November 5th Financial Breakfast: Record-breaking US government shutdown sends gold prices down nearly 2%, while concerns about demand prospects weigh on oil prices.

2025-11-05 07:31:09

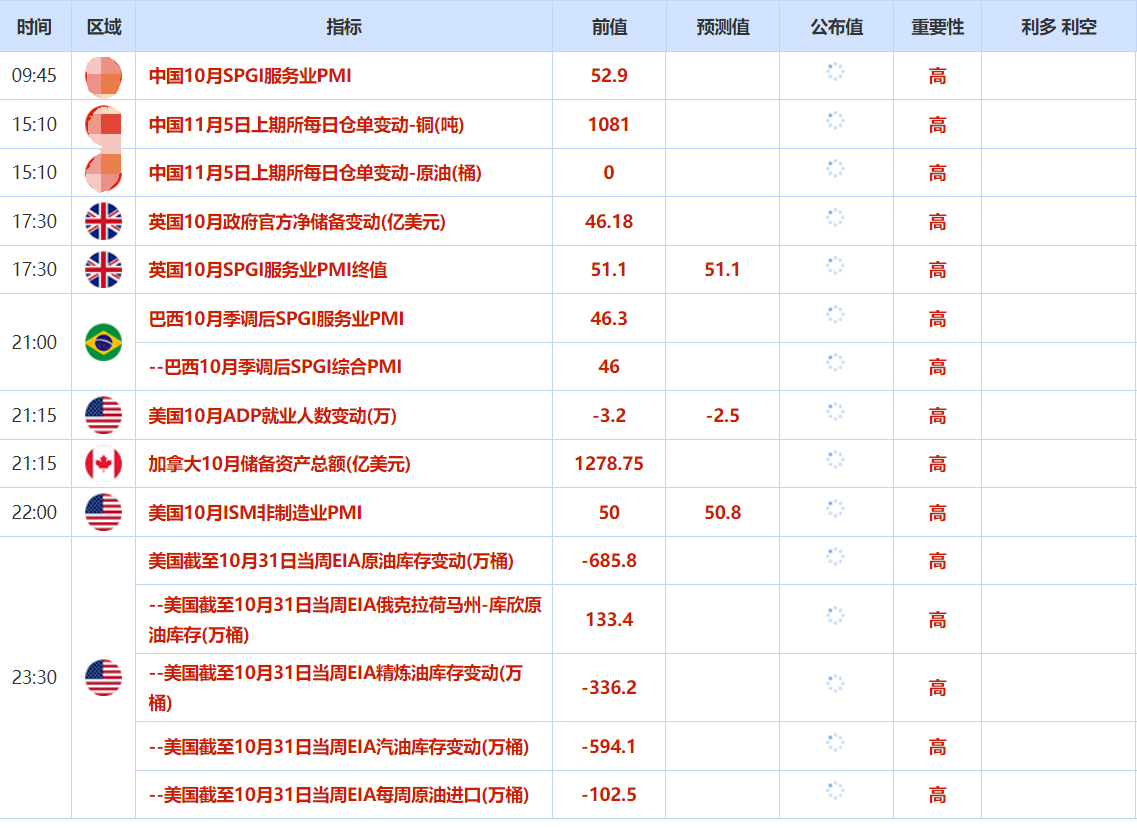

Key Focus Today

stock market

U.S. stocks suffered a sharp sell-off on Tuesday, with all three major indexes closing lower. The S&P 500 and Nasdaq both recorded their biggest one-day declines since October 10, reflecting growing concerns about overvaluation.

The Dow Jones Industrial Average fell 0.53% to 47,085.24 points; the S&P 500 fell 1.17% to 6,771.55 points; and the Nasdaq Composite fell 2.04% to 23,348.64 points.

The recent decline was triggered by warnings from the CEOs of major banks such as Morgan Stanley and Goldman Sachs, raising concerns about a potential bubble in the market. Previously, the S&P 500 had repeatedly hit new highs, driven by the artificial intelligence boom.

The technology sector significantly dragged down the Nasdaq, falling 2.3%, making it the worst-performing sector in the S&P 500. Of the closely watched "Big Seven" tech stocks, six related to artificial intelligence declined. The Philadelphia Semiconductor Index also fell sharply by 4.0%.

Analysts point out that investors seem more concerned about valuations than ever before. Many companies' stock prices are already too high, while their earnings, though good, haven't reached an "outstanding" level, prompting investors to take profits. JPMorgan CEO Jamie Dimon has also previously warned of a significant risk of a stock market correction over the next six months to two years.

The US federal government shutdown has entered its 35th day, tying a record. The lack of official economic data has made the market more reliant on employment reports released by private institutions such as ADP. Investors are carefully analyzing comments from Federal Reserve officials for clues about the direction of monetary policy.

Gold Market

Gold prices fell nearly 2% on Tuesday, pressured by a stronger dollar and diminished market expectations of a Federal Reserve rate cut. Spot gold settled at $3,940.75 an ounce, down 1.5%; U.S. gold futures for December delivery fell 1.3% to settle at $3,960.50.

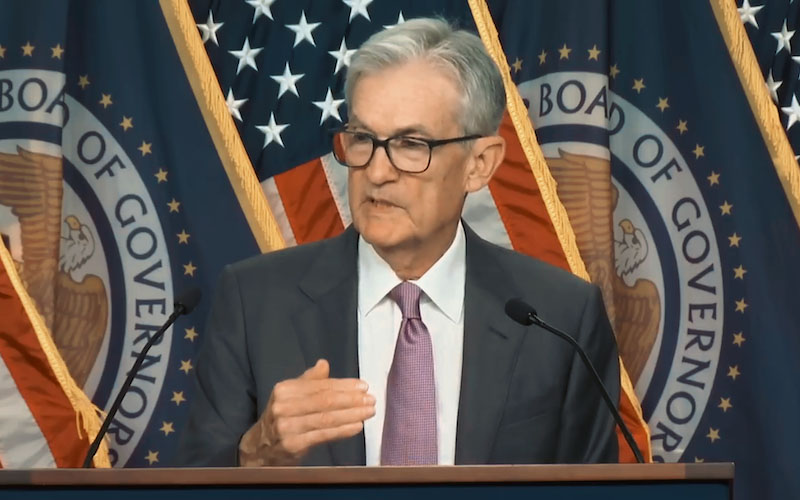

The main pressure on gold prices came from the US dollar, with the dollar index hitting a three-month high on the day. Market analysts pointed out that the recent strength of the dollar and the pressure on gold stemmed from traders lowering their expectations for another Federal Reserve rate cut in December. Although the Fed implemented a rate cut last week, Powell hinted that this might be the last one this year. Currently, the interest rate futures market shows that traders believe the probability of a December rate cut has fallen from over 90% a week ago to 71%.

Meanwhile, the ongoing U.S. federal government shutdown has prevented the release of key official economic data. This situation will cause investors to focus more on Wednesday's ADP private sector employment report for economic clues. Furthermore, Federal Reserve officials are divided on how to address the current data gap.

Other precious metals also generally closed lower: spot silver fell 1.5% to $47.32 per ounce; platinum fell 1.8% to $1,538.05; and palladium saw the largest decline, falling 3.1% to $1,400.30.

oil market

International oil prices closed lower on Tuesday, influenced by multiple factors. Brent crude futures fell 0.7% to settle at $64.44 a barrel, while U.S. crude futures fell 0.8% to settle at $60.56.

The decline in oil prices was mainly due to two pressures: firstly, the strengthening of the US dollar to a four-month high; and secondly, weak manufacturing data that triggered market concerns about the outlook for global oil demand.

Analysts point out that oil prices are feeling pressure from the overvalued dollar and the ongoing US government shutdown. Meanwhile, the sharp decline in Wall Street stocks has exacerbated market concerns about the economic outlook and domestic fuel demand.

On the oil-producing front, OPEC+ agreed on Sunday to suspend production increases in the first quarter of next year, a decision interpreted by the market as a sign of the alliance's concerns about a potential supply glut. Meanwhile, OPEC's production increases in October had already slowed significantly compared to previous periods.

Total Energy predicts in its annual report that global oil demand is expected to continue growing until 2040, before gradually declining, due to energy security concerns and a lack of political coordination that will slow emissions reduction efforts.

Foreign exchange market

The dollar strengthened across the board on Tuesday, rising to a four-month high against the euro, mainly as internal policy disagreements within the Federal Reserve cast doubt on market expectations for another rate cut this year. Meanwhile, deteriorating global risk sentiment prompted investors to seek refuge in the dollar.

The dollar index broke through the 100 mark for the first time since early August. The euro fell against the dollar for the fifth consecutive trading day, dropping to $1.1483, its weakest level since August 1. Although the yen and Swiss franc, also considered safe-haven currencies, remained strong, the dollar fell slightly against the yen to 153.60, but the yen itself is still hovering near an eight-and-a-half-month low. Market strategists point out that despite frequent media discussions about the "death of the dollar," the dollar remains the most reliable safe-haven asset for investors during periods of market turmoil.

This shift in market sentiment towards risk aversion echoes the stock market decline and the surge in demand for government bonds. In this environment, the commodity currency, the Australian dollar, came under significant pressure, falling 0.8% to US$0.649, as the Reserve Bank of Australia kept interest rates unchanged and expressed caution regarding further easing.

The shift in Federal Reserve policy expectations is the core factor driving the dollar's strength. Following last week's expected rate cut, Chairman Powell hinted that another rate cut in December was not inevitable, causing traders' expectations for a December rate cut to plummet from 94% a week earlier to 65%. The ongoing US government shutdown, resulting in a lack of economic data, has made the differing views of Fed officials on the current economic situation a focus of market attention.

Despite the recent strength of the US dollar, some analysts have expressed doubts about the sustainability of its rally. Deutsche Bank points out that economic growth forecasts for both the US and Europe have been revised upwards in tandem, and the growth gap between the two countries is narrowing. This moderate global growth environment is not sufficient to support a sustained strengthening of the dollar.

In other currencies, the pound fell 0.9% to $1.3015 as the UK Chancellor of the Exchequer highlighted the challenging economic backdrop of high debt, low productivity, and stubborn inflation.

Regarding the yen, while the Bank of Japan's decision to maintain interest rates provided some support, its weakening trend still prompted the Japanese Finance Minister to warn that the government is monitoring foreign exchange market dynamics with a high degree of urgency. The yen's exchange rate is currently approaching levels that previously triggered market intervention by Japanese authorities in 2022 and 2024.

International News

US government shutdown to break records

On November 4th local time, the U.S. Senate again failed to advance a temporary federal government funding bill proposed by Republicans and already passed by the House of Representatives. This means that the current federal government shutdown, which began on October 1st, is about to break the historical record of 35 days set during the shutdown from the end of 2018 to the beginning of 2019, becoming the longest government shutdown in U.S. history. The vote again failed to reach the 60-vote threshold required for passage, with a final result of 54 votes in favor and 44 against. Three Democratic senators voted in favor, and one Republican senator voted against. This is the 14th time the Senate has failed to end a government shutdown. (CCTV International News)

Ukraine: Will establish arms export offices in Germany and Denmark

Ukrainian President Volodymyr Zelenskyy announced on November 3 that Ukraine will establish arms export and joint arms production offices in Berlin, Germany, and Copenhagen, Denmark, this year to raise funds for the production of weapons in short supply domestically. President Zelenskyy stated, "We will establish offices in the capitals of Germany and Denmark to handle joint arms production and arms exports. We will sell the weapons we are able to sell in order to raise more funds for the manufacture of weapons currently in short supply." (CCTV)

US media: Trump administration considers controlling Venezuelan oil fields

According to The New York Times, the Trump administration has developed several military action plans against Venezuela, including direct strikes against forces protecting President Maduro and potential actions to seize control of the country's oil fields. Trump has not yet decided whether or how to proceed and has shown a reluctance to involve U.S. troops or subject them to political consequences. Senior advisors are pushing for tougher measures, including ousting Maduro from power. The administration has requested legal guidance from the Justice Department to justify expanding military action from anti-drug operations to a broader scope. Such legal advice could aim to provide a legal basis for action against Maduro without congressional authorization or a formal declaration of war.

The European Commission has adopted the EU enlargement plan for 2025.

On November 4, local time, the European Commission announced that it had adopted the EU's annual enlargement program, which comprehensively assessed the progress made by the enlargement partners over the past year. The program reaffirms that the enlargement process remains a key priority on the EU's agenda. It also confirms that the accession of new member states is imminent. Montenegro, Albania, Ukraine, Moldova, Serbia, North Macedonia, Bosnia and Herzegovina, Turkey, and Georgia have all made progress in their respective accession efforts.

Federal Reserve Chair Jerome Bowman: Banks should be able to participate in digital asset business if they wish.

Federal Reserve Governor Bowman said on Tuesday that regulators are also studying capital surcharges for large banks and have proposed changes to stress tests and a key rule called “enhanced supplemental leverage.” In addition to bank capital plans, the Fed is weighing follow-up measures regarding cryptocurrencies following the passage of the GENIUS Act, which requires stablecoin issuers to formally register and hold sufficient dollar reserves. Bowman had previously stated that the agency was soliciting feedback on how best to implement the new stablecoin regulations, and on Tuesday emphasized that it is “crucial” that banks should be able to participate in digital asset business if they wish. “We need to ensure that banks don’t fall behind, and we also need to ensure that digital assets on their balance sheets are effectively segregated from regular business activities,” she said. Bowman noted that officials need to meet customer demand for new services while ensuring the safe and sound operation of banks.

The US government shutdown continues; the Transportation Secretary warns of possible forced closure of some airspace.

On November 4th local time, U.S. Transportation Secretary Duffy warned that if the government shutdown continues, the Department of Transportation may be forced to close some airspace to cope with staff shortages and aviation safety pressures. The United States has long faced a shortage of air traffic controllers, and many air controllers were already forced to work overtime before the government shutdown. Since the federal government shutdown, approximately 13,000 air traffic controllers and about 50,000 employees responsible for airport security have been forced to work without pay, and the number of employees taking sick leave is steadily increasing.

Domestic News

China's commodity price index for October showed a sixth consecutive month of increase.

The China Federation of Logistics and Purchasing (CFLP) released its October China Bulk Commodity Price Index today (October 5th). The index shows a sixth consecutive month of increase, with the rate of increase significantly larger than the previous month. This indicates that as the effects of national policies aimed at stabilizing growth continue to be released, and international trade tensions have eased, business confidence has further strengthened, and the commodity market continues to recover. The October China Bulk Commodity Price Index was 113.2 points, up 1.2% month-on-month, marking the sixth consecutive month of increase. Among the 50 key commodities monitored by the CFLP, 16 saw month-on-month price increases in October. Electrolytic copper, corrugated paper, and coking coal saw the largest increases, rising by 6.9%, 6%, and 6% respectively compared to the previous month. (CCTV News)

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.