The Bank of England won't cut rates, but why did the pound surge and then fall? The real test is approaching!

2025-09-18 19:24:43

This decision, against the backdrop of high CPI annual rates (3.8%) and core CPI (3.8%) in August and the upward revision of the GDP forecast for the third quarter to 0.4%, highlights the central bank's cautious balance between inflation stickiness and weak economic growth.

The Bank of England's Monetary Policy Committee (MPC) voted 7-2 to maintain the base rate at 4.00%, in line with market expectations. It also reduced the annual scale of quantitative tightening (QT) from £100 billion to £70 billion, slightly above the market's median forecast of £67.5 billion. This fluctuation reflects the market's brief optimism about stable interest rates being quickly diluted by supply pressures from slowing QT, shifting trading sentiment from "dovish expectations" to "neutral digestion."

The current market context needs to be contextualized within the global macroeconomic landscape. Yesterday (September 17th), the Federal Reserve cut interest rates by 25 basis points to a range of 4.00% to 4.25%. The dot plot suggests only two further easing measures for the entire year. Coupled with risk aversion fueled by Trump's tariff rhetoric, the US Treasury yield curve flattened, and the US dollar index stabilized at 101.50. The European Central Bank maintained its deposit rate at 2% last week, highlighting inflation uncertainty. In the UK, wage growth stickiness (increased corporate social security contributions delaying the decline in labor costs until 2026) has exacerbated divisions within the MPC: dovish members Singla and Taylor advocate a 25 basis point rate cut, while Chief Economist Peel insists on maintaining the QT scale, arguing that its market disruption is limited. Prior to the decision, retail investors were betting on a "stable interest rate push for the pound to break through 1.37," while institutional investors expected no action before November, with a probability of only 33%.

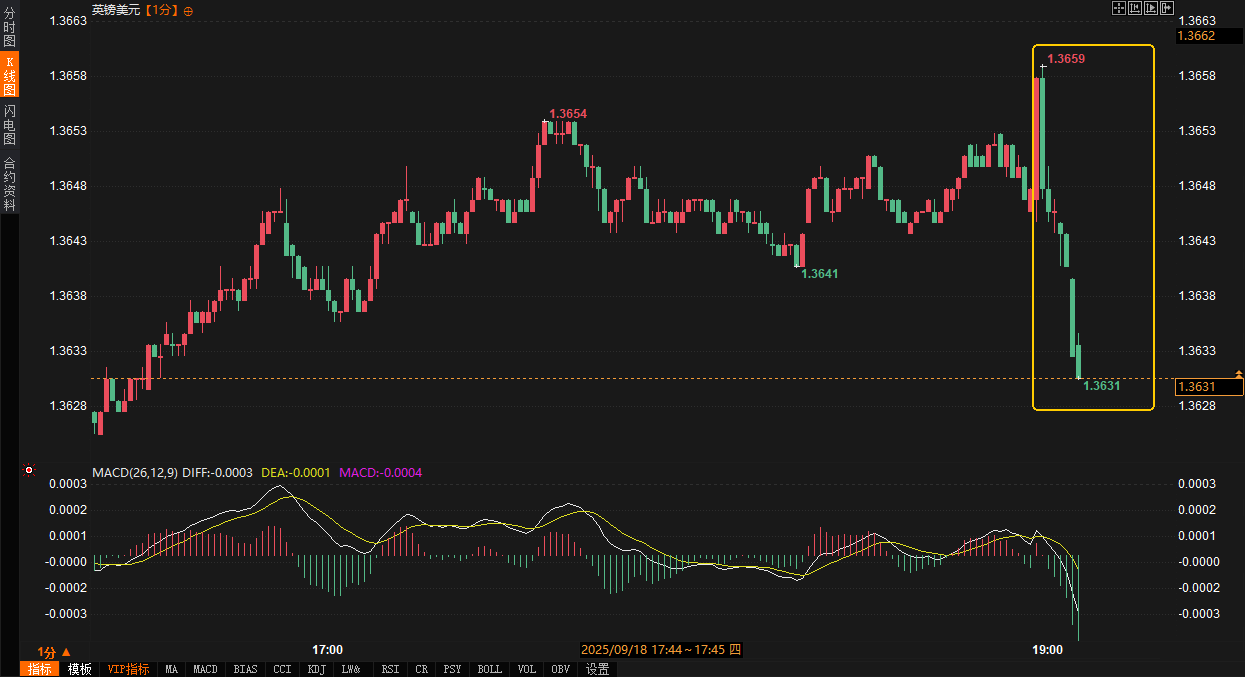

Real-time quotes: British pound rises and then falls, bond market stabilizes

The market trajectory following the decision confirmed traders' instinct to "sell the facts." The British pound rallied briefly to 1.3659, capitalizing on the positive impact of stable interest rates. Trading volume surged 20%, leading to an influx of long positions. However, the details of the QT tapering—a 40:40:20 split of government bond sales for the 2025/26 fiscal year (short-term, medium-term, and long-term), with a reduction in long-term bond sales to mitigate market volatility—triggered supply concerns, sending the pound tumbling over 30 pips to below 1.3650.

Bond market reactions were mixed: the two-year gilt yield fell 1.5 basis points to 3.95%, reflecting rising expectations of short-term easing; the 10-year yield was little changed, falling 0.5 basis points to 4.62%, reflecting long-term investors' vigilance against fiscal pressures. The FTSE 100 edged up 0.1% to 8250, led by a 0.5% gain in banks. Energy and consumer sectors came under pressure, with trading volume thin.

Historically, the August 2024 rate cut (from 5.25% to 5.00%) triggered a 50-point plunge in the British pound and a surge in the 10-year yield to 4.80%, which the market interpreted as "premature easing." The current stabilization more closely resembles the "wait-and-see" pattern of June 2025, with the pound fluctuating by only 10 points and the yield curve stabilizing. The latest quotes show that the British pound rebounded over 150 points from its August low of 1.3500, but the intraday decline erased some of these gains, highlighting the double-edged effect of the QT slowdown: while easing bond supply pressure, it reinforces the narrative that "policy remains on its pre-set path," dampening bullish momentum. The reaction confirms this shift: before the decision, retail investors were buzzing about the "pound's surge after the Fed cut"; after the announcement, institutions quickly liquidated their positions, and retail investors followed suit, sending the VIX briefly near 15.

Market Interpretation: Institutional investors are rational, while retail investors are divided

The impact of the resolution on Fed rate cut expectations and market sentiment highlights transatlantic policy divergences. The Fed's risk-managed rate cuts, combined with Powell's meeting-by-meeting statements, and the dot plot (4.00% by the end of 2025), put short-term pressure on the US dollar, but prevented a collapse. Bank of England Governor Bailey emphasized that "we are not out of the woods yet, and interest rate cuts need to be gradual and cautious." The policy statement retained the phrase "monetary policy is not on its pre-set path," suggesting a ceiling on the tolerance for a CPI peak (4% in September).

Diverging interpretations: Institutional investors focused on the "structural dovish" outlook for the QT slowdown. One senior economist, stating that "the £70 billion package minimizes the impact on the bond market, leaving room for rate cuts," received widespread retweets, echoing Bailey's statement of "continued balance sheet reduction." Retail investors were more emotional, stating that "unchanged interest rates are hurting mortgage holders" and comparing the Fed to "why the UK is so conservative." Some pessimists, however, suggested a "safe haven in US Treasuries, and the pound is headed for a downturn."

The subtle injection of liquidity from the QT adjustment lies at the heart of the shift in sentiment. Prior to the decision, the market was concerned that long-term Treasury auctions (yields hit a 1998 high earlier this month) would exacerbate supply squeezes. The 40:20 ratio tilted toward short-term and medium-term bonds this time indirectly reassured bond bulls, flattening the front end of the gilt curve by 0.8 basis points. Compared to the launch of the QT in 2022 (a 100 billion yuan scale triggered an LDI crisis and sent yields soaring by 30 basis points), this slowdown signals a more "soft landing," prompting institutions to raise their fourth-quarter liquidity forecasts. Institutional threads emphasized that "the QT slowdown reinforces the cautious narrative, and short-term GBP bulls should be wary of resistance at 1.36." Retail investors, however, were disgruntled by the contrast that "the Fed has cut twice, while we're still stuck at 4%," amplifying selling sentiment. The GBP saw intraday fluctuations of 45 points, 30 points higher than the previous week's average.

Trend outlook: short-term fluctuations, long-term gradual progress

In the short term (until year-end), the British pound is likely to fluctuate between 1.35 and 1.37. While the slowdown in QT provides a buffer, CPI peaks and wage stickiness constrain the MPC's aggressiveness. Bailey's "gradual and cautious" tone suggests a 40% probability of a November rate cut (market pricing is 30%). If third-quarter GDP growth of 0.4% is confirmed and the unemployment rate rises to 4.5%, a 25 basis point rate cut in December becomes a reality, with the target price at 1.40. External risks, such as an escalation in tensions between Russia and Ukraine or a rebound in oil prices, could delay easing, with the 10-year yield moving up 10 basis points. Compared to the Fed's "two cuts" approach, the UK's "gradual" approach prioritizes inflation anchoring, avoiding overly rapid easing in the event of a rebound in 2023. An institutional outlook states, "The slowdown in QT serves as a bridge between caution and future rate cuts, but caution is warranted against the slow-release impact of US tariffs." A pragmatic retail investor perspective states, "After stabilization, mortgage holders will breathe a sigh of relief, but don't expect a rapid rate cut; the probability of a soft landing is 60%."

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.