A chart: The Baltic Dry Index rose slightly due to stronger freight rates for large vessels.

2025-12-16 23:31:03

The Baltic Dry Index (BDI), published by the Baltic Exchange, which tracks freight rate fluctuations for ships transporting dry bulk commodities such as iron ore, coal, and grain globally in real time, saw a slight increase on Tuesday. Market analysts pointed out that the key support for this rebound came from the significant strengthening of freight rates for Capesize vessels, which to some extent offset the pressure from declining freight rates for other vessel types.

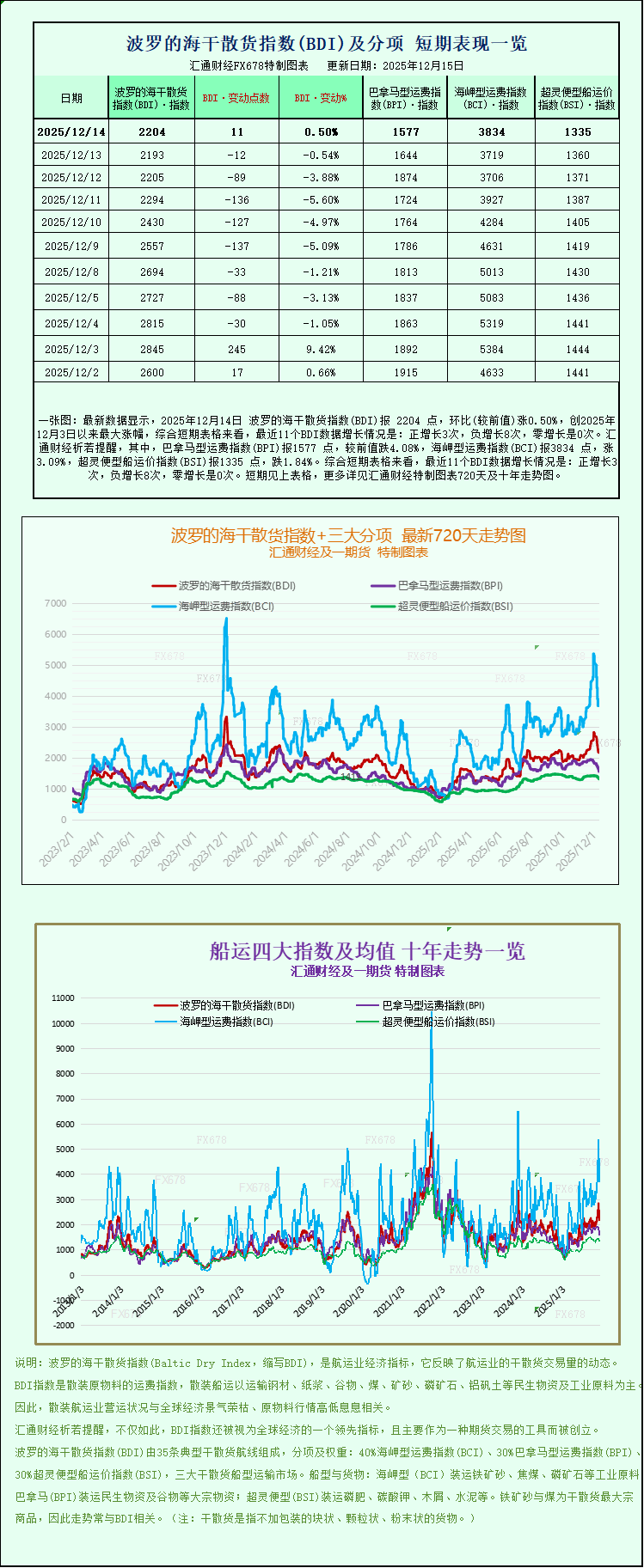

The core composite index (which comprehensively covers freight rates for the three major dry bulk carriers—Capesize, Panamax, and Supramax—and is a key indicator reflecting the overall health of the global dry bulk shipping market) performed strongly, successfully ending an eight-day losing streak. Specifically, the index rose 11 points, or 0.5%, to close at 2,204 points, injecting a much-needed boost into the recently sluggish dry bulk shipping market.

The Capesize index, the core driver of this index rise, showed strong performance on the day, rising 115 points, or about 3.1%, to close at 3,834 points. Capesize vessels, as the "giants" of the global dry bulk shipping market, mainly undertake transoceanic transportation of bulk commodities such as iron ore and coal, and their freight rate fluctuations are of significant indicative importance to the activity of global commodity trade.

In terms of shipowner profitability, Capesize vessels with a single voyage capacity of 150,000 tons, transporting iron ore and coal, saw a corresponding increase in profitability (the underlying index also improved). Data shows that the average daily revenue of this type of vessel increased by $959 from the previous trading day, eventually climbing to $31,800, indicating a clear recovery in profitability.

It is worth noting that the inter-sectoral linkages within the dry bulk shipping market are significant. On Tuesday, iron ore futures prices rebounded rapidly after hitting a five-month low during the session, following a new low on Monday. Market analysts believe that this rebound in iron ore futures prices is mainly due to optimistic market expectations for Chinese iron ore demand. As the world's largest iron ore consumer, Chinese steel mills typically replenish their inventories before the Spring Festival holiday, and the market anticipates that this peak demand season will drive up iron ore transportation demand, thereby boosting related shipping freight rates.

In stark contrast to the strong performance of Capesize vessels, the Panamax index continued its downward trend on the day, with a significant drop. The index fell 67 points, or 4.1%, to close at 1,577 points, its lowest level since July 8th of this year, reflecting downward pressure on the corresponding transportation segment.

On the profitability side, the earnings of Panamax vessels also declined. These vessels mainly transport coal or grain in the 60,000 to 70,000 tonne class. Affected by the weak demand for the corresponding cargo, their average daily revenue decreased by US$607 from the previous trading day to US$14,189, increasing the profit pressure on shipowners.

In the small and medium-sized dry bulk carrier sector, the Very Large Vessel Index failed to maintain its previous stable trend, experiencing a slight decline of 25 points to close at 1,335 points. Market analysts believe that the slight adjustment in freight rates for small and medium-sized vessels was mainly due to the combined effects of periodic fluctuations in regional dry bulk shipping demand and changes in market capacity supply.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.