Forex Market Report: The dollar's defenses crumbled after three weeks, the euro is on the verge of collapse, and the pound sterling retreated after being ambushed by data.

2025-12-13 13:38:05

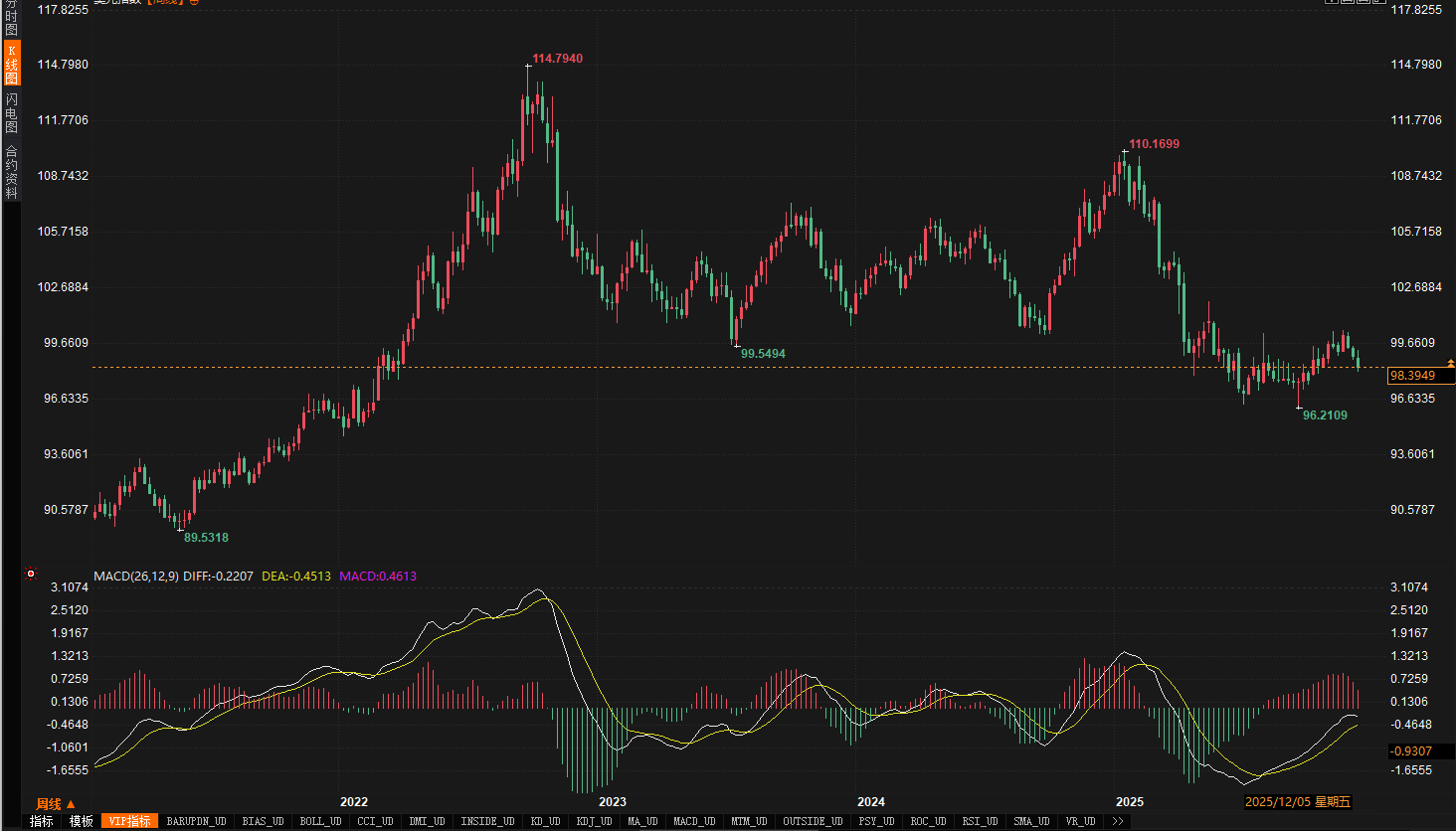

US Dollar (USD): Three-day losing streak amid easing hawkish stance; market divergence deepens between the Fed and the market.

Trend Review:

The US dollar index continued its weak trend this week, exhibiting a volatile downward pattern. In the first half of the week, market sentiment was cautious ahead of the Federal Reserve's interest rate decision, putting pressure on the dollar. After the Fed cut rates as expected on Wednesday, the market interpreted Chairman Powell's remarks and policy statement as less hawkish than anticipated, intensifying the selling pressure on the dollar, and the index fell to a two-month low on Thursday. Although it recorded a slight technical rebound on Friday, closing at 98.44, it still fell 0.6% for the week, marking its third consecutive week of decline. Year-to-date, the dollar index has fallen by more than 9%, on track for its largest annual drop since 2017.

Institutional and analyst opinions:

Data and event analysis:

1. Federal Reserve Interest Rate Decision: The core driver of the market this week. The Fed announced an interest rate cut, but market focus was on the future policy signals it conveyed. Investors generally believed that Powell's comments weakened previous market concerns about a "hawkish" outlook and strengthened market expectations for further rate cuts in 2026. This interpretation became the main catalyst for the dollar's decline this week.

2. The Gap Between Market and Policymaker Expectations: There is a significant discrepancy between current market pricing and official guidance from the Federal Reserve. Traders are currently betting on two rate cuts in 2026, while the Fed policymakers' latest dot plot projections suggest only one rate cut next year, with the other in 2027. This divergence increases uncertainty about the path of monetary policy and continues to put pressure on the dollar.

3. External Risk Sentiment: The global trade environment remains tense due to actions such as the unilateral imposition of tariffs by the United States, triggering market concerns about global economic growth. This risk aversion, at times, failed to boost the dollar as traditionally expected; instead, market concerns about trade frictions damaging the US economic outlook indirectly pressured the dollar.

Bob Savage, head of macro strategy at NYCB, attributed Friday's rebound to "Friday fatigue" and a technical correction, noting that the recent weakness in the dollar was partly due to expectations of a Federal Reserve rate cut. He commented that the Fed's action was a "neutral rate cut," disagreeing with some market participants' descriptions of a "hawkish rate cut," and emphasized that the Fed's stance differs from that of some other central banks discussing rate hikes (such as the European Central Bank and the Reserve Bank of Australia).

BMO Chief Economist Douglas Porter points out that the dollar index has fallen about 7% from its January peak. He predicts that with the Federal Reserve further easing policy (expecting another 75 basis point rate cut), and other central banks potentially taking different paths, the dollar index could depreciate by another 2%-3% in 2026.

British Pound (GBP): Unexpected GDP contraction dashes gains, further solidifying expectations of a central bank rate cut.

Trend Review:

The British pound experienced a rollercoaster ride against the US dollar this week. From the beginning of the week until Wednesday, the pound sterling trended upwards against a backdrop of generally weaker US dollars, reaching a seven-week high on Thursday. However, unexpectedly weak UK GDP data released on Friday caused the pound to fall back, erasing most of its intraday gains. Ultimately, the pound still closed the week slightly higher by 0.29%, but its upward momentum was clearly hampered.

Data and event analysis:

1. UK Q3 GDP Data: The most direct event affecting the pound this week. Data showed that the UK economy unexpectedly contracted by 0.1% in the three months from August to October, while the market expected it to remain flat. This data exacerbated market concerns about the health of the UK economy and was seen as a possible signal that the UK economy may be heading into a technical recession.

2. Bank of England Interest Rate Expectations: Weak GDP data has largely solidified market bets that the Bank of England will cut interest rates at its monetary policy meeting next week (December 18). Although the market had almost fully priced in this rate cut, the deteriorating economic data reinforces the necessity of this action and could influence the central bank's statements on the future path of interest rates.

Institutional and analyst opinions:

The market widely believes that the GDP data was the direct cause of the pound's reversal from gains to losses on Friday. The data not only confirmed the fragility of the UK economy but also further tilted the balance between supporting economic growth and controlling inflation towards interest rate cuts at the Bank of England. Analysts pointed out that after the data release, the probability of a Bank of England rate cut next week in the interest rate futures market has approached 100%.

Euro (EUR): Steadily rising to challenge higher levels, awaiting guidance from the ECB decision.

Trend Review:

The euro performed steadily against the dollar this week, exhibiting a fluctuating upward trend. Supported by a weakening dollar, the euro reached a more than two-month high on Thursday. On Friday, the euro was essentially flat against the dollar around 1.1737, but still gained 0.825% for the week, marking its third consecutive week of gains.

Data and event analysis:

1. The dominant role of the weakening US dollar: The euro's rise this week was mainly driven by the general weakness of its counterpart, the US dollar, especially the change in interest rate expectations brought about by the Federal Reserve's dovish policy stance.

2. ECB Policy Expectations: The market widely expects the European Central Bank (ECB) to keep interest rates unchanged at its meeting next week. Investors are focused on ECB President Christine Lagarde's statements regarding the inflation outlook, economic assessment, and future policy path, particularly any clues about when discussions on policy normalization might begin.

3. Economic Data and Geopolitical Factors: The market is simultaneously focusing on the performance of economic data within the Eurozone, as well as the potential impact of geopolitical events such as the Russia-Ukraine conflict on European economic confidence and market sentiment.

Institutional and analyst opinions:

Analysts believe the euro's recent strength primarily reflects the market's repricing of the policy cycle differences between the Federal Reserve and the European Central Bank. In the short term, the euro's performance is likely to continue to be influenced by the overall momentum of the US dollar and the outcome of next week's ECB meeting.

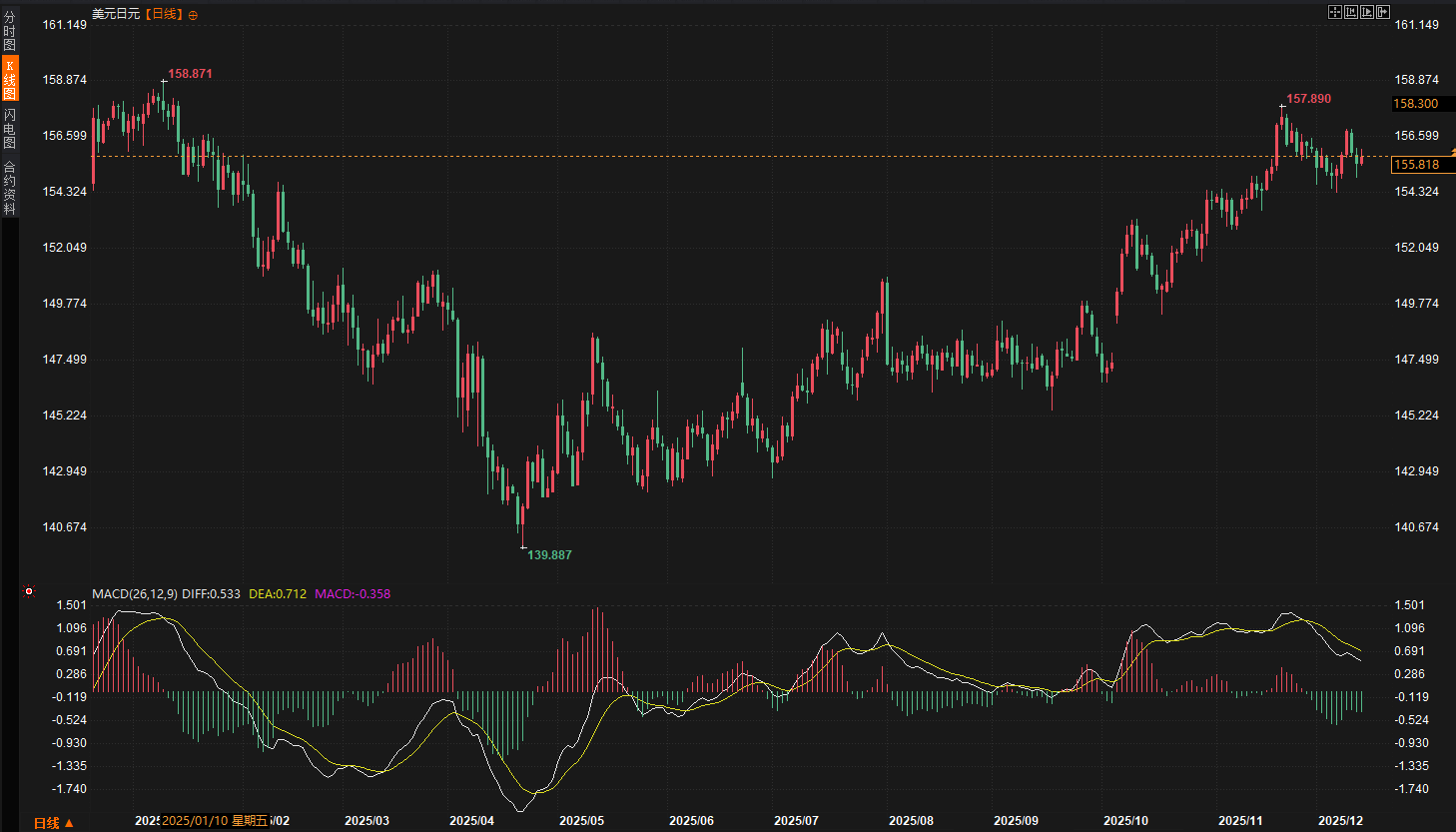

Japanese Yen (JPY): Interest rate hike expectations are building ahead of schedule; awaiting the Bank of Japan's "historic" decision.

Trend Review:

The USD/JPY pair initially rose but then fell this week. At the beginning of the week, the exchange rate rose due to a brief rebound in the US dollar and improved risk sentiment. However, as market attention shifted to the Bank of Japan's interest rate decision next week, rising expectations of a rate hike provided support for the yen, pushing the USD/JPY pair lower. Overall, the yen appreciated by approximately 0.31% against the dollar for the week.

Data and event analysis:

1. Bank of Japan Interest Rate Decision Preview: Next week's Bank of Japan monetary policy meeting is the core focus of the market's pricing of the yen. The market widely expects the Bank of Japan to raise its policy rate, which would be a key step in its monetary policy normalization process.

2. Policy Path Communication Becomes Key: Beyond the interest rate hikes themselves, the market is more focused on the Bank of Japan's policymakers' comments and forward guidance regarding the interest rate path from 2026 onwards. The Bank of Japan may pledge to continue its interest rate hike process, but at the same time emphasize that future rate hikes will be gradual and highly dependent on the economy's response to each rate increase.

3. External risk sentiment: Market risk aversion triggered by global trade tensions and geopolitical risks has also provided additional support for the traditional safe-haven currency, the Japanese yen, at certain times.

Institutional and analyst opinions:

Traders and analysts are largely focused on the Bank of Japan's decision next week. The consensus is a rate hike, but the key lies in the central bank's assessment of inflation sustainability and its statements regarding subsequent steps in exiting its ultra-loose monetary policy. Any hint that the rate hike cycle might be shorter or longer than expected could trigger significant volatility in the yen's exchange rate.

Swiss Franc (CHF): Central Bank's Stability Measures Benefit from Trade Boosts, Demonstrating Safe-Haven Resilience

Trend Review:

The US dollar initially rose against the Swiss franc this week before weakening overall. The Swiss franc performed strongly, influenced by the overall weakness of the US dollar and the Swiss National Bank's interest rate decision, with the dollar/Swiss franc pair falling a cumulative 1.06% for the week.

Data and event analysis:

1. Swiss National Bank Interest Rate Decision: The Swiss National Bank (SNB) kept its policy rate unchanged at 0% at its meeting on Thursday, as expected. Its statement noted that the recent agreement to reduce US tariffs on Swiss goods improved Switzerland's economic outlook. This statement was seen as a mild positive for the Swiss franc.

2. Inflation and Economic Outlook: The Swiss National Bank (SNB) also noted that although domestic inflation was somewhat lower than expected, improvements in the external trade environment provided support for the economy. This relatively balanced and slightly optimistic tone alleviated market concerns that the SNB might intervene in the foreign exchange market to curb the excessive appreciation of the Swiss franc.

3. Safe-haven capital flows: Against the backdrop of global economic uncertainty and geopolitical tensions, the Swiss franc, as a traditional safe-haven currency, continues to attract some capital inflows.

Institutional and analyst opinions:

Market analysts interpret the Swiss National Bank's policy statement as generally neutral to slightly positive. Acknowledging that lower-than-expected inflation may reduce pressure to raise interest rates hastily, while emphasizing the improved economic outlook resulting from the US-Swiss tariff agreement alleviates concerns about the impact of the Swiss franc's appreciation on exports. This allows the Swiss franc to strengthen moderately in the current environment due to its safe-haven characteristics.

Weekly Summary and Outlook

Key takeaways from this week:

Over the past week, the trading logic in the foreign exchange market clearly revolved around two main themes: "monetary policy divergence" and "economic data verification." The dovish signals from the Federal Reserve successfully perpetuated the "interest rate cut narrative," setting the tone for a broad-based weakening of the US dollar and leading to a general rise in its major counterpart currencies. However, the unexpectedly weak GDP data from the UK served as a cold shower, promptly reminding the market that fundamentals cannot be ignored, causing the pound's rise to abruptly end and highlighting the immediate impact of economic health on central bank decisions and currency value. Meanwhile, the Japanese yen and Swiss franc, respectively relying on clear expectations of central bank interest rate hikes and a prudent central bank stance combined with external positive factors, demonstrated their independence and resilience among non-US dollar currencies.

Risk Outlook for Next Week:

Looking ahead to the week of December 15-20, the foreign exchange market will witness a veritable "Central Bank Super Week" and a "data deluge." The Bank of England, the European Central Bank, and the Bank of Japan will all announce their interest rate decisions, and their policy statements and forward guidance will directly reshape interest rate differential expectations for various currencies. Meanwhile, the US will release a slew of key economic data from October and November (including non-farm payrolls, CPI, retail sales, and the PCE price index). These delayed data will provide a more complete picture of the resilience of the US economy and inflationary pressures, potentially significantly influencing market judgments on the pace of future interest rate cuts by the Federal Reserve, and consequently triggering a repricing of the US dollar and even the global foreign exchange market.

Investors need to prepare for potentially high volatility. Any unexpected policy shift by major central banks, or signs of economic strength or weakness revealed in supplementary US data, could be catalysts that disrupt the current market balance and drive significant exchange rate fluctuations.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.