The Fed's interest rate cut suspense hinges on this! Five charts reveal the key to its decision-making process

2025-09-17 10:53:18

The Federal Reserve has so far resisted President Trump's calls to lower its benchmark interest rate, which directly affects borrowing costs for businesses and consumers. Trump has pointed to relatively tame inflation this year as evidence the Fed has been too slow to lower borrowing costs.

In addition to pressure from Trump to cut rates, the Fed faces growing economic uncertainty ahead of its Sept. 17 meeting, which increases the risk weight of its rate decision.

On the one hand, the labor market is showing signs of weakness, with hiring stalling, which supports rate cuts. On the other hand, inflation is creeping higher under the pressure of the Trump administration's tariffs—a reason the Fed has previously cited for keeping its benchmark interest rate unchanged this year.

Further complicating matters is Trump's pressure on the Fed to cut interest rates, to which Fed Chairman Powell responded by emphasizing the Fed's independence, noting that the Federal Open Market Committee (FOMC) bases its decisions on economic data, not political pressure .

Erasmus Kerstin, an economics professor at Villanova University, noted: "The committee needs to comprehensively assess the biggest downside risks to the economy and weigh them at the end of the meeting - this is both a science and an art."

When does the Federal Reserve announce its interest rate decision?

The Federal Reserve will announce its latest interest rate decision at 2:00 p.m. Eastern Time on September 17 (2:00 a.m. Beijing Time on September 18).

The CME FedWatch tool puts the probability of a 25 basis point rate cut at 96%, while the tool also suggests there's only a 4% chance of a larger 50 basis point cut.

Economists will also closely monitor whether the Fed provides forward guidance on the path of rate cuts at its two subsequent meetings in 2025 (October and December).

What data will determine the Fed's decisions?

The Federal Reserve has a so-called "dual mandate," which is to keep inflation low while achieving full employment.

But these two goals may conflict: rising inflation requires the Fed to curb it by raising interest rates, but raising interest rates will increase borrowing costs for businesses and consumers, thereby suppressing spending; conversely, the most effective way to deal with high unemployment is to cut interest rates, because lowering interest rates can reduce the cost of business expansion and promote hiring .

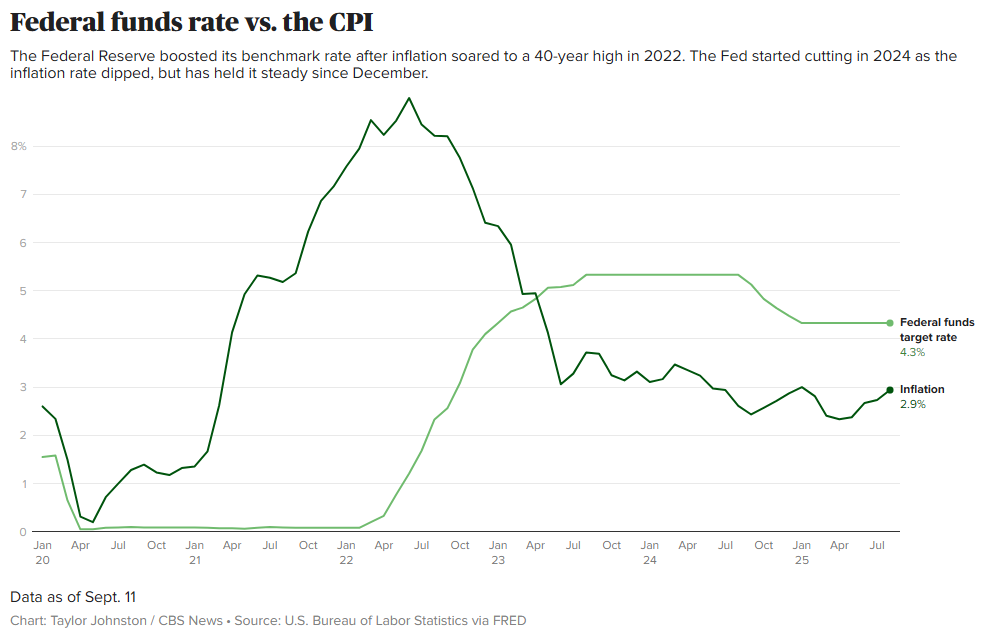

The Fed continued to raise its benchmark interest rate after inflation surged to a 40-year high in 2022. As inflation receded in 2024, the Fed began a cycle of rate cuts but has held rates steady since December.

Fed officials will closely scrutinize inflation and employment data to weigh which of their dual mandates deserves priority.

(Comparison chart of federal funds rate and CPI trends)

Meanwhile, the labor market is showing signs of weakness: several industries, including manufacturing, which Trump has vowed to revive, cut jobs in August. This has led to a significant slowdown in hiring—employers added only 29,000 jobs per month from June to August, far below the monthly average of about 106,000 in 2024.

"Balancing these two conflicting objectives will be very difficult, but that is the challenge the Fed must face," Kerstin said.

(Monthly employment changes in the United States)

Does the United States have different problems than other countries?

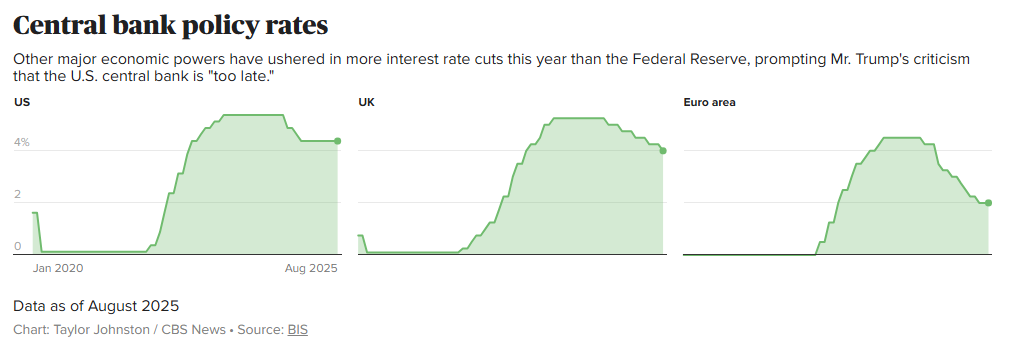

Trump criticized the Fed's on-hold approach this year by contrasting it with decisions by other central banks, noting that institutions such as the Bank of England and the European Central Bank have cut borrowing costs.

"Europe has cut interest rates 10 times and we haven't cut them once," Trump wrote in a June social media post. "No inflation, Strong Economy - our interest rates should be cut by at least 2-3 percentage points!"

(Comparison of policy interest rates of major economies around the world)

Yet the United States faces an urgent challenge that no other country has faced: the tariffs implemented by Trump .

Because tariffs are import taxes paid directly by U.S. companies to the federal government, their costs are primarily borne by American businesses and consumers, not by other countries. The White House claims that overseas exporters are the primary bearers of tariffs, while Trump administration officials argue that achieving more balanced trade with U.S. economic partners will create jobs, revitalize manufacturing, and generate revenue for the federal government in the long run.

Federal Reserve Chairman Powell cited tariffs as one reason for the Fed's caution, given that many economists believe import tariffs will reignite inflation in the United States. The Consumer Price Index (CPI), a closely watched inflation indicator, rose 2.9% year-on-year in August, the largest increase since January. The CPI data showed that highly import-dependent goods such as coffee, audio equipment, and home furniture saw the largest increases last month.

If other central banks slow down their easing pace and the Federal Reserve accelerates interest rate cuts, the dollar's relative interest rate advantage will shrink.

How can American consumers afford it?

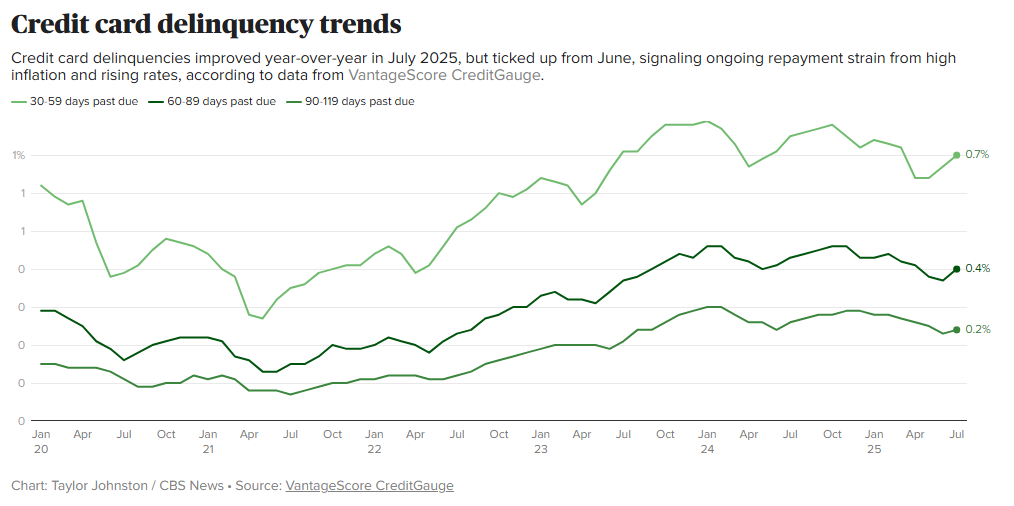

Many Americans are growing pessimistic about the economic outlook , feeling the pinch from rising costs of everything from housing to groceries.

A recent CBS News poll showed that two-thirds of Americans said prices have continued to rise over the past few weeks, and the same proportion expect this trend to continue. More than half of consumers believe the U.S. economy is worsening, while only about a quarter believe it is improving.

The CPI has continued to climb since falling to an annual rate of 2.3% in April, just above the Fed's 2% target.

(Credit card overdue trend chart)

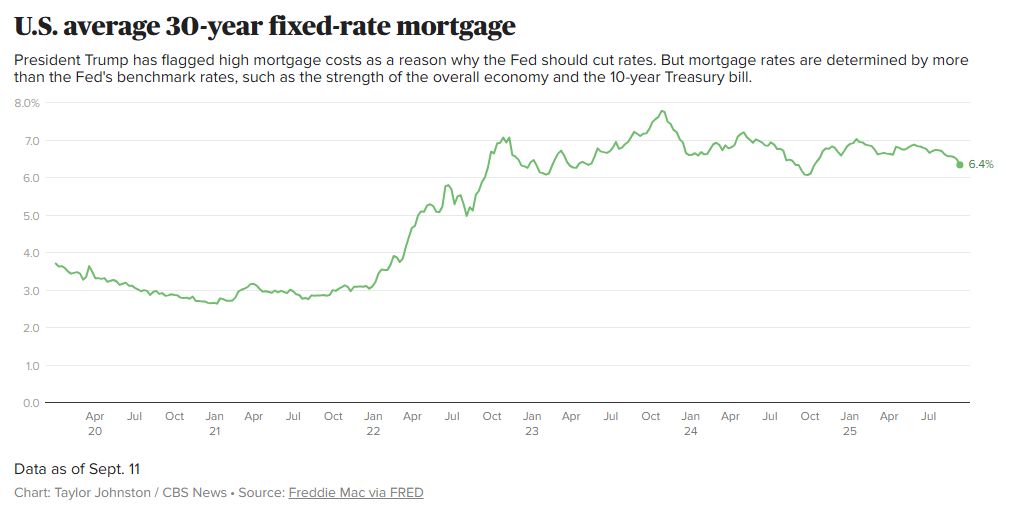

Meanwhile, President Trump has pointed to mortgage rates, which are near 7% through most of 2025, as contributing to the weak housing market.

"Can someone tell Powell that he is always too late and is severely damaging the housing industry? People can't get mortgages because of his policies. There is no inflation at all and all signs point to a big rate cut," the president wrote in an Aug. 19 social media post.

(Average interest rate for a 30-year fixed-rate mortgage in the United States)

However, mortgage rates are influenced not only by the Federal Reserve's benchmark interest rate but also by a variety of factors, including the strength of the U.S. economy and the 10-year Treasury yield. Recently, due to market expectations of a Fed rate cut and weak economic data, mortgage rates have fallen, reaching 6.35% in the week ending September 11.

Experts point out that even so, interest rate cuts can still ease pressure on some consumers by reducing borrowing costs .

"A falling interest rate environment will provide some breathing room for borrowers, whether they're homeowners with 7% mortgages or recent graduates looking to restructure their student loans and credit card debt," Bankrate financial analyst Stephen Cates said in an email. "Lower interest rates will provide relief to many indebted households through refinancing or debt consolidation opportunities."

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.