De-dollarization alert! Global central banks are withdrawing from US debt. What does this wave of reductions portend?

2025-10-09 13:41:10

This may seem surprising, as the recently released U.S. Treasury's International Capital Flows (TIC) report and the International Monetary Fund's (IMF) "Cofer" foreign exchange reserves report show that overseas demand for Treasury bonds and U.S. dollar assets remains relatively robust. These two data sets are the gold standard for measuring U.S. capital flows and global foreign exchange reserves. However, they are released with a long lag—the latest TIC data is from July, and the latest Cofer data is from the second quarter.

In comparison, the New York Fed's custodial holdings data is not as comprehensive - central banks can hold U.S. Treasuries through other channels - but the data is released weekly and is an almost "real-time" indicator of cross-border central bank capital flows.

Now, those custodial holdings are declining rapidly. The latest data shows that the New York Fed holds $2.78 trillion in U.S. Treasuries on behalf of foreign central banks, the lowest level since August 2012, a decrease of $130 billion in just two months.

Changes in the size of foreign holdings of U.S. Treasury bonds

It is worth noting that the peak holdings of $2.95 trillion over the past year and a half occurred between March and April of this year, when US President Trump's "Liberation Day" tariff policy triggered sharp market fluctuations. Judging by this "thermometer", foreign central banks' interest in US Treasuries seems to have cooled since then.

The Fed's custody data is just one indicator of overseas demand for U.S. Treasuries. Will it be a precursor to the upcoming TIC and Cofer reports?

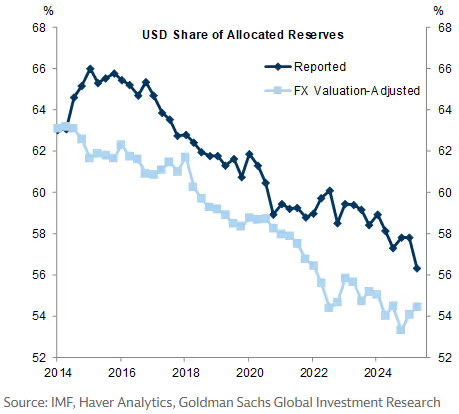

Analyzing the share of the US dollar in foreign exchange reserves

The latest TIC data shows that foreign central banks bought a net $17.1 billion in U.S. Treasuries in July. JPMorgan analysts said that net purchases totaled $38 billion in the first seven months of this year, about $4 billion more than the same period in 2024.

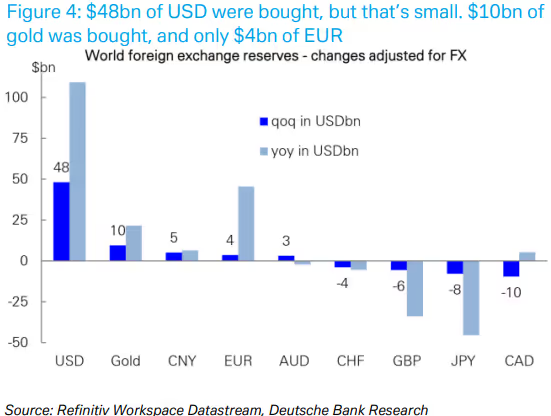

Meanwhile, the latest Cofer data shows that even after accounting for the dollar's sharp depreciation, central banks actually remained net buyers of dollar reserves in the second quarter. Deutsche Bank analysts estimate that central banks purchased nearly $50 billion in dollar-denominated securities, mostly U.S. Treasuries, during the quarter.

(US dollar fund flow chart)

While these figures pale in comparison to the $12 trillion in global foreign exchange reserves and the $29 trillion U.S. Treasury market, they nonetheless demonstrate persistent demand for U.S. Treasuries among reserve managers and counter the argument for "de-dollarization," a global move away from U.S. dollar assets due to concerns about Trump's policy agenda and the deteriorating U.S. fiscal situation.

But as mentioned earlier, TIC and Cofer data have a lag, and now that we are in October, the Fed's weekly interest rate data suggests that the situation may have changed since the summer.

Steve Barrow of Standard Bank said the decline in custodial holdings was cause for concern, especially given the apparent weakness of the dollar. Foreign central banks typically sell U.S. Treasuries when the dollar strengthens to raise funds for currency market intervention.

(Chart of the U.S. dollar share in allocated foreign exchange reserves)

“Such a rapid decline in the size of U.S. Treasury holdings could indicate that central banks have lost interest in Treasuries, and by extension, the dollar, in recent months,” Barrow wrote on Monday. “Weekly data can fluctuate, and a more comprehensive assessment of central banks’ appetite for Treasury bonds is needed. But could the Fed’s custodial holdings data be an early warning sign of de-dollarization?”

This news exerts negative pressure on the US dollar in both the short and long term. It shakes market confidence in the "undisputed" status of US dollar assets as the global reserve currency and may signal the beginning of a structural shift. The US dollar index declined slightly on Thursday, failing to continue its upward trend from the previous three trading days. Consequently, the downside risk to the US dollar index has increased significantly.

At 13:41 Beijing time, the US dollar index is currently at 98.72.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.