Has the Federal Reserve's interest rate cut channel begun? Exploring interest rate trends from history

2025-10-09 16:15:39

The widely anticipated rate cut came after data showed the unemployment rate edged up to 4.3% in August 2025, from 4.2% in July. Looking ahead, the unemployment rate remained in the 4%-4.2% range from May 2024 to July 2025, having hit a historic low of 3.4% in April 2023. By historical standards, 4.3% remains a relatively healthy level of unemployment. The natural rate of unemployment (the unemployment rate at full employment) has declined steadily over recent decades and is currently estimated to be between 4.3% and 4.5%.

In addition to the rising unemployment rate, other indicators also point to a slowing labor market: the duration of unemployment increased to 24.5 weeks in August 2025, significantly longer than the 21 weeks in August 2024 and the highest level since April 2022; the number of people continuing to receive unemployment benefits has reached its peak since the fall of 2021. The rise in the U-6 unemployment rate from 7.9% in July to 8.1% in August also supports this trend. This means that once unemployed, workers will take longer to find a job again.

The Federal Reserve has a dual mandate: achieving maximum employment and maintaining price stability. The second mandate has been challenging since 2021, as inflation has consistently exceeded the 2% policy target. At the time of the September 17, 2025, rate cut, the overall personal consumption expenditures price index was up 2.6% year-over-year in July, and the consumer price index was up 2.9% year-over-year in August.

In the past, the Fed has referred to such short-term moves to raise or lower interest rates as "risk management," "policy adjustments" or "mid-cycle adjustments."

Cutting interest rates in the current environment of relatively low unemployment raises four key questions:

How often does the Fed cut interest rates when the unemployment rate is below 4.6%?

After completing the first adjustment rate cut, how many times does the Federal Reserve usually continue to cut interest rates in the short term?

What impact has this had on the Treasury bond market?

How do stock markets react during such policy adjustments?

How often has the Fed cut interest rates when unemployment is below 4.6%?

The Fed's "adjustment" rate cuts typically come as geopolitical tensions rise or certain economic indicators begin to show signs of slowing. These adjustments often occur at critical moments when the Fed is trying to balance its dual policy goals.

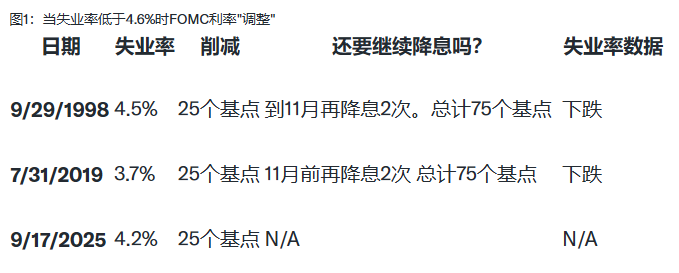

Since the 1970s, as shown in Figure 1, the Fed has only cut interest rates three times when the unemployment rate was below 4.6%, which was considered an "adjustment" move.

1998 interest rate adjustment

On August 17, 1998, Russia devalued its currency, defaulted on its ruble-denominated debt, and suspended payments to foreign creditors of Russian financial institutions, a move that sent shockwaves through global markets. Credit spreads subsequently widened, and the prominent hedge fund Long-Term Capital Management collapsed.

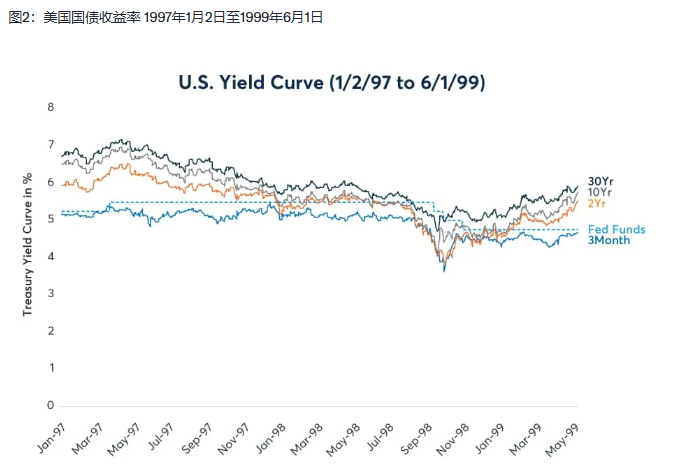

The federal funds rate remained at 5.5% from March 25, 1997, until the Federal Open Market Committee (FOMC) meeting on September 29, 1998. Alan Greenspan, then-Federal Reserve Chairman, lowered the federal funds rate by 25 basis points, from 5.5% to 5.25%, in response to the Russian debt default crisis and to "mitigate the impact of weakening foreign economies and tightening domestic financial conditions on future U.S. economic growth." Two further 25 basis point rate cuts were made on October 15, 1998 (during the FOMC meeting), and on November 17, 1998, bringing the federal funds rate to 4.75%.

After the March 1997 rate hike, U.S. Treasury yields continued to decline before and during the first two rate cuts in 1998, then began to rise before the third rate cut and maintained an upward trend (Figure 2). During this period, the unemployment rate continued to decline.

July 2019 interest rate adjustment

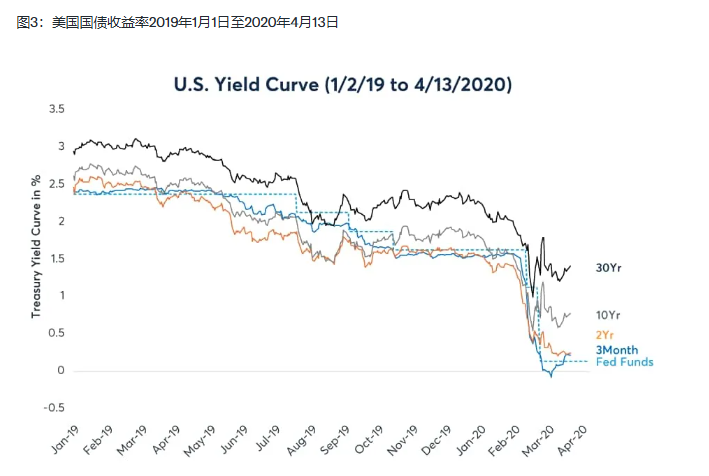

As of July 31, 2019, the unemployment rate was at a historic low of 3.7%, and in June, the PCE and CPI rose by 1.4% and 1.6% year-on-year, respectively. The Federal Reserve lowered its median policy rate by 25 basis points to 2.125%, and then cut it by another 25 basis points in September and October, bringing the median federal funds rate to 1.625%.

The Federal Reserve cut interest rates three times in 2019, despite a very strong job market and a 50-year low unemployment rate. According to the minutes of the July 2019 FOMC meeting, the reasons for the 2019 rate cuts included "signs of deceleration in economic activity in recent quarters," "a notable slowdown in economic growth in overseas economies," and concerns about inflation running below the 2% target for a prolonged period. The FOMC considered this a "prudent risk management" decision.

Before July 2019, the Fed last adjusted its interest rate in December 2018, when it raised the federal funds rate from 2.125% to 2.375%.

During the 2019 adjustment period, the unemployment rate fell from 3.7% to 3.5%, until March 2020, when COVID-19 entered our discourse, when it rebounded to 4.4%.

The 30-year Treasury yield rose after the Fed’s second rate cut, and the 10-year yield rose after the third rate cut (Figure 3).

Interest rate adjustment in September 2025

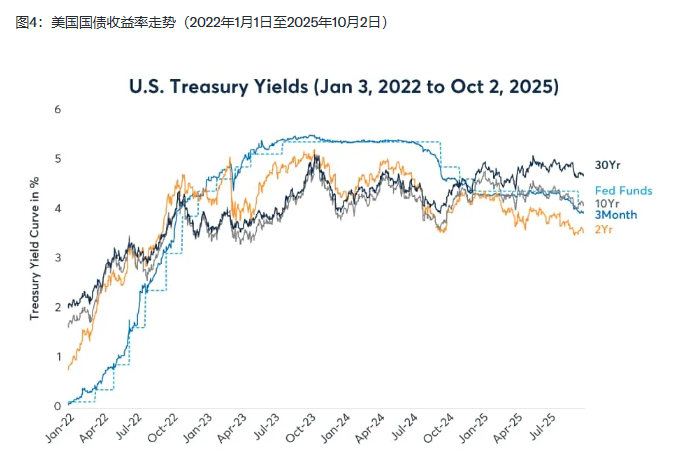

The Fed's most recent adjustment was a 25 basis point interest rate cut on September 17, 2025, as a number of economic indicators showed that the labor market was slowing. At the subsequent press conference, Powell mentioned that after the Fed focused on price stability in the past few years, the Fed now believes that the downside risks to the labor market have increased.

Figure 4 shows the policy rate and Treasury yield curve before the Fed's recent "risk management" rate cuts. Following the fall 2024 rate cuts, the long end of the yield curve moved higher. Since September 17, the yield curve has generally trended upward.

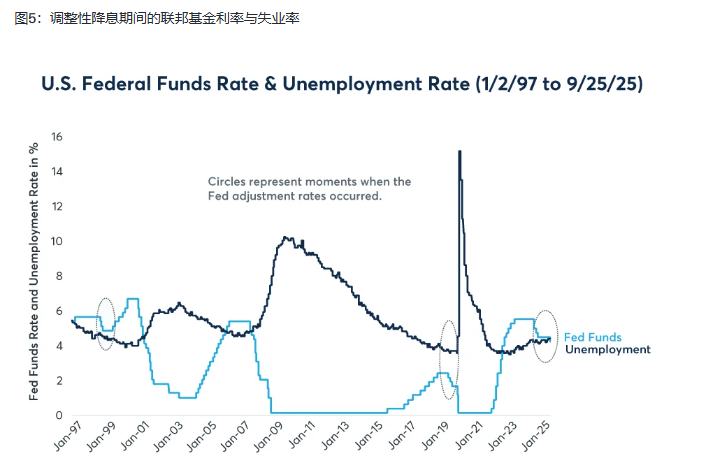

The black dotted circles in Figure 5 mark the points at which the Federal Reserve adjusted its interest rate cuts, as well as the changes in the federal funds rate and unemployment rate in the following months.

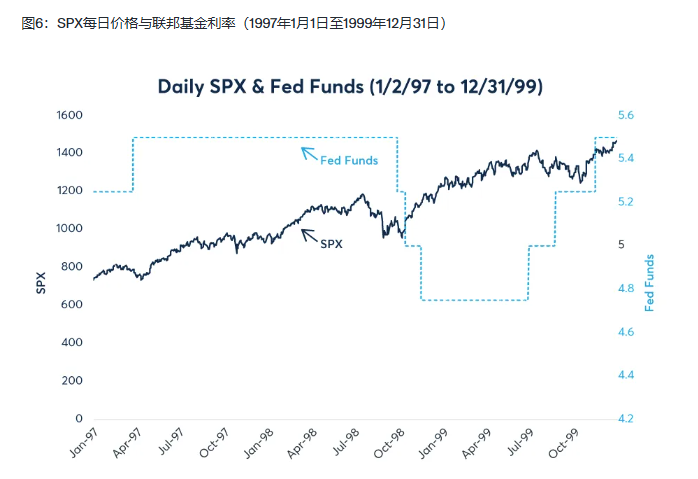

When the Russian ruble depreciated on August 17, 1998, the S&P 500 index (SPX) had already retreated 10.4% from its July 17 peak by August 14, bottoming out on August 31, having fallen 19.3% (Figure 6). On October 8, 1998, just before the Federal Reserve implemented its second 25 basis point rate cut on October 15, the S&P 500 retested its low. The stock market subsequently began to recover, and by mid-December, the S&P 500 had broken through its previous high.

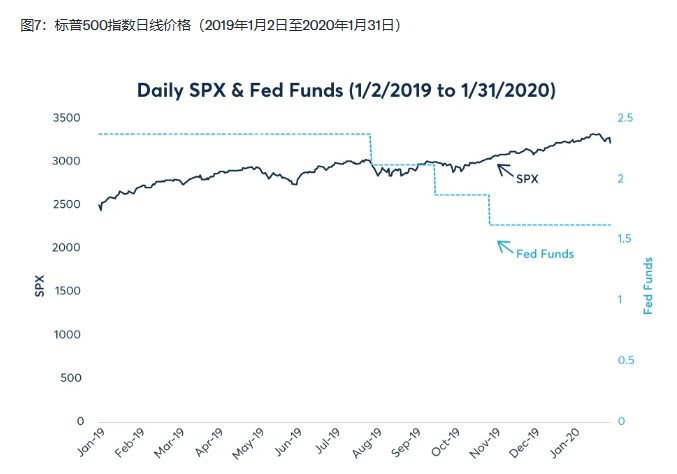

Prior to the July 2019 rate cut, the S&P 500 index was trading sideways with slight upward movement. After peaking on July 26, 2019, the index fell 1.5% following the Federal Reserve's adjustment rate cut on July 31. However, the S&P 500 bottomed out on August 14, retracing 5.6% before reaching a new high on October 28 (Figure 7) .

In previous years, when the unemployment rate was below 4.6%, the Fed had implemented a 25 basis point policy adjustment and subsequently cut interest rates by two more 25 basis points.

The market will interpret this rate cut as the beginning of a "mid-cycle adjustment"-style rate-cutting cycle, rather than an isolated incident. If the market generally expects the Fed to cut interest rates twice more in the coming months, this forward-looking expectation will be reflected in the exchange rate in advance. Investors will tend to sell the US dollar in advance, causing continued pressure on the US dollar before the rate cut is fully implemented.

Yield curves tend to stabilize or steepen in the months following adjustment rate cuts. Will the Fed follow past patterns and implement two more 25 basis point rate cuts in the coming months?

At 16:11 Beijing time, the US dollar index is currently at 99.04.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.