From Bernanke to Powell: The Fed's Crisis Relay and Expectations of a December Rate Cut

2025-11-25 15:39:43

This visual metaphor later proved to be an accurate prediction of the crisis—Lehman Brothers collapsed in September 2008, directly triggering turmoil in global financial markets and the Great Recession of 2008-2009.

The "high-risk" transition environment for Powell's successor

President Trump is expected to finalize his successor to Federal Reserve Chairman Jerome Powell by the end of the year (Powell's term expires next May).

The background to this power transition is a complex situation where US public debt has entered a clearly unsustainable track, the international trade system is under severe pressure, and both the stock market and private credit market exhibit typical bubble characteristics.

Even more challenging is the prospect of the next Federal Reserve Chairman facing a president determined to undermine the Fed's independence by installing cronies on the Board of Governors and exerting continuous pressure to maintain a low-interest-rate environment.

This inevitably leads one to wonder: Will The Economist recreate the classic cover, only this time in a relay scene, with Powell handing over the dynamite stick to his successor?

Hidden concerns about economic fundamentals: the double burden of high debt and reliance on foreign investment.

Even during periods of stable macroeconomic conditions, monetary policy formulation remains a challenging issue; and when a country is burdened with high public debt and a large fiscal deficit, the difficulty of this task increases exponentially—this is precisely the "hot potato" that Powell's successor will soon be taking on.

According to the latest IMF forecast, the US fiscal deficit will remain stable at around 7% of GDP for the foreseeable future. This trend will push public debt to 128% of GDP by 2030, on par with the debt levels of heavily indebted countries such as Greece and Italy.

The core vulnerability of the US economy lies in its heavy reliance on foreign financing for its budget and current account deficits. Data from the US Treasury Department shows that foreign investors currently hold $8.5 trillion in US Treasury bonds, representing 30% of the total $29 trillion in outstanding Treasury debt.

If foreign investors become unwilling to continue financing the US deficit or renew maturing bonds at current interest rates due to factors such as decreased risk appetite or adjusted yield demands, long-term interest rates may experience a precipitous surge—this would not only become a fatal obstacle to economic recovery but also trigger severe turmoil in the financial system.

The successor faces a dual challenge: maintaining confidence and dealing with the bursting of the bubble.

One of the core challenges for the new Federal Reserve Chair is maintaining global investors' confidence in the United States: demonstrating a firm stance on controlling inflation while alleviating market concerns about "inflation diluting debt."

If President Trump continues to undermine the Federal Reserve's independence and installs "compliant" cronies to dominate the Board's decision-making, this goal will be extremely difficult to achieve. Furthermore, if the government restarts discussions on "mandating the conversion of foreign-held Treasury bonds into 100-year zero-coupon bonds," it will undoubtedly further shake the foundation of market confidence.

Another major challenge is dealing with the secondary risks following the bursting of stock and credit market bubbles.

Given the potential for long-term interest rate jumps due to hidden risks in US public finances, the probability of a bubble bursting next year is highly realistic.

Historically, the current cyclically adjusted price-to-earnings ratio (CAPE) of the S&P 500 is around 40, more than double the long-term average, and the risk of a 40% market correction cannot be ignored. Warren Buffett's "stock market valuation/GDP ratio" is still 50% higher than its historical peak, indicating significant bubble characteristics.

At the same time, the $1.5 trillion private credit market has begun to expose risks, and the possibility of local crises spreading into systemic risks should not be underestimated.

Even in an ideal environment of policy coordination and market stability, the Federal Reserve faces immense difficulties in dealing with credit or stock market crises.

These challenges will be even more disruptive given the fragmented macroeconomic decision-making and lack of policy coherence under the Trump administration. For Jerome Powell, not having to take on the "Herculean task" of stabilizing the economy amidst the bursting of various financial bubbles may be considered a stroke of luck.

Ahead of the December interest rate meeting: Expectations for a rate cut are rising, and institutions are issuing statements to set the tone.

Williams' comments have cemented the likelihood of a rate cut, and with the December 9-10 FOMC meeting approaching, the Fed's policy direction has become the market's focus. Williams, the Fed's third-in-command and president of the New York Fed, made dovish remarks, stating that he believes there is "still room for further rate cuts in the near term," significantly strengthening expectations of a December rate cut.

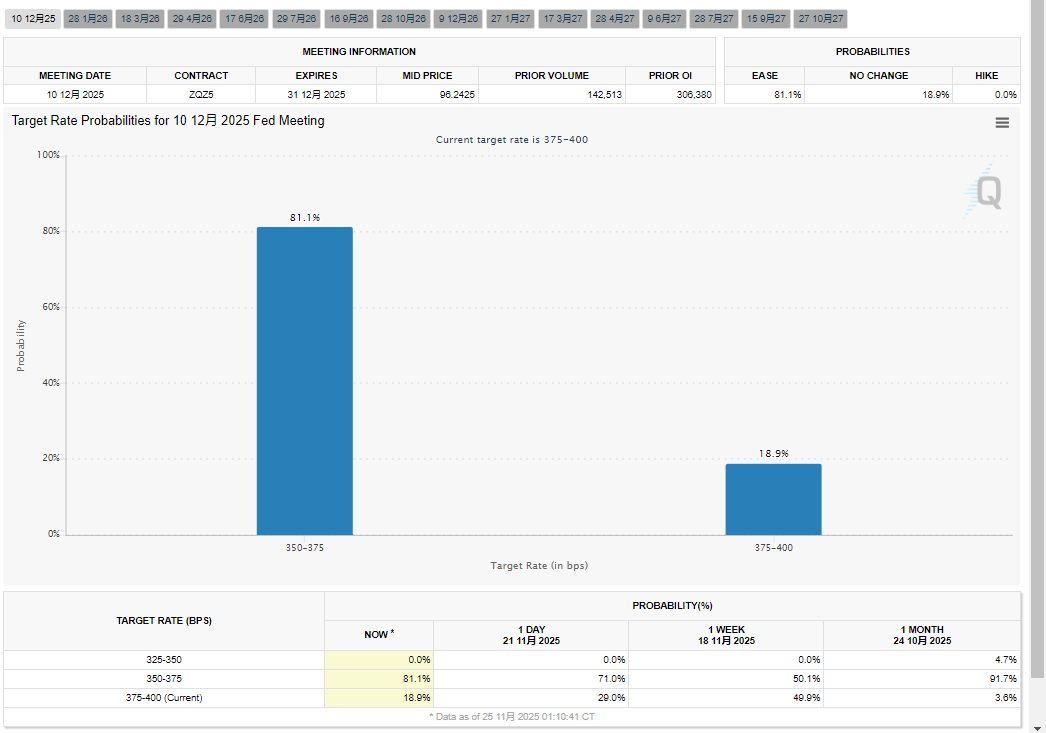

According to CME FedWatch data, six days ago the market estimated that the probability of the Fed cutting interest rates in December was only 30.5%, while the probability of keeping rates unchanged was 69.5%. After Williams' speech, the probability of a rate cut surged from 30% to around 70%. Then, on Monday, Waller expressed that the US labor market was weak and continued to weaken, and that inflation was expected to slow down. He believed that these factors were sufficient to support the proposal of a 25 basis point rate cut at the December meeting.

Despite Waller's consistently dovish stance and status as a leading candidate for Fed Chair, which has had a limited impact on expectations of an overall Fed rate cut in December, the market has still pushed up CMEFedWatch's December rate cut futures to 81%.

Institutional analysis: Goldman Sachs and Pantheon reach consensus on interest rate cuts

In a strategy report released today, Goldman Sachs Chief Economist Jan Hatzius pointed out the core issue: "Although the September non-farm payroll data was released with a significant lag, this data has most likely already locked in the FOMC meeting on December 9-10 with a 25 basis point rate cut decision."

He further explained to clients: "(New York Fed President Williams') statement is highly consistent with Chairman Powell's position—who almost clearly signaled three rate cuts in the September dot plot—and also aligns with the majority view among the 12 voting FOMC members, although it may not receive the support of all 19 participating members."

Goldman Sachs' latest forecast also indicates that the Federal Reserve will cut interest rates twice more in 2026, in March and June, eventually bringing the federal funds rate down to a range of 3.00%-3.25%.

The bank believes that slowing inflation and a cooling labor market provide policymakers with room to further ease monetary policy. The Federal Reserve may maintain a cautious tone in the short term, but the trajectory of core prices and wage growth suggests that the policy stance may gradually transition to a neutral level next year.

Pantheon macroeconomics analysts Samuel Thomas and Oliver Allen were even more decisive, believing that Williams' remarks had already sealed the deal on a rate cut: "Mr. Williams's comments carry far more weight than those of other FOMC members—since becoming president of the New York Fed in 2018, and during his tenure as president of the San Francisco Fed from 2011 to 2018, he has consistently aligned himself with the majority and never contradicted the chairman's position. We judge that Mr. Williams would never have easily hinted at the possibility of a December rate cut without prior communication with key members of the Fed Board, including Chairman Powell."

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.