Tonight's ADP data could trigger a Euro crash! Technical support and fundamentals are in fierce competition.

2025-09-04 16:38:20

Wednesday's weak JOLTS job openings data further solidified the labor market's sluggishness and reinforced market expectations of an imminent Federal Reserve rate cut, a view subsequently reinforced by comments from Fed Governor Christopher Waller and Atlanta Fed President Raphael Bostic.

Investor expectations for the Federal Reserve to ease policy at its September meeting rose to 97% from about 87% the day before, easing concerns about ballooning fiscal debt in major economies that had plagued markets earlier this week. The yield on the 30-year U.S. Treasury bond retreated from a high of 5% on Wednesday to below 4.90%, while the yield on long-term German government bonds in Europe also fell to 3.35% from a multi-year high of 3.43%.

However, market sentiment remains cautious. Today's focus shifts to the US ADP employment report, which is expected to show relatively weak job growth, setting the tone for the non-farm payroll data. If Friday's non-farm payroll data confirms labor market weakness, it could prompt the Federal Reserve to announce a 25 basis point interest rate cut at the Federal Open Market Committee (FOMC) meeting on September 17.

Investors remain cautious ahead of US jobs data

Easing debt concerns and fading risk aversion are providing support for the euro, but investors remain reluctant to short the dollar on a large scale, wary of potential surprises in the non-farm payroll data that could weaken expectations for a September rate cut. Against this backdrop, the euro is likely to continue fluctuating within its previous range .

Data released on Wednesday showed that the US JOLTS job openings fell to 7.181 million in July, a nearly one-year low and well below the 7.40 million expected by market analysts. In addition, the June data was revised down to 7.357 million from 7.437 million.

Later that day, Federal Reserve Board Governor Christopher Waller hinted in an interview with CNBC that the Fed may start cutting interest rates in September and "may see multiple rate cuts in the next six months." Atlanta Fed President Raphael Bostic also expressed support for a rate cut in 2025, but stressed that inflation remains the Fed's primary focus .

It was also reported on Wednesday that the candidate nominated by US President Trump for the Federal Reserve Board (to replace Adrienne Kugler) promised at a Senate Banking Committee hearing that he would firmly maintain the independence of the Federal Reserve.

On the Eurozone economic calendar, the focus on Friday will be on July retail sales data, which is expected to show a 0.2% month-on-month decline (after a 0.3% increase previously).

US markets are focused on the ADP private sector payrolls data due Thursday evening, with expectations of 65,000 new jobs added in August (down from 104,000 in July). This relatively weak reading is likely to exacerbate market concerns about a weakening labor market and set the tone for Friday's non-farm payroll report, significantly increasing the downside risks facing the US dollar .

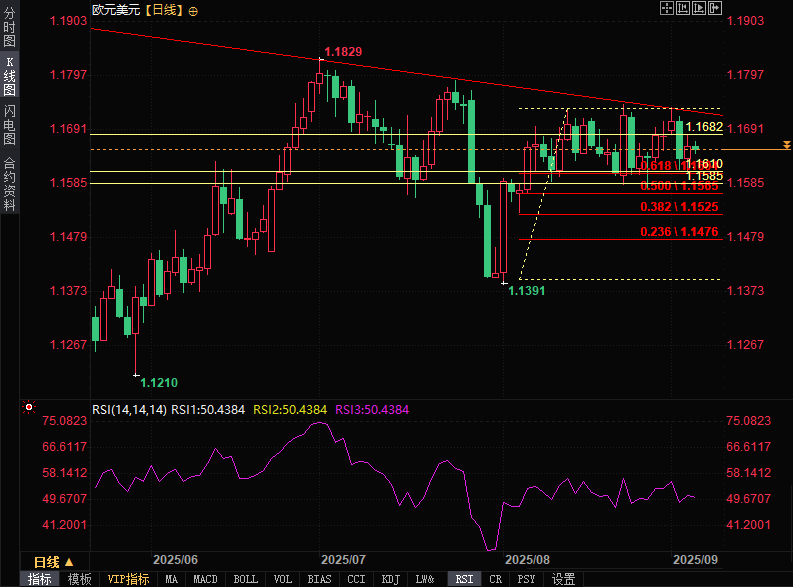

The euro remains vulnerable against the dollar, with short sellers targeting the 1.1585 support area.

The euro has shaken off the bearish pressure seen earlier this week against the dollar, but is not yet out of the woods. Market sentiment remains cautious, with long-term yields still near record highs and the uncertain political situation in France continuing to weigh.

Technical indicators show a lack of clear directional bias, but the exchange rate remains relatively close to the bottom of the nearly four-week trading range (1.1585 area).

Near-term support is near Wednesday's low of 1.1610, with key support seen in the 1.1575-1.1590 range (which effectively contained bearish activity on August 11, 22, and 27). Further downside could see the 50% Fibonacci retracement level of the early August rally (1.1565) offer potential support, with further support around the August 5 low of 1.1530.

On the upside, Wednesday's high of 1.1682 constitutes initial resistance, followed by the downward trend line (current entry point around 1.1725) and the 1.1735 area (this position has suppressed bullish offensives several times on August 13, 22 and September 1).

(Euro/USD daily chart, source: Yihuitong)

At 16:29 Beijing time, the euro was trading at 1.1651/52 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.