US Dollar Outlook: Dollar to continue falling ahead of ADP and ISM data releases.

2025-12-03 19:02:40

OCBC foreign exchange analysts Francis Zhang and Christopher Wang pointed out that the US dollar index closed at 99.19 in overnight trading. Due to the lack of new positive factors, the dollar continued to weaken and failed to show effective rebound momentum.

Weak US economic data and a dovish tone from the Federal Reserve dominated the market downturn.

Recent US macroeconomic indicators suggest a gradual cooling of economic activity. While the overall situation remains stable, employment and output data have signaled a slowdown in demand, reinforcing market expectations that the Federal Reserve will initiate easing measures earlier than initially anticipated. Dovish comments from several Fed officials have further solidified the rationale for a December rate cut, with the central bank emphasizing concerns about slowing growth momentum and manageable inflationary pressures in its communications.

The saga of the Federal Reserve Chair nominee: Hassett emerges as the frontrunner, dovish expectations rise.

Adding to the dollar's woes, speculation about the next Federal Reserve chairman has become a key market driver. Reports indicate that the Trump administration canceled interviews with several finalists, including Christopher Waller, who was scheduled to meet with Vice President Vance today. In fact, President Trump clearly expressed his personnel preferences on Air Force One last weekend, with Kevin Hassett, currently director of the National Economic Council, emerging as the most likely candidate, whose policy stance is considered highly aligned with the president's. Hassett, known for his advocacy of low interest rates, has seen his chances of being elected in betting markets surge from 35% before Thanksgiving to 85% this week. Trump recently hinted at this at an event he attended with Hassett: "I think the potential next Fed chairman is here. I'm not sure… can we call him a 'potential' Fed chairman?" Although Jerome Powell's term will continue until mid-May next year, Trump has stated that he will announce his nominee in early 2026, with the final candidate requiring Senate confirmation.

The market interpreted Hassett's potential appointment as a strong signal of a more dovish monetary policy, further exacerbating the dollar's weakness given market expectations that the Federal Reserve would adopt a more accommodative stance under her leadership. However, some institutional investors warned that the dollar sell-off might ease once the appointment takes effect—partly because Hassett's actual policy proposals may not be as dovish as the market anticipates, and partly because the Fed's collective decision-making mechanism will constrain her policy freedom, making it difficult to implement excessively loose monetary policy. It is worth noting that the market has largely priced in a rate cut at the December FOMC meeting, and investors' focus is now shifting to the Fed's rate cut path guidance for 2026, with the selection of the new chair becoming a key variable influencing this path.

Geopolitical tensions offer limited support

Typically, geopolitical tensions drive safe-haven buying and support the dollar, but this time it failed to prevent the dollar from falling. Reports of stalled negotiations between US and Russian envoys and rising regional uncertainty were overshadowed by the dominant narrative of an impending Federal Reserve rate cut. Investors prioritized monetary policy expectations over geopolitical risks, making the dollar vulnerable to further downward pressure amid continued market bets on rate cuts.

Key Economic Data Preview: ADP Employment and ISM Services PMI to be in Focus

Traders are closely watching two sets of core US data released today, which will provide the latest reference for the Federal Reserve's policy decisions. First is the December ADP employment report. The market predicts only 10,000 new jobs, far below the previous figure of 42,000, indicating that the US job market may be cooling further. Although this data is unlikely to change market expectations for a 25 basis point rate cut next week (currently priced in at 92%), lower-than-expected data could reinforce dovish bets and further suppress the dollar; if the data unexpectedly strengthens, it could trigger a short-term pullback. Second is the December ISM Services PMI. Last month, the index recorded a contractionary reading of 48, a recent low. If this data rises above the 50-point threshold (indicating industry expansion), it could provide temporary support for the dollar; if it declines further, it will exacerbate market concerns about slowing economic activity and reinforce the necessity for the Fed's aggressive easing measures.

Furthermore, Friday's PCE price index (the Fed's preferred inflation indicator) will provide a key reference for price pressures. Continued weakness in inflation data could solidify expectations of further interest rate cuts in 2026. Overall, the current dollar price has not fully reflected the recent decline in US short-term interest rates. If today's data again falls short of expectations, it could be a catalyst for the dollar index to break below the 99.00 level, triggering a new round of downward momentum.

Technical Analysis

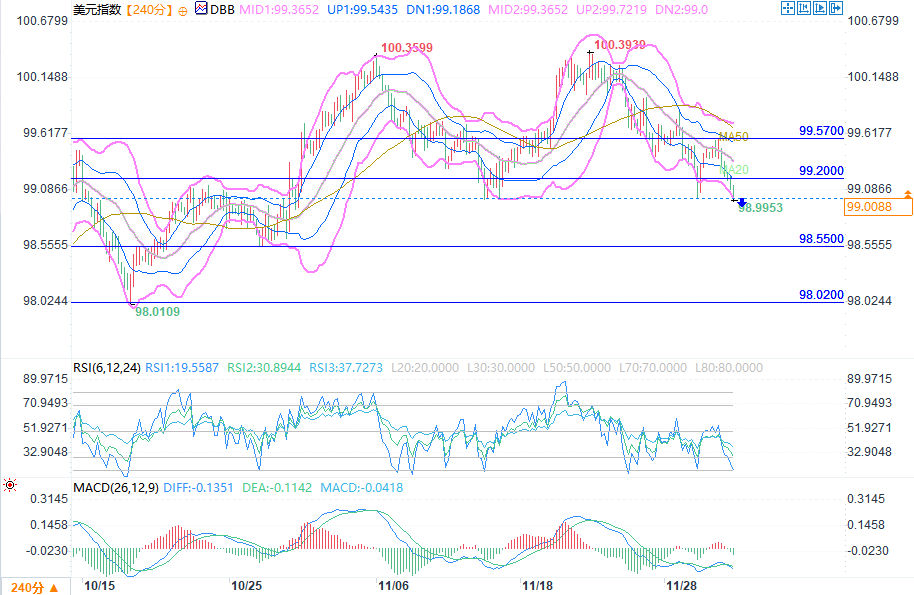

(US Dollar Index 4-hour chart source: FX678)

From the 4-hour chart, the US dollar index is currently in a clear downward continuation trend. The key signals can be analyzed from three aspects: trend pattern, indicator correlation, and key price levels.

First, let's look at the trend and the Bollinger Bands: The Bollinger Bands (pink and blue lines) are generally diverging downwards, with the middle band continuing to slope downwards. The upper band is providing simultaneous resistance, and the lower band is extending in tandem. Volatility has not converged, indicating that bearish momentum is still being released. The price has been trading close to the lower Bollinger Bands for several consecutive days. During this period, rebound highs (such as around 99.2 at the end of November) were all suppressed by the middle Bollinger Band and fell back, consistently remaining below the 20-day moving average (MA20). The downward alignment of the MA20 and MA50, along with the middle Bollinger Bands, forms overlapping resistance, further solidifying the downward trend.

Let's look at the resonance verification of the indicators: The RSI is currently in the 30-40 bearish zone. When the price refreshed the low point (98.9989), the RSI fell in sync, without any divergence signal, which means that the bearish momentum has not exhausted. The MACD double lines remain below the zero axis. Although the green bars have narrowed slightly, they have not turned red or formed a golden cross, indicating that the short-term fluctuations have not changed the nature of the bearish trend.

Finally, pay attention to key price levels: short-term support is concentrated at 98.9989, near the current double lower Bollinger Bands. If it breaks down, the next target is the previous low of 98.5510. On the resistance side, the first resistance level is around 99.2, corresponding to the middle Bollinger Band (overlapping with the MA20), followed by the 99.5 level, corresponding to the previous rebound high. When the price rebounds to the 99.2 area, it is likely to be suppressed by the overlap of the double Bollinger Bands and the moving averages and fall back.

Overall, the US dollar index is currently in a downtrend dominated by bears. For trading, short positions can be held with a stop-loss set at 99.2 (the resistance level of the double middle band + MA20). Those who haven't entered the market can wait for the price to rebound to around 99.2 and encounter resistance before shorting, with a target of 98.55. If the price breaks through 99.2 and holds, then the risk of a phased pullback should be noted.

Summarize

Given that the market has already fully priced in expectations of a Fed rate cut, and Hassett's nomination has further reinforced dovish sentiment, the dollar is likely to remain under pressure in the short term. Today's ADP and ISM data will be key catalysts, determining whether the dollar index can hold the key support level of 99.00 or face further selling pressure.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.