EUR/USD Forex Signals: The pair remains volatile ahead of the ECB interest rate decision.

2025-10-30 18:50:33

Federal Reserve and European Central Bank interest rate decisions

The euro/dollar currency pair retreated after the Federal Reserve announced its second interest rate cut of the year. The Fed cut rates by 25 basis points, lowering the benchmark interest rate to a range of 3.75%-4.00%, the lowest level since 2022.

It is worth noting that Federal Reserve officials have hinted at ending quantitative tightening in December. This three-year program has already shrunk the Fed's balance sheet by $2 trillion, and it will continue to reduce its mortgage-backed securities portfolio by approximately $35 billion per month thereafter.

The ongoing US government shutdown and weak macroeconomic data provide a significant backdrop for the Federal Reserve's interest rate cuts. A report released earlier this month by ADP showed that the private sector lost 36,000 jobs in September.

Meanwhile, inflation was brought under control. The overall consumer price index (CPI) rose 3.0% year-on-year in September, below the market median expectation of 3.1%; the core inflation rate fell slightly to 3.0%.

With the Federal Reserve's decision now finalized, the next key news affecting the euro/dollar exchange rate will be the upcoming European Central Bank (ECB) interest rate decision. Given that the ECB has largely achieved its 2% inflation target, economists expect the bank to keep interest rates unchanged.

Most European Central Bank officials have stated that they support maintaining the current interest rate level in the short term.

Another key driver for the euro/dollar exchange rate will be the EU's preliminary third-quarter GDP data. While this data is important, its impact on the currency pair may be limited.

Technical Analysis

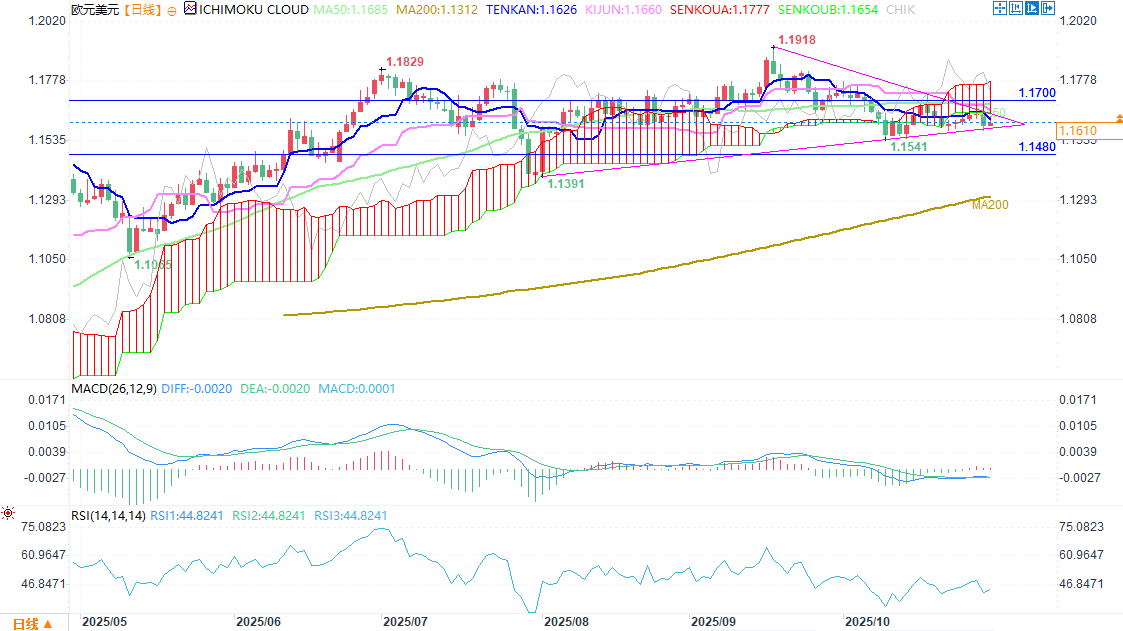

(EUR/USD daily chart source: FX678)

The euro/dollar exchange rate has been under downward pressure in recent weeks, falling from a high of 1.1918 in September to the current level of 1.1541.

The currency pair has fallen below the 50-day moving average (SMA) and the Ichimoku Cloud indicator.

The price movement is in the lower region of a symmetrical triangle pattern, and the Relative Strength Index (RSI) continues to decline after falling below the 50 neutral level.

Therefore, the most likely scenario is that the currency pair will continue to decline before the ECB's interest rate decision is announced, and may further test the key support level of 1.1485.

bearish view

Sell the EUR/USD currency pair and set a take-profit level at 1.1480.

Set the stop-loss level at 1.1700.

Timeframe: 1-2 days.

Bullish viewpoints

Buy the EUR/USD currency pair and set a take-profit level at 1.1700.

Set the stop-loss level at 1.1480.

At 18:48 Beijing time, the euro/dollar exchange rate was 1.1610, up 0.09%.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.