an immediate interest rate cut. After all, hastily easing policy while inflation remains above target would be tantamount to adding fuel to the fire.

A complex picture of the job market

Meanwhile, the July jobs report was equally confusing. Job growth fell far short of expectations, with the previous two months experiencing the largest downward revisions on record, raising alarm bells. However, accelerating wage growth, increased work hours, and only a slight increase in the unemployment rate provided some positive signals for the labor market. These conflicting data have left both the market and the Federal Reserve unsure whether the labor market is cooling or remaining robust.

The market is clearly more focused on the softness in the jobs data, with investors seemingly believing the Fed's threshold for a rate cut is far lower than its threshold for maintaining the status quo. However, Powell has explicitly stated that a significant rise in the unemployment rate is a prerequisite for a rate cut. However, the post-pandemic labor market is distorted by supply constraints: employers are reluctant to lay off workers, and Trump's immigration policies have limited the number of job seekers. This makes the unemployment rate data potentially inaccurately reflect economic reality, further complicating the Fed's decision-making process.

Risks of interest rate cuts and prudent decisions

The illusion of financial market prosperity

Judging from the performance of financial markets, the urgency of a rate cut does not seem obvious. The S&P 500 and Nasdaq are near all-time highs, gold prices have hit new highs, and corporate bond spreads have narrowed to their lowest levels in years. These signs suggest that the current policy environment is far from "restrictive." In this context, would a hasty rate cut by the Federal Reserve truly be consistent with risk management principles? Economist Phil Suttle bluntly stated: "Preparing to cut interest rates in the context of full employment and accelerating inflation could be a risky move."

Powell's communication challenges

Perhaps the biggest challenge for Powell is explaining the Fed's stance to the market and the public. Cutting interest rates before unemployment has significantly increased would be difficult for the Fed to justify. Furthermore, political pressure from Trump makes every public statement by Powell tread carefully. If the Fed acts hastily due to external pressure, its independence and credibility could be undermined. Therefore, patience and caution are the most rational options at this time.

A choice in the fog: Where is the Federal Reserve going?

The Federal Reserve stands at a critical crossroads. Noise in economic data obscures the rationale for rate cuts, while the shadow of political pressure makes every decision fraught with controversy. Market expectations for a September rate cut are virtually certain, but Powell and his colleagues need more convincing evidence. Against the backdrop of lingering inflationary pressures, conflicting employment data, and buoyant financial markets, the Fed may need more time to clarify its signals and identify the optimal timing for a rate cut.

This game not only concerns the future of the US economy but also tests the Federal Reserve's wisdom and fortitude in a complex environment. Amidst the fog of data and political turmoil, can Powell lead the Fed to a steady path? The answer may gradually emerge from the upcoming economic data and market reactions.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.