Gold prices fell back after hitting a new high. Can the upward trend continue after the Fed’s decision?

2025-09-17 12:06:59

Preview of the Federal Reserve decision: Is a rate cut a foregone conclusion?

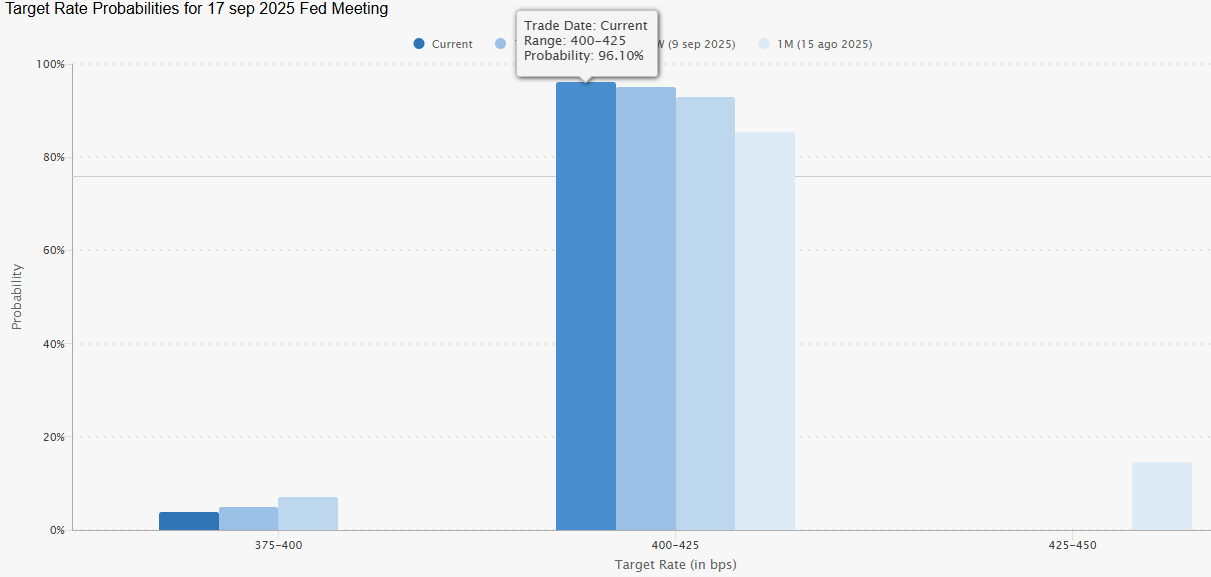

On the eve of the Federal Reserve's interest rate decision, all signs pointed to a 25 basis point rate cut—from 4.5% to 4.25%. CME data continued to confirm this expectation: the probability of a rate cut on August 15 was 85.41%, and as of Tuesday, it had climbed to 96.10%, making any other outcome highly unlikely.

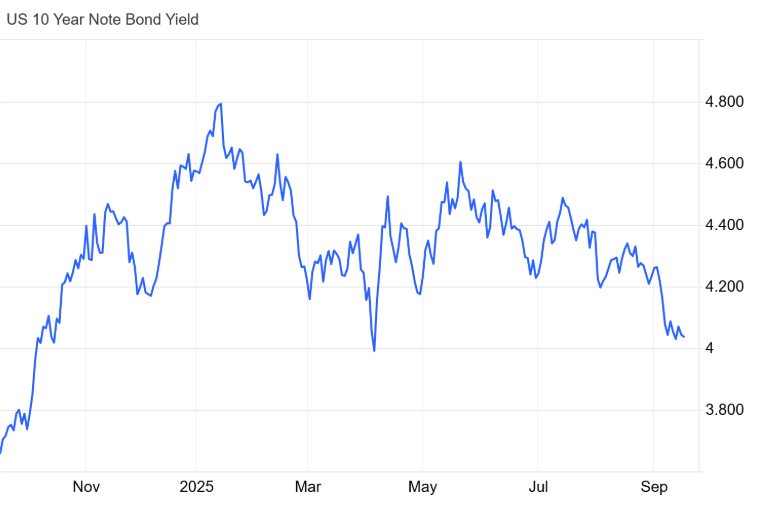

As this scenario became increasingly apparent, its impact also spread to the 10-year Treasury bond, where yields continued to decline, approaching the 4.0% mark, hitting a new low since April. So far, this trend shows no signs of reversing: market expectations of Fed rate cuts have been almost directly transmitted to the yield curve, weakening the appeal of US Treasuries relative to other assets.

The current environment is ideal for gold. While both bonds and gold are safe-haven assets, gold's importance as an alternative becomes significantly greater when bond yields weaken . Since gold doesn't pay interest or dividends, its appeal naturally increases when yields on interest-bearing assets decline. Weakness in fixed income markets is becoming a key driver of gold demand in the short term .

If the Federal Reserve cuts interest rates as expected and strengthens its signal of maintaining an accommodative stance this year, downward pressure on the bond market may continue, thereby supporting gold demand and maintaining the bullish trend of spot gold.

Is the US dollar weakening?

Beyond the bond market, low interest rates are also impacting the US dollar, which has continued to weaken in recent weeks. The US dollar index (DXY), which measures the greenback's performance against a basket of currencies, fell below 97 on Tuesday, briefly approaching its July 1 low of 96.54, and is currently trading at 96.74.

The US dollar index fell significantly on Tuesday and experienced a slight technical correction on Wednesday, but this did not affect the overall bearish trend. At the same time, the US dollar index has technically fallen below the downward channel formed in the past two months, further strengthening the bearish trend.

(Daily chart of the US dollar index, source: Yihuitong)

A weak dollar is directly beneficial to gold. First, the two are competing for their safe-haven properties: the weakening credit of the dollar drives funds into gold; second, because gold is priced in US dollars, the depreciation of the dollar enables international buyers to purchase it at a lower cost, thereby boosting global demand.

In this context, as long as DXY maintains its downward trend and the US dollar continues to weaken, the buying pressure on gold will be difficult to dissipate in the short term .

Spot gold technical analysis

The rally that began on August 20 pushed gold prices to a record high of $3,702.93 per ounce, confirming the dominant bullish trend on the chart.

However, there were signs of a pullback during Wednesday's Asian session, suggesting that this long-term uptrend may be experiencing a period of pause. Generally speaking, when prices remain near their highs, a short-term technical correction is inevitable.

The daily relative strength index (RSI) remains above 70, firmly in overbought territory, a reading that highlights robust buying momentum.

The MACD histogram is still above the zero axis, but has begun to show gradually shrinking bars, indicating that the short-term bullish momentum is weakening, which suggests that a consolidation process may be needed in the next few trading days before returning to the uptrend.

Key point analysis:

$3,700 – Major Resistance: This is both a historical high and the most important psychological level in the short term. A successful break above this level will strengthen the bullish bias and could extend the dominant trend to new targets.

$3640 - recent barrier support: a neutral point formed in the past few trading days. If the short-term retracement continues, this position may be converted into an initial support level.

$3,500 - key support level: corresponding to the high position before April, it has now been converted into important support. If the price returns to around this point, it will test the strength of the current upward trend; once it falls below, the risk of intensified bearish tendencies will increase.

(Spot gold daily chart, source: Yihuitong)

At 12:03 Beijing time, spot gold was trading at $3,681.56 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.