On the eve of a storm! Behind the bizarre balance in oil prices, a World Bank report reveals the "supply-demand gap" in 2026.

2025-11-05 15:46:14

Asian stocks opened lower on Wednesday, driven by short-selling firms disclosing their short positions in stocks such as Nvidia, raising concerns that stock valuations, especially for companies related to artificial intelligence, are already high.

Risk aversion has driven the dollar higher relative to other major currencies. A stronger dollar makes dollar-denominated crude oil more expensive for holders of other currencies, which could impact demand.

This article, based on the World Bank's Commodity Market Outlook report, compiles relevant information about oil prices in light of recent oil price developments.

Overall oil price trend and recent fluctuations in 2025

Oil prices rose 5% at the end of the month after the United States announced new restrictions on Russian oil companies, with Brent crude closing at around $65 a barrel on October 29.

Throughout 2025, oil prices generally declined due to ongoing trade tensions and concerns about oversupply, although geopolitical events occasionally triggered short-term price increases. The drop in Brent crude prices caused Urals crude prices to fall below $60 per barrel—a price cap that took effect in February 2025—followed by an even lower cap of $47.6 per barrel implemented in September.

Global oil demand: Growth remains weak, with significant regional disparities.

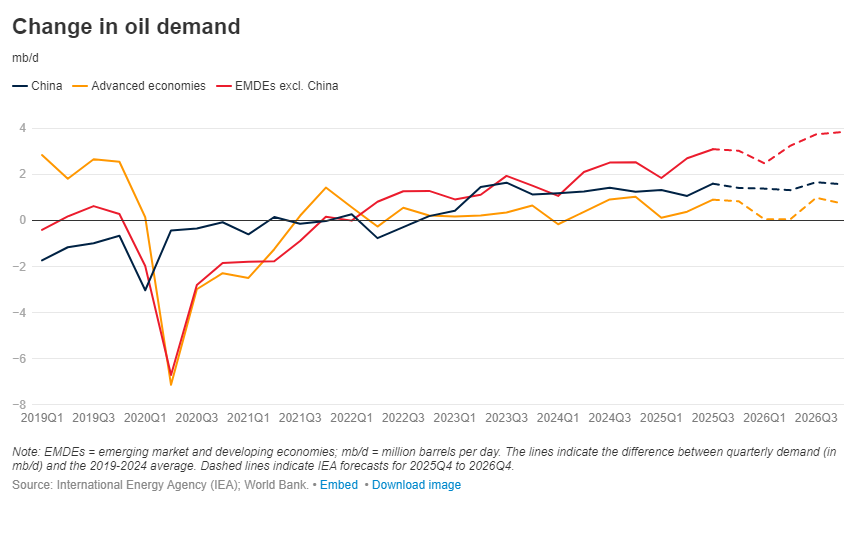

Oil demand growth remains weak. Global oil demand is projected to increase by only 800,000 barrels per day (mb/d) in the third quarter of 2025, a year-on-year increase of 0.7%, indicating that demand growth remains weak compared to the average level of 2015-2019. This trend is expected to continue, with global annual oil demand reaching 103.8 million barrels per day in 2025 and 104.5 million barrels per day in 2026.

(Crude oil demand trend chart, orange represents developed countries, red represents emerging markets and developing countries)

Oil consumption in developed economies is expected to remain stable, while demand growth in China may slow due to the accelerated adoption of electric and hybrid vehicles. India is one of the major contributors to global oil demand growth, which is projected to be driven by liquefied petroleum gas (LPG), gasoline, naphtha, and diesel.

Global oil supply: driven by new capacity, with varying regional growth patterns

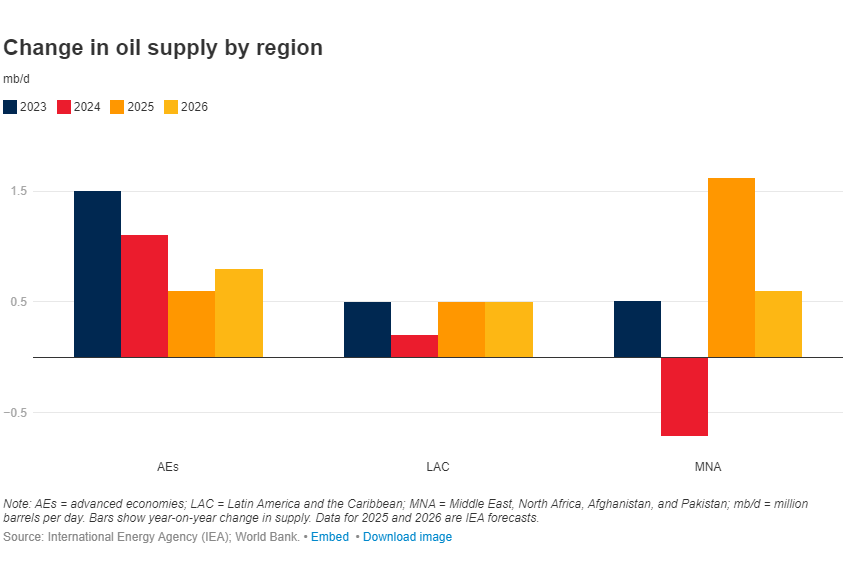

Oil supply is expected to increase in 2025 and 2026 as new production capacity comes online. Oil production is projected to increase by 3 million barrels per day (2.9%) in 2025, reaching 106.1 million barrels per day, and is expected to further increase to 108.5 million barrels per day in 2026.

In 2025, oil supply growth is projected to resume in the Middle East and North Africa, Afghanistan, and Pakistan (MNA region), accelerate in Latin America and the Caribbean (LAC region), while supply growth in developed economies will slow. Nearly half of the increased oil supply in 2025 will come from the Organization of the Petroleum Exporting Countries (OPEC+), reflecting the organization's increased production targets.

(Crude oil supply trend chart: Overall supply accelerated in 2025 and 2026)

Supply and demand imbalance: Surging production coupled with weak demand has led to a global oversupply of oil.

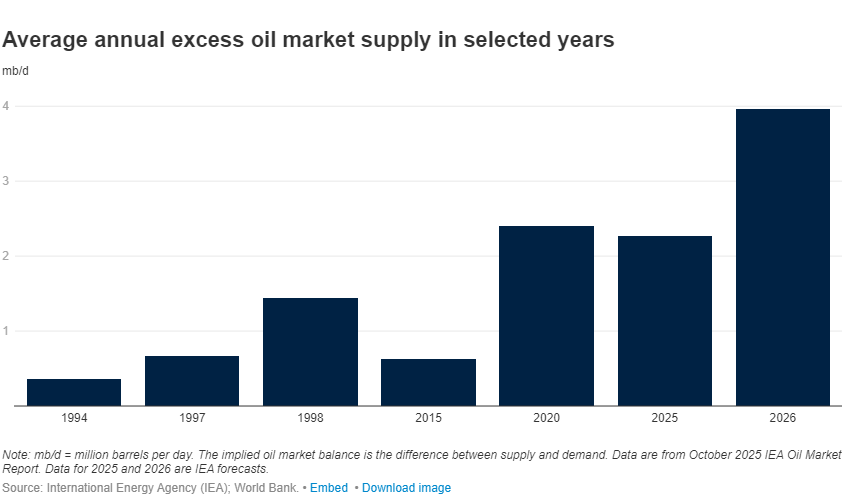

The combination of surging production and weak consumption growth is leading to a global oil oversupply. The implied oil surplus (supply minus demand) is projected to be 2.7 million barrels per day in the third quarter of 2025, partly due to OPEC+ raising its production targets multiple times since April.

While the inventory growth observed in 2025 reflects only about half of the implied surplus, recent market dynamics increasingly suggest a global oil supply glut is emerging: several crude oil tankers in the Middle East have recently faced unsold inventory, while oil tanker loads at sea have surged. On an annual basis, the International Energy Agency (IEA) projects an oil surplus of 2.3 million barrels per day in 2025, increasing to 4 million barrels per day in 2026, 1.6 million barrels per day higher than the surplus during the 2020 pandemic.

(Bar chart showing crude oil surplus; risk of crude oil surplus increases significantly in 2026)

Oil Price Forecast and Risks: Overall bias is downward, with both possibilities present.

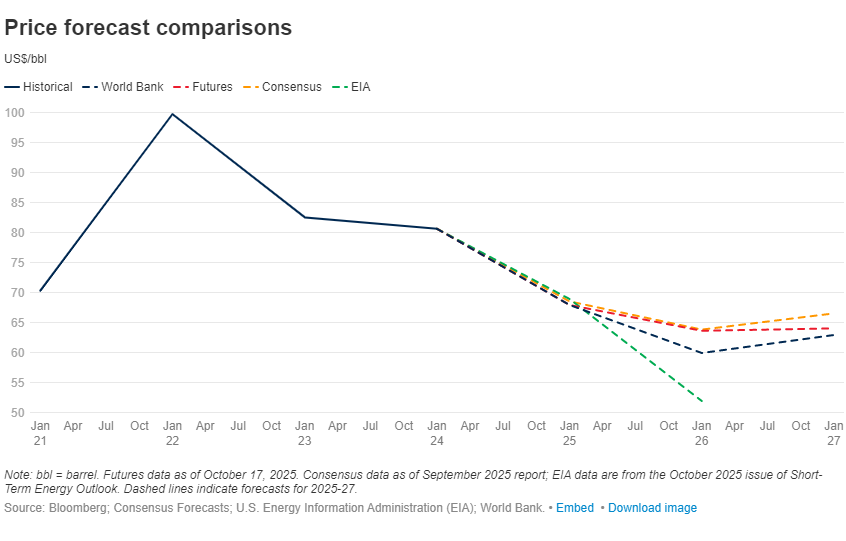

The risks to oil price forecasts are tilted to the downside. Brent crude oil prices are projected to average $68 per barrel in 2025, fall to $60 per barrel in 2026, and then recover to $65 per barrel as market conditions stabilize.

The most significant downside risks include the possibility that OPEC+ may further increase its production targets. Other downside risks include renewed trade tensions and increased policy uncertainty.

On the upside risk side, if the oil market is tighter than expected, oil prices could exceed the baseline forecast.

This outcome could be attributed to stronger-than-expected demand from major non-OECD consuming countries, and limited supply growth due to OPEC+ restrictions or declining US production. Furthermore, escalating conflicts in regions such as the Middle East or Ukraine, along with the impact of additional restrictions (including recent US measures against Russian oil companies), could also push oil prices higher than currently forecast.

(Chart of oil price forecasts from different institutions)

Technical Analysis:

The December futures contract for US crude oil is currently trading in a range-bound pattern in the upper half of the trading range, with resistance at 61.30 and support around 59.40 and 58.48.

The MACD and RSI indicators currently show that the bearish momentum is weakening, but both indicators are still below the expansion/contraction threshold. If oil prices can continue to fluctuate and wait for the moving averages to flatten out, they may break through the upper trading range. However, the current trend is still bearish.

(Daily chart of US crude oil December futures contract, source: FX678)

At 15:40 Beijing time, the December futures contract for US crude oil was trading at $60.52 per barrel.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.