A chart: Baltic shipping ended its three-day winning streak as capesize rates fell

2025-10-09 23:53:05

The Baltic Exchange's dry bulk shipping index, which monitors freight rates for ships transporting dry bulk commodities, edged lower on Thursday, snapping a three-day winning streak, as it came under pressure from falling capesize rates.

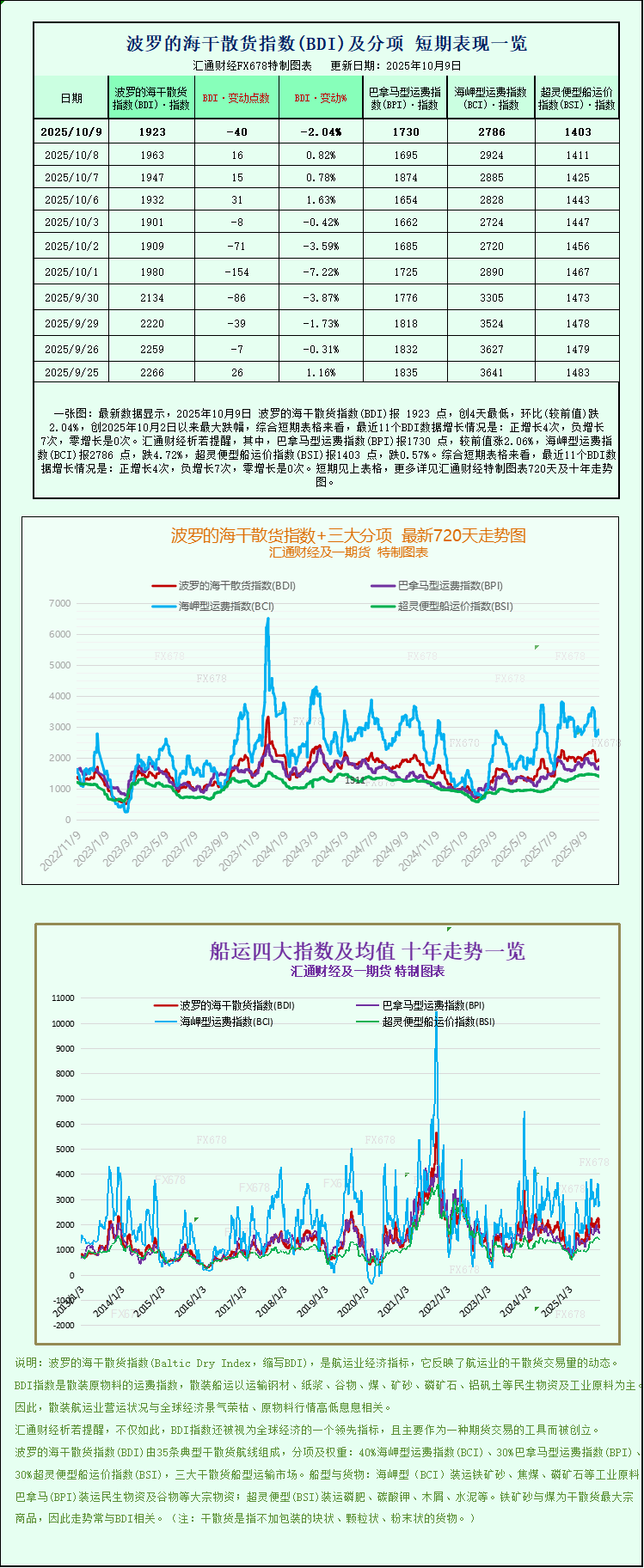

The main index measuring freight rates for Capesize, Panamax and Supramax vessels fell 40 points to 1,923.

The capesize index fell after four consecutive days of gains, dropping 138 points to 2,786 points.

Average daily earnings for capesize vessels, which typically carry 150,000 tonne cargoes such as iron ore and coal, fell $1,151 to $23,101.

“Overall market sentiment still points to a downward revision next month. Once market activity stabilizes after the holiday season, underlying fundamentals and some seasonal weakness may put pressure on freight rates again,” said Yiannis Parganas, head of research at Intermodal Shipbrokers.

Iron ore futures rose on Thursday, supported by Chinese steel mills restocking after the National Day holiday, but profit margins and concerns about steel trade restrictions weighed on market sentiment.

Meanwhile, the Panamax index hit its highest point in more than a week, rising 35 points to 1,730, its highest level since September 30.

Average daily earnings for Panamax vessels, which typically carry 60,000-70,000 tonnes of coal or grain, rose $316 to $15,568.

Among smaller vessels, the supramax index fell for the tenth consecutive session, down 8 points to 1,403 points.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.