In the conflict between "fear" and "greed", gold becomes the biggest winner!

2025-10-21 16:25:38

This ambivalence was vividly demonstrated last week. The first signs of volatility in US regional bank credit triggered a global stock market sell-off and a surge in volatility—only to have bargain-hunters rush in again within 24 hours.

Faced with this situation, Morgan Stanley raised a timely question in its report on Monday (October 20): "Trick or treat?" The bank further pointed out that the market may have underestimated the possibility of a continued warming of the economic cycle against the backdrop of a "triple easing" of monetary, fiscal and regulatory policies.

The market is divided over the nature of the current rally: Is it the end of a bull market, prompting a timely exit, or the beginning of a new AI supertrend and investment cycle, fueled by government deregulation? This core conflict became one of the most contentious topics during last week's International Monetary Fund (IMF) Annual Meetings.

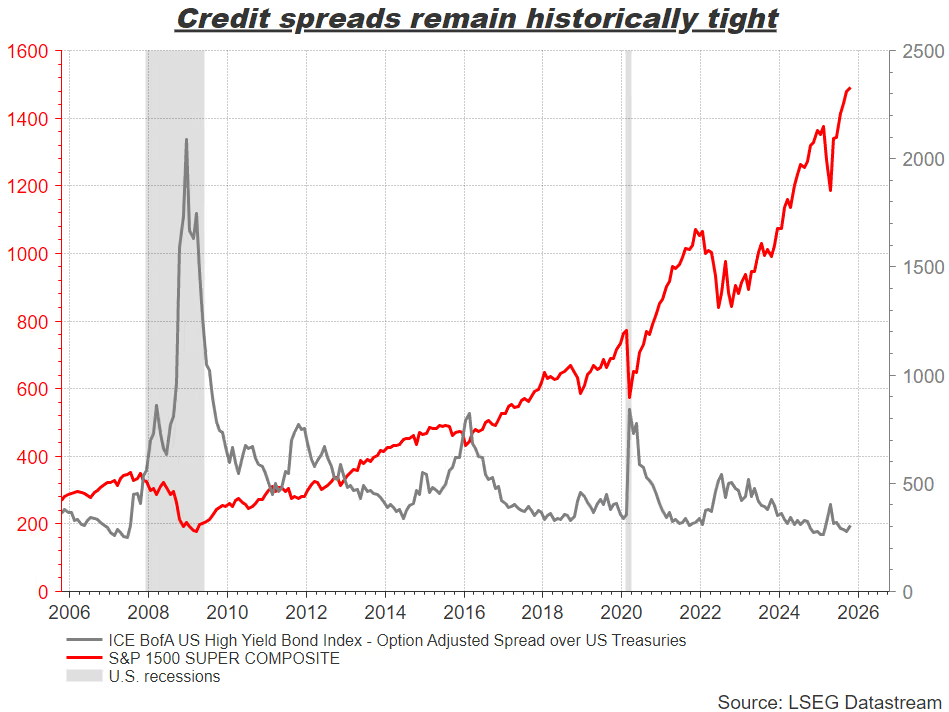

(Chart: Credit spreads on U.S. junk bonds remain at historical lows)

The Fed's Dilemma

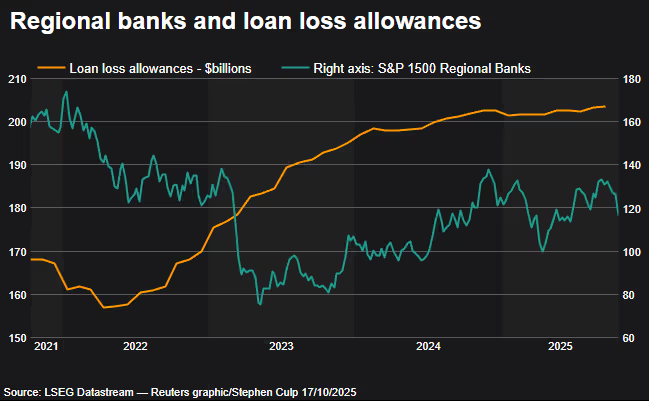

Faced with this complex situation, the Federal Reserve has revealed a policy dilemma. Chairman Powell and his team favor continuing to push for rate cuts, citing their caution: tightening money markets could prompt banks to set aside more loan loss reserves, while the current immigration shock could have a lasting negative impact on the labor market.

Fed Governor Waller put it more bluntly last week: "Something has to give—either economic growth slows to accommodate a weak labor market, or the labor market rebounds to match stronger economic growth."

However, with financial markets at their loosest in nearly four years, stock markets hitting record highs, and credit spreads remaining low, the path of further rate cuts is highly controversial. If a bubble does exist in the market, the current easing policy will only inflate it further.

All of this makes Friday’s release of September inflation data crucial. If the delayed report shows annualized inflation rebounding above 3%, the Federal Reserve will face a tough reality check.

(Graphic: Regional Banks and Loan Loss Provisions)

Hidden concerns amid the credit market boom

The current market faces multiple uncertainties, with two key issues particularly alerting investors:

First, there are long-standing structural risks. The rapidly expanding private credit market lacks transparency, potentially concealing accumulating pressures within the financial system. Even more worrying is the "maturity wall" created by the unique maturity structure of these credit funds. When multiple funds face difficulties simultaneously, this can easily trigger a chain reaction, amplifying the risk impact. Faced with these difficult-to-quantify "tail risks," gold is a traditional and effective tool for addressing these uncertainties.

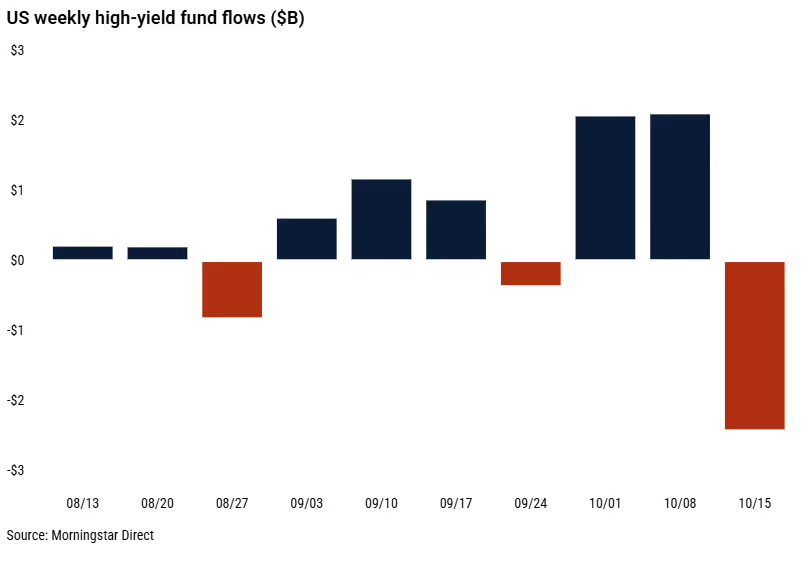

(Figure: Weekly Fund Flows of U.S. High-Yield Funds)

JPMorgan Chase CEO Jamie Dimon's warning: "Credit markets are like discovering cockroaches. When you see one problem, there are often more risks lurking in the shadows." This vivid metaphor continues to strike a chord with the market.

The paradox of risk and rebound

Given the numerous hidden dangers, why can the market still quickly recover its lost ground?

From a fundamental perspective, the US economy has yet to show signs of a substantial slowdown, although some economic data is still incomplete due to technical reasons. Meanwhile, earnings season has started solidly, the AI narrative remains strong, and major investment banks have benefited significantly from the resurgence in mergers and acquisitions. Perhaps the most supportive factor is policy: the Trump administration's deregulation and industry-focused policies have injected strong momentum into the market.

Although a sense of caution always lingers, investors still find it difficult to leave the market easily under the influence of trend forces - this contradictory mentality is precisely the most true portrayal of the current market.

Gold shines amid uncertainty

In the current environment, gold's core value in hedging against uncertainty is highlighted, and its outlook is brighter and more positive than that of the US dollar.

The prospect of "triple easing", whether it is interest rate cuts (reducing the opportunity cost of holding interest-free gold) or expansionary fiscal policy, is likely to push up long-term inflation expectations, which is fundamentally positive for gold .

When the market shifts from "fear of missing out" to "fear of losing everything," gold will become a safe haven option alongside the US dollar. More importantly, if the crisis stems from concerns about US debt or the stability of the financial system (such as regional banking problems), gold, as a non-US, non-sovereign credit asset, may outperform the US dollar .

Gold is playing a nearly two-pronged game in the current environment. When the market is bullish, it benefits from loose monetary conditions; when the market is negative, it serves as a safe haven. This makes its downside risk relatively limited, while leaving room for potential upside gains.

Gold has risen by over 64% so far this year, a rare feat in recent years. Last week, it surged 5.69%, marking its ninth consecutive week of gains. Against this backdrop of positive fundamentals, any substantial decline remains limited, and a short-term correction does not affect the overall bullish trend.

(Spot gold daily chart, source: Yihuitong)

At 16:22 Beijing time, spot gold was trading at $4264.22 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.