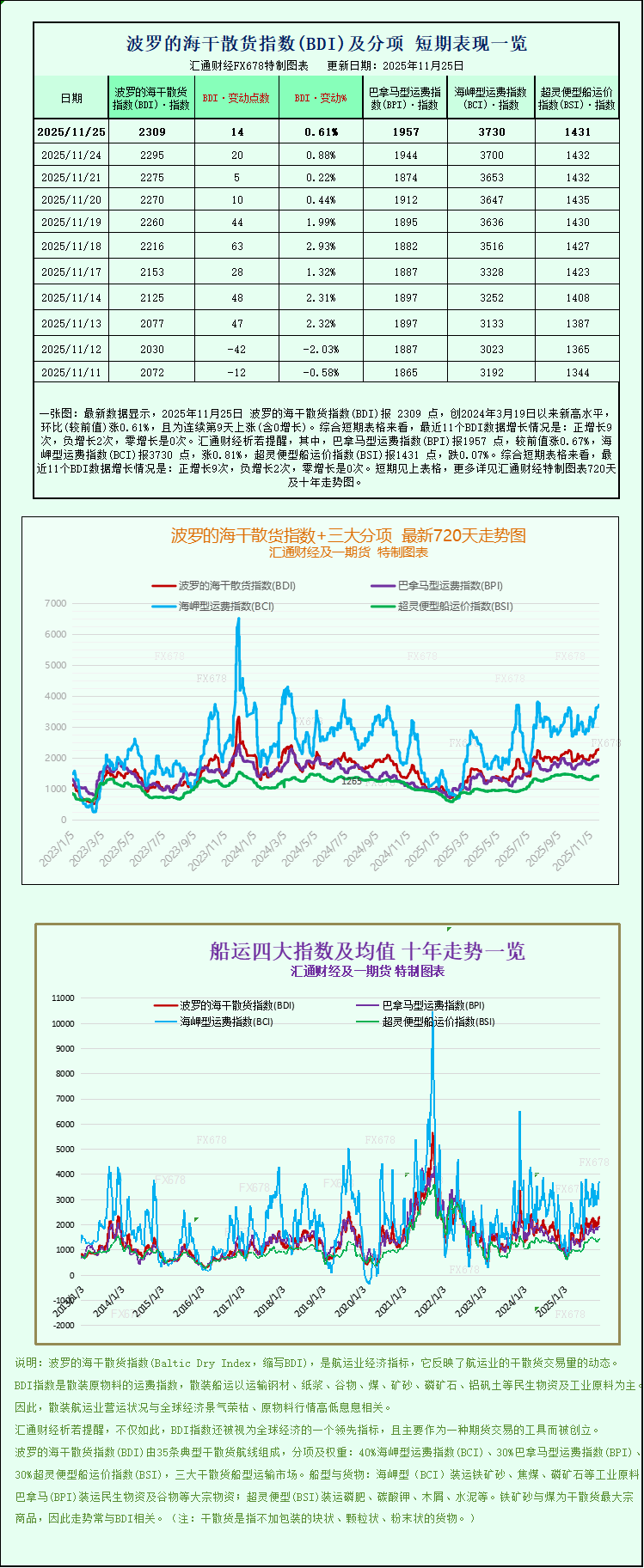

One chart: The Baltic Dry Index rises for the ninth consecutive day, reaching a new high in nearly two years.

2025-11-26 00:05:14

The Baltic Dry Index (BDI) published by the London Baltic Exchange rose for the ninth consecutive trading day on Tuesday, November 25, reaching its highest level in nearly two years since March 2024. The continued strength of Capesize and Panamax freight rates was the core driver of the index's rise, injecting significant confidence into the global dry bulk shipping market.

As a core indicator for measuring the health of the global dry bulk shipping market, the Baltic Dry Index (BDI) covers freight rates for three main types of dry bulk carriers: Capesize, Panamax, and Supramax. Data shows that the index rose 14 points, or 0.6%, to close at 2309 points. This continuous upward trend is not a short-term impulsive phenomenon—tracing back to mid-November, the index began a steady climb from November 17th, with a cumulative increase of nearly 8% to date, clearly reflecting a substantial recovery in global dry bulk shipping demand.

Among the various vessel types, large vessels responsible for transoceanic bulk commodity transportation performed particularly well, becoming the "main force" driving the index increase. Specifically, the Capesize freight rate index rose 30 points, or 0.8%, to close at 3730 points, reaching a peak in nearly four months. Capesize vessels, the "juggernauts" of dry bulk shipping, generally have a deadweight tonnage of over 150,000 tons. Because their size exceeds the navigation restrictions of the Panama Canal and the Suez Canal, they often need to round the Cape of Good Hope, hence the name "Capesize vessels." These vessels primarily handle transoceanic transportation of heavy bulk commodities such as iron ore and coal. Iron ore accounts for as much as 68% of their total transport volume, and coal accounts for 19%, making them a key carrier in the global industrial raw material supply chain. Driven by rising freight rates, the average daily earnings of Capesize vessels increased by $253 to $30,938 per day, significantly improving the profitability of shipping companies.

The strong performance of the Capesize vessel market closely mirrors recent developments in the iron ore market. On November 25th, iron ore futures prices rose in tandem, with one of the core driving factors being the anticipated implementation of China's port fee adjustment policy. Market rumors suggest that China plans to optimize port storage fees and rules, uniformly adjusting the free storage period to 30 days. Storage fees will gradually increase after this period, reaching 1 yuan/day for storage exceeding 180 days, with exemptions only available to some state-owned steel mills and traders. This policy is expected to effectively curb long-term hoarding in the market, accelerate iron ore inventory turnover, and thus stimulate immediate transportation demand, directly boosting demand for Capesize vessels. Looking at the specific trend of iron ore futures, the November contract (I11M) on the Dalian Commodity Exchange closed at 734.5 yuan/ton, up 6.5 yuan from the previous trading day, maintaining an upward trend for three consecutive trading days, further confirming the recovery in market demand.

The Panamax market also performed steadily, becoming another important force supporting the index. The Panamax freight index rose 13 points, or 0.7%, to close at 1957 points, marking its fifth consecutive trading day of gains and reaching a new high since mid-September. These vessels, with a deadweight tonnage of 60,000 to 70,000 tons, exhibit a diversified transport structure, with coal accounting for 44% and grain for 39%, making them a core transport tool for global energy and food trade. With many parts of the world entering the peak winter energy demand season and the steady growth of international food trade flows, the demand for Panamax shipping continues to be released, driving its average daily earnings up by $117 to $17,615 per day. Analysts from shipping companies such as China Shipping and COSCO point out that in the second half of 2025, global food transportation will be driven by holiday consumption booms, increased restocking demand from feed companies, and seasonal growth in coal transportation, suggesting that the Panamax market is expected to maintain high prosperity.

In contrast to the strong surge in large vessels, the market for smaller vessels remained relatively stable. The Supramax freight rate index dipped slightly by 1 point, or 0.1%, to close at 1431, ending an 11-day winning streak. However, looking at the overall trend, the index has accumulated a gain of nearly 10% since the beginning of October, and its weekly increase since November is still 1.9%. Market activity has not diminished despite the slight daily adjustment, only exhibiting a structural characteristic of "large vessels leading the rise, with small vessels following suit." This divergence is related to the different demand scenarios for different vessel types—Supramax vessels mainly handle small-volume bulk cargo transportation and are more affected by fluctuations in specific commodity markets, while large vessels directly benefit from the increased demand for basic industrial products such as iron ore and coal, and are more closely linked to the pace of global infrastructure recovery.

The industry is generally optimistic about the overall outlook for the dry bulk shipping market in the second half of 2025. From the demand side, the expansion of China's special-purpose bonds is driving steady infrastructure construction, and the gradual release of steel demand will continue to boost iron ore transportation demand. Against the backdrop of global energy structure adjustments, cross-regional coal transportation demand remains stable, coupled with seasonal growth in grain trade, jointly supporting the demand for dry bulk shipping. From the supply side, environmental policies are accelerating the early retirement of older vessels, while the growth rate of new ship deliveries is slowing. The growth rate of dry bulk shipping capacity in 2025 is projected to be 2.9%, lower than the 3.1% of the previous year, further easing the pressure of overcapacity. This continued improvement in the supply-demand relationship provides solid support for the subsequent trend of dry bulk freight rates.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.