The Federal Reserve just adopted a hawkish stance, and now the European Central Bank is following suit? What will become of the euro?

2025-10-30 09:20:30

Euro Outlook Summary

Of this week's central bank feast, the European Central Bank's (ECB) policy decision on Thursday is the least likely to trigger major moves. Economic data has been quite robust, and inflation has returned to target levels, with the market widely expecting interest rates to remain unchanged for the foreseeable future.

With the Federal Reserve's interest rate meeting concluded, only Apple and Amazon among the tech giants have yet to release their earnings reports. Traders may soon be able to focus more on price action than headlines when assessing potential positions—unless, of course, Trump further escalates trade risks following the meeting in South Korea.

The macroeconomic backdrop suggests that the European Central Bank will hold its policy steady.

With the Bank of Canada and the Federal Reserve both making hawkish rate cuts on Wednesday, this week's wave of central bank decisions is nearing its end, with only the Bank of Japan and the European Central Bank remaining among the major central banks yet to take action.

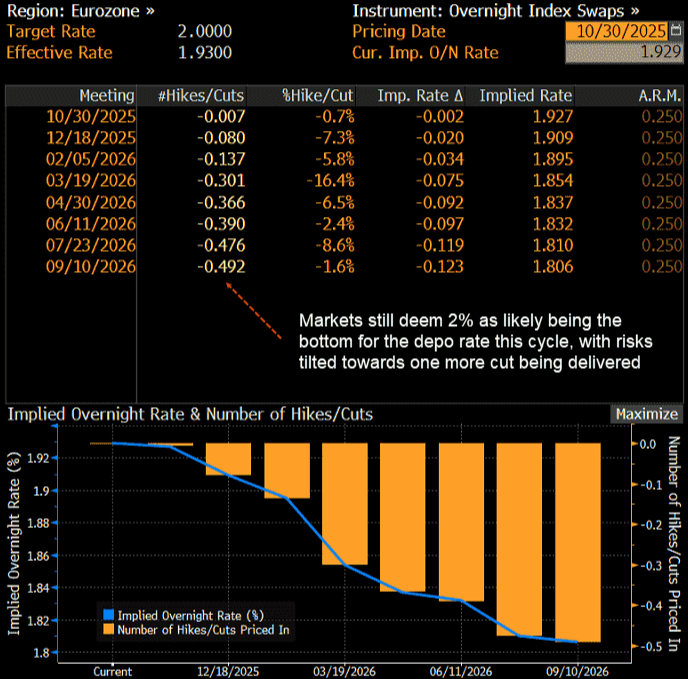

The market widely expects the European Central Bank to keep its key deposit rate unchanged at 2% later today, but overall, its guidance on the interest rate outlook may be more hawkish than current market pricing suggests.

Given the macroeconomic backdrop, this trend is not unexpected. Simply observe the recent European data trends tracked by the Citi Economic Surprise Index (see chart below): the index is slightly positive, indicating that recent economic data has generally exceeded expectations and there are no signs of rapid deterioration requiring further policy stimulus.

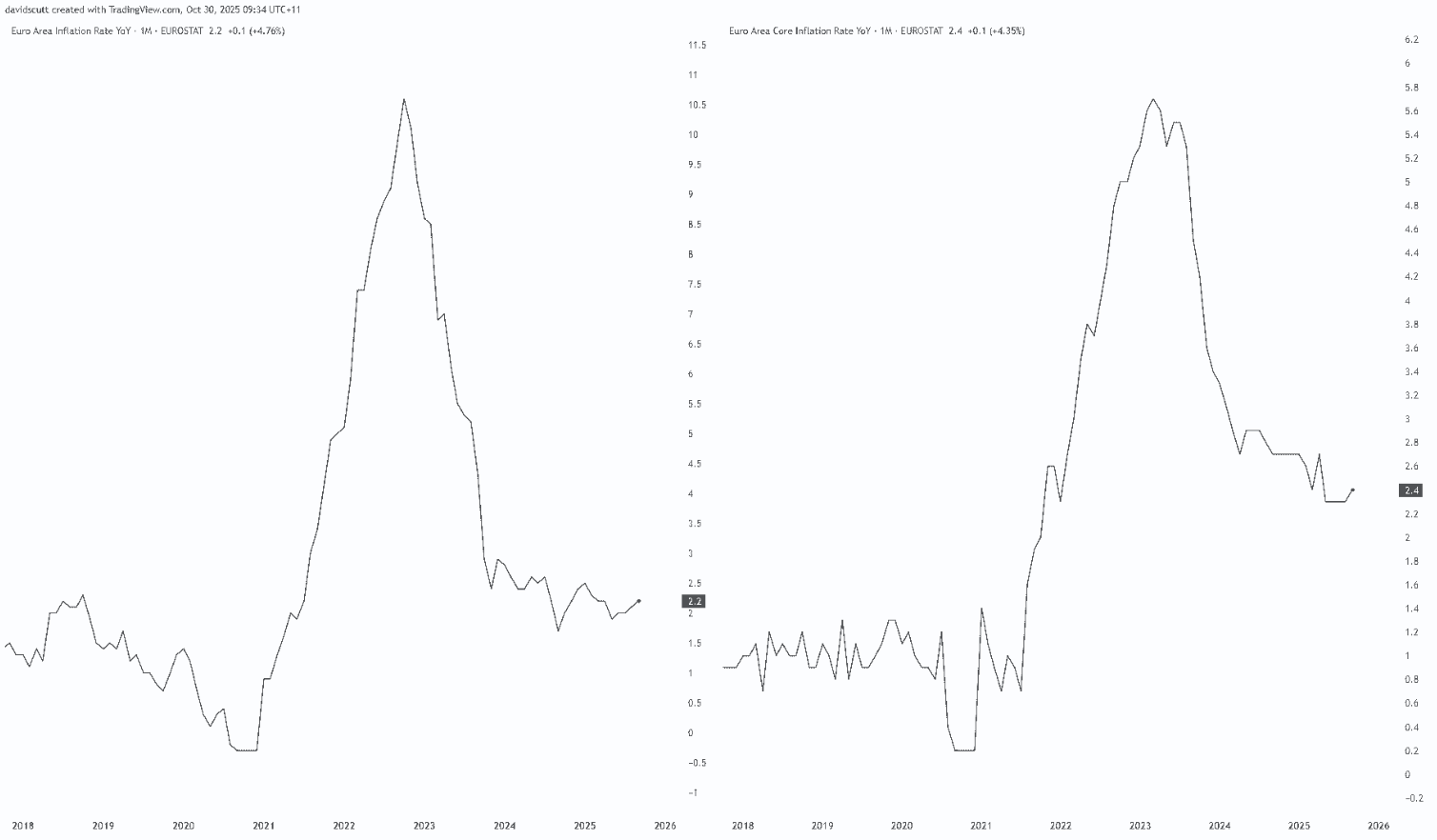

Eurozone inflation indicators are also slightly above the target level, with the latest data showing that overall prices rose 2.2% year-on-year, while core inflation was slightly stronger at 2.4%.

Similarly, these data do not indicate a need for interest rate cuts, although in the long run, a stronger euro could become a potential risk if it begins to dampen economic activity and lower import prices.

No wonder the market expects the ECB to keep interest rates in place for a long time into next year, with swap pricing still slightly favoring 2% as the lowest point for deposit rates in this cycle.

While the flat swap curve shown in the chart below leaves room for the ECB to create surprises through forward guidance—which would significantly impact the euro given that many believe the easing cycle is over—the question remains: if they do create surprises, will they be more dovish or more hawkish?

The European Central Bank's interest rate guidance may lean hawkish.

Currently, given that optimism about international trade is at its highest level this year, and considering the Eurozone's reliance on offshore markets, the European Central Bank is more likely to lean hawkish than dovish.

This means that, from a fundamental perspective, the directional risk for the euro following the ECB decision is slightly to the upside rather than the downside. However, this depends on the currency pair in question.

EUR/USD is showing a bearish pattern.

Looking at the daily chart of EUR/USD, the pair attempted to break through and hold above the 1.1650 resistance level earlier this week but failed. Ultimately, the bears gained the upper hand due to Jerome Powell's hawkish comments that "a Fed rate cut in December is far from a done deal."

These remarks led to a large bearish candlestick on the daily chart, forming a three-candle evening star pattern, suggesting short-term downside risk.

However, the exchange rate has repeatedly found support below 1.1600 recently, and a similar trend was observed last week. Unless major events occur in Asia, whether it's a meeting between the leaders of the two largest economies or a policy decision by the Bank of Japan, the euro/dollar is unlikely to deviate significantly from its current level in the short term.

On the downside, the 1.1544 level is the double bottom formed at the beginning of the month, highlighting its importance. If this level is breached, there is a lack of significant support before falling to 1.1450 and 1.1400, although buying interest may emerge near 1.1500.

On the upside, 1.1650 remains the primary resistance level, with the 50-day moving average (MA, 1.1685) just above it – both posing a significant challenge to the bulls. If the price can break through and hold above the 50-day moving average (1.1685), there will be no major resistance levels before reaching 1.1900.

Although the momentum indicator shows a slightly bearish signal, the upward trend of the RSI (14) and the flattening of the MACD convey a neutral message, which further emphasizes the guiding role of recent price action in decision-making.

(Euro/USD daily chart, source: FX678)

At 9:20 Beijing time, the euro was trading at 1.1610/11 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.