Non-Farm Payrolls Forecast: How Will Large-Scale Government Layoffs Affect Non-Farm Payroll Data?

2025-12-16 15:50:33

However, due to data collection difficulties caused by the shutdown, the October household survey (including the unemployment rate) will not be released for the time being.

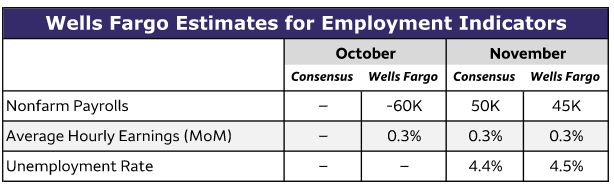

Wells Fargo forecasts a 60,000 decrease in nonfarm payrolls in October, but this figure exaggerates the weakening of job growth momentum. October is the first month that participants in the federal government's delayed resignation program officially exited the payroll register, coupled with the government's continued hiring freeze. It is estimated that federal employment will decrease by about 125,000 in that month. This means that if government layoffs are excluded, nonfarm payrolls may show a positive growth of 65,000. Therefore, there is no need to panic excessively about the significant decrease in nonfarm payrolls data in October.

It should be clarified that the government shutdown itself will not impact federal employment data, because furloughed employees ultimately receive their full wages for the survey reference period and are still included in employment statistics, meaning it does not affect the unemployment rate.

Since the October and November data are released together, the latter will provide more timely and complete guidance for the job market. Wells Fargo judges that the labor market is still in a fragile balance, expecting non-farm payrolls to increase by 45,000 and the unemployment rate to rise slightly to a cycle high of 4.5%.

If the expected outcome materializes, the Fed's "full employment" goal, one of its dual mandates, will further expose its risk exposure.

(Wells Fargo's non-farm payroll data forecast)

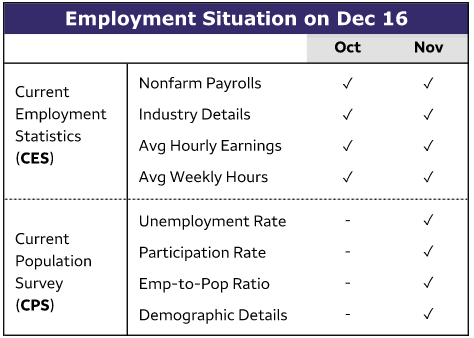

Key Data Highlights for December 16

The next U.S. jobs report will be released on December 16, and its unique feature is that it covers data from October and November. The October data will be in a "semi-complete" form: the Current Employment Statistics Survey (CES, i.e., the institutional survey) data will be released as normal (the data source is from businesses, although minor interference from the shutdown cannot be ruled out), while the Current Population Survey (CPS, i.e., the household survey) data will not be released for the time being due to obstruction of the original collection.

(The October household survey will not be available.)

Institutional surveys have a natural advantage in retrospective data collection, as complete salary records from enterprises can support data reconstruction; while household surveys rely on individuals' memories of activities during specific periods, which are relatively less accurate and traceable, and this is the core reason for the missing household survey data in October.

October Employment Data: The Reference Value of Half a Report

Wells Fargo predicts that nonfarm payrolls will fall by 60,000 in October, which, if true, would be the largest monthly drop since December 2020, but the data is significantly distorted.

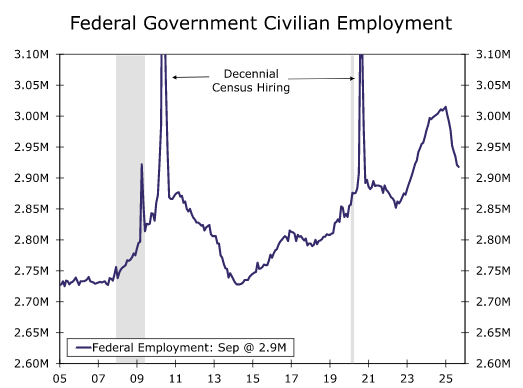

The federal employee deferred resignation program introduced by the Trump administration at the beginning of the year resulted in a large number of participants retaining their payroll slots until the end of September, which were then included in the agency’s employment statistics. In October, these employees collectively dropped off the list, causing a one-off sharp decline in federal employment data.

Combined with the impact of the government's hiring freeze, federal employment is expected to decrease by 125,000 in October, a single-month drop exceeding the cumulative decrease of 97,000 this year.

(The number of government employees declined at the beginning of the year due to the federal government's downsizing plan, and this decline is expected to continue in October and November.)

Excluding the federal government portion, private sector employment is expected to increase by 65,000 in October, slightly below the average growth rate of 71,000 over the past three months, reflecting a moderate slowdown in private sector hiring momentum.

November Data: A Complete Verification of the Job Market

The core value of the November data lies in its timeliness and completeness, as it will include all the core indicators from the regular employment report. Technical biases in data collection should be closely monitored.

Chairman Powell explicitly warned after the FOMC meeting on December 10 that the record 43-day shutdown could lead to a "technical distortion" in the November household survey—although the response rate was still within the normal range after the shutdown in 2013, the shutdown this time lasted several times longer than before, which may cause deviations in response rates, seasonal adjustments, and other aspects.

Wells Fargo predicts that nonfarm payrolls will increase by 45,000 in November, further below the average growth rate of 62,000 in the past three months and 58,000 in the past six months, indicating a continued weak employment trend.

Alternative indicators corroborate this trend: ADP private sector employment fell by 32,000 in November (mainly due to layoffs in small businesses), while Revelio total employment fell by 9,000; regional Fed PMI surveys show that service sector hiring remains in contraction territory. However, seasonal hiring in the retail and transportation/warehousing sectors has shown a slight recovery compared to last year, providing some support for the data.

(Overlay chart of trends from three employment surveys)

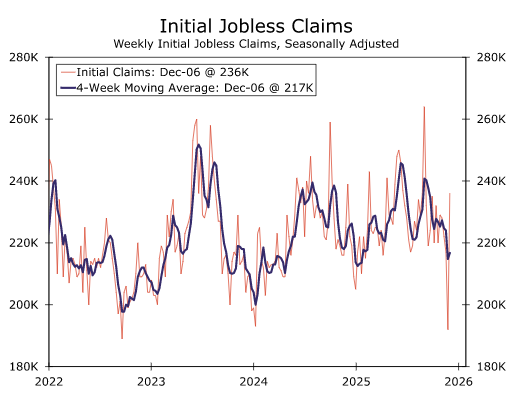

Employers are adopting a cautious approach to hiring and laying off fewer employees: initial jobless claims declined during the non-farm payrolls survey reference period (see Figure 4), and the number of Challenger layoff announcements in November was lower than in October.

(Initial jobless claims trend chart)

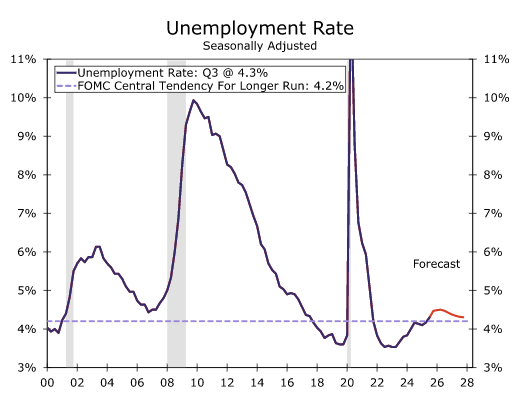

Labor demand growth was slightly slower than supply growth, pushing the unemployment rate up slowly; the Conference Board's Employment Opportunity Gap Index declined in November, confirming an expansion of slack in the labor market, and the unemployment rate is expected to rise to 4.5% in November.

(The chart shows the trend of the Conference Board's Job Opportunity Gap Index, which reflects the ease of finding a job in the United States. The larger the positive value, the easier it is to find a job.)

Wage growth reflects the fragility of the supply-demand balance: average hourly wages are expected to grow by 0.3% month-on-month in both October and November (in line with the average level of the past year), but the year-on-year growth rate will fall to a cyclical low of 3.6%, further easing inflationary pressures.

Overall, this "bi-monthly data deluge" will continue the core trends in the job market: moderate positive job growth and a slow rise in the unemployment rate to 4.5%.

It is worth noting that the unemployment rate of 4.5% is higher than the 4.0% full employment level estimated by Wells Fargo, and also exceeds the FOMC's median long-term forecast of 4.2%. Coupled with the simultaneous weakening of indicators such as job vacancies and worker confidence, the goal of full employment is clearly facing risks.

(Chart showing the trend of the US unemployment rate)

Summarize:

Multiple charts related to employment prospects, after removing the significant fluctuations during the COVID-19 pandemic, show that prior to this special bi-monthly employment report, the US labor market's growth momentum was still moderately but clearly weakening, excluding one-off disruptions from government layoffs.

The rise in the unemployment rate to a sensitive level and the easing of wage pressures provide a basis for the Federal Reserve to shift to an accommodative monetary policy in the coming quarters. The market needs to pay close attention to subsequent data to confirm this trend.

Based on its forecast that inflation will continue to converge toward the 2% target in 2026, Wells Fargo maintains its trading expectation that the Federal Reserve will implement two more 25 basis point rate cuts in the first half of next year.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.