Dangerous Consensus: Everyone Expects Volatility? Beware of the Fed Turning "Expectation Management" into a "Liquidity Trap"

2025-12-09 20:18:05

On the fundamental front, policy disagreements within the Federal Reserve have become key to bond market pricing. While half of the committee members may favor holding rates steady, the market expects the chairman to push for a 25 basis point rate cut to the 3.5%-3.75% range and set a higher threshold for further easing in the statement. This "wait-and-see" strategy, similar to that of 2019, aims to balance inflation and employment risks. However, the delayed release of key data (such as the October and November employment and inflation reports) forces the Fed to remain cautious in the absence of sufficient evidence, amplifying market sensitivity to policy signals. Retail traders generally believe that this data vacuum could exacerbate bond market volatility, and the recent rise in yields has already partially reflected expectations that the Fed will not be overly dovish.

Analysis of US Treasury Market Dynamics and Dollar Trends

The performance of the US Treasury market directly impacts the short-term trend of the US dollar. Although the 10-year US Treasury yield declined slightly during the day, technical indicators show that the price is trading above the middle Bollinger Band, and the MACD indicator is approaching a golden cross, suggesting that the short-term decline may be slowing. This is related to the liquidation pressure brought about by the rebound in European bonds in the morning, resulting in a flattening yield curve. Currently, market trading is cautious, with a strong wait-and-see attitude.

From a transmission mechanism perspective, the recent rise in US Treasury yields has provided support for the US dollar, but intraday fluctuations also reflect market divergence. The US dollar index is currently trading within a narrow range above the middle Bollinger Band, and the MACD indicator shows that downward pressure has eased somewhat. Analysts believe that market expectations for the extent of future easing by the Federal Reserve have significantly weakened (for example, pricing in only one rate cut in the first half of 2026), which has strengthened the dollar's interest rate advantage by pushing up yields. Analysts emphasize that internal divisions within the Federal Reserve and the risk of leadership changes have made the market skeptical of future guidance. This uncertainty is transmitted through the US Treasury-German bond yield spread (which has now widened to 131.4 basis points), limiting the dollar's downside.

Retail traders' views further corroborate the above logic. They believe that due to the lack of key data, the Fed's guidance will tend to be conservative, which may keep US Treasury yields under upward pressure, indirectly supporting the dollar. Some also view this decision as a close contest, pointing out that if interest rates approach neutral levels after the rate cut, bond yields are likely to stabilize, increasing the probability of a dollar rebound. Furthermore, the hawkish tendencies of major global central banks (such as the ECB and the Bank of Japan) have pushed up global bond yields, which, through their linkage with US Treasuries, also benefit the dollar. Technically, for the dollar index to break upwards, US Treasury yields need to effectively break through recent resistance; conversely, if the flattening trend of the bond yield curve continues, the dollar will test lower support levels.

The divergence between hawks and doves within the Federal Reserve has been amplified in the bond market: hawks are concerned about recurring inflation, while doves are wary of a sudden deterioration in the labor market. This uncertainty about the policy path may be interpreted by the bond market as a downside risk to the economy, thereby depressing yields and dragging down the dollar. Some retail traders have pointed out that the Fed's decisions may become more politically driven, potentially leading to faster rate cuts in the future, but current bond market pricing does not reflect strong dovish expectations, which has allowed the dollar to maintain a certain degree of resilience amid volatility. In short, during this data vacuum, the bond market's interpretation of the Fed's statements will be the direct driver of short-term dollar fluctuations.

The transmission of the safe-haven effect of spot gold

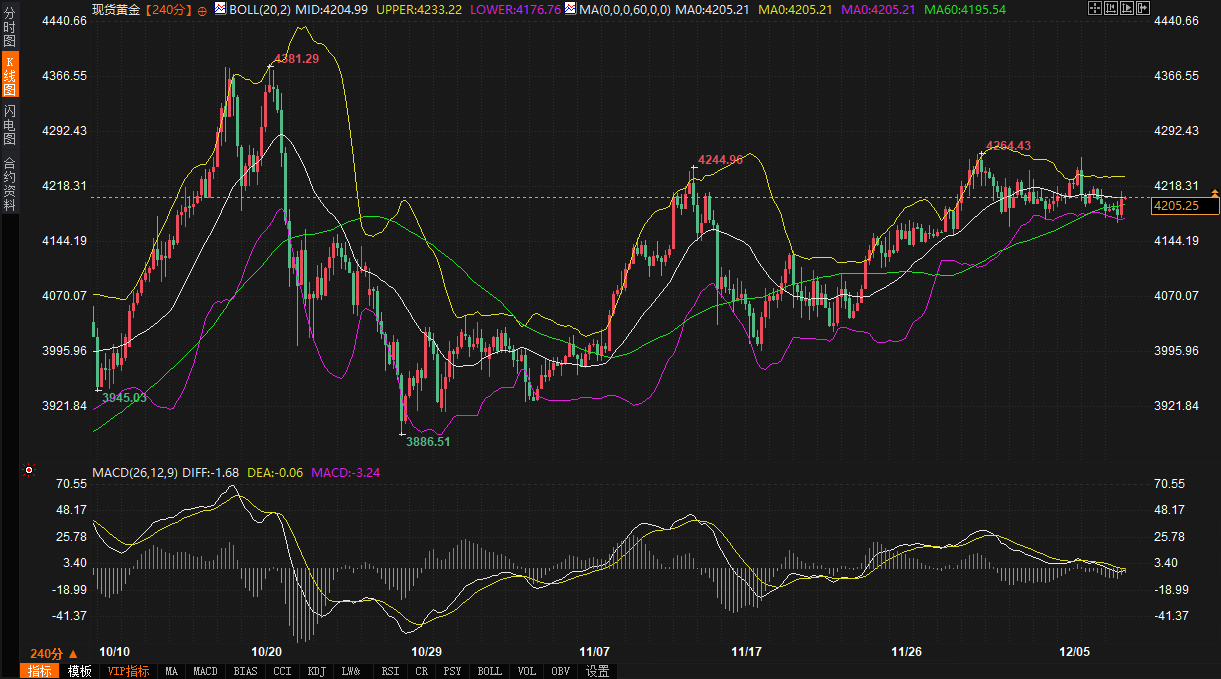

The price action of spot gold highlights its unique reaction pattern as a safe-haven asset. Gold prices rose slightly during the day, with technical indicators showing that the price is closely following the middle Bollinger Band, and downward momentum has weakened. This is not due to direct geopolitical conflict, but rather a safe-haven allocation by the market through an indirect interpretation of bond market volatility.

A key blind spot in gold's price movement lies in the transmission chain of signals from the bond market. Theoretically, rising US Treasury yields should weaken gold's appeal. However, current policy disagreements within the Federal Reserve and a lack of data have exacerbated economic uncertainty, pushing up overall market volatility and safe-haven demand, from which gold actually benefits. Institutional views point out that while the bond market's pricing in hawkish signals may suppress risk assets, it also creates demand for gold as a safe-haven asset. Some Fed officials have warned of a non-linear decline in the labor market; if future data is weak, the bond market may react in advance, and declining yields will directly benefit gold.

Retail traders added details: Gold prices have stabilized after retreating from their highs in the first week of December. High market expectations for an interest rate cut at this meeting have provided a floor for gold prices, with some forecasting a year-end target of $4,300 or even higher. Continued gold purchases by central banks also provide long-term support.

Technically, gold's trading range is closely related to bond market movements. If US Treasury yields fall further to test lower support, gold prices are expected to test recent resistance; conversely, if the bond market stabilizes after the Fed's decision, gold's upside potential will be limited. The immediate reaction of the bond market after the Fed's decision statement needs close monitoring during trading. Some retail traders have conducted scenario analysis: if the Fed is dovish, gold prices may surge quickly; if it is hawkish, gold prices may fall, but there is also solid buying support below. The current resilience of gold stems from the market's pricing in the uncertainty of the Fed's decision in the absence of data.

Short-term trend outlook

Over the next two to three days, the market will be centered on the Federal Reserve's decision, with the bond market's reaction serving as the central driver of price transmission across various assets. The 10-year US Treasury yield is expected to fluctuate within the range of 4.067% to 4.201%. If the policy statement or the chairman's remarks are hawkish, a test of the upper limit of the yield range will support the US dollar index within the 98.8359-99.1213 channel; conversely, if the market interprets the Fed's divergence as a further ambiguity in the policy path, yields may decline, putting pressure on the dollar.

The price movement of spot gold will passively depend on signals from the bond market. Gold prices are likely to fluctuate within the range of 4176.75-4233.20. If US Treasury yields fall after the decision, gold prices are expected to consolidate above the middle band and seek upward movement; however, if the bond market remains stable, gold's safe-haven premium will be limited, and the price movement will mainly be range-bound.

Overall, this meeting takes place during a data vacuum, making the Fed's art of "expectation management" crucial. An overly cautious stance could stabilize bond yields, thus limiting both the downside for the dollar and the upside for gold. While retail traders anticipate rate cuts, the bond market is currently relatively calm and hasn't factored in excessive dovish expectations. In the short term, the market may maintain a delicate balance before key economic data releases: if the flattening of the US Treasury curve continues, the dollar will face slight pressure, while gold will maintain its safe-haven resilience. The true trend direction may need to be reshaped by the major data releases starting next week.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.