With yields nearing the 2% "forbidden zone," the USD/JPY exchange rate is fluctuating above 155: are traders betting that central banks won't intervene?

2025-12-17 17:26:42

Fundamental Overview: Fiscal Concerns and Central Bank Signals Exert Pressure

The selling pressure on Japanese government bonds on Wednesday was not an isolated event, but rather the result of a series of recent fundamental factors. The latest and most direct catalysts came from two aspects.

First, expectations of fiscal expansion exacerbated debt concerns. According to Kyodo News, Japan's draft budget for fiscal year 2026 (beginning in April 2026) may exceed 120 trillion yen in total spending, higher than the 115.2 trillion yen for the current fiscal year. Although this news broke last night (Tuesday), its impact continued into today's trading session. Market analysts believe that against the backdrop of an uncertain economic growth outlook, continued fiscal expansion will inevitably lead to a further increase in the scale of government bond issuance, increasing market supply pressure. This expectation directly caused the futures market to weaken overnight, and even though yields in other major global bond markets generally declined at that time, it failed to offset concerns within Japan.

Secondly, the Bank of Japan's routine bond-buying operations yielded unexpectedly weak results, sending a worrying signal to the market. The Bank of Japan conducted regular bond purchase operations today across multiple maturities, including 1-3 years, 3-5 years, 5-10 years, and 10-25 years. However, the results of all operations, particularly the 10-25 year operation, were weaker than market expectations. For example, in the 10-25 year operation, although the market price for the 20-year current bond (JL194) was 2.915%, the Bank of Japan's purchase results showed that participants were willing to sell at an average yield as high as 2.931%. This clearly indicates that bondholders' willingness to sell to the central bank is very strong, far exceeding the price level the central bank is currently willing to accept. A trader at a Japanese securities firm commented, "The results of the 5-10 year bond-buying operation weren't particularly weak, so it's a bit surprising to see 10-year bonds being sold off so aggressively." He further speculated, "Perhaps everyone wants to see the 10-year yield reach 2% by the end of the year." This comment reveals a general market sentiment: stimulated by fiscal concerns and marginal changes in central bank operations, traders are actively testing the Bank of Japan's substantive tolerance threshold for its yield curve control (YCC) policy.

These two forces combined resulted in particularly heavy selling pressure on 10-year bonds. In the afternoon, the benchmark 10-year yield briefly touched 1.98%, a new 18-year high. It's worth noting that long-term bonds (such as 30-year and 40-year bonds) saw some buying during the session as investors rolled over from lower-yield older bonds to higher-yield newer ones, but this technical adjustment failed to reverse the overall downward trend. When the surge in the 10-year yield dragged futures down to their daily low, the 30-year yield also turned upward. This shows that the movement of the 10-year yield remains the pricing anchor and sentiment indicator for the entire yield curve.

Technical Analysis: The Resonance Between Yields and Exchange Rates

Based on the provided technical indicators, the market is currently at a critical juncture.

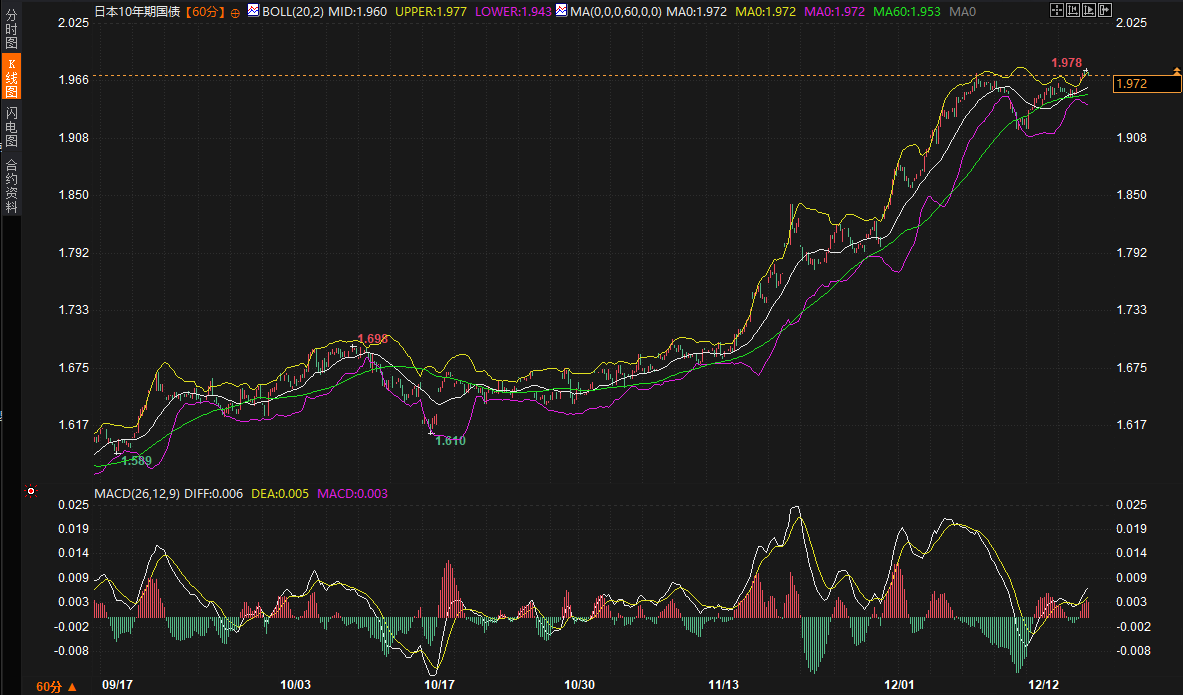

10-year Japanese government bond yield (240-minute chart) :

Price : Latest price 1.972%, up 1.08% on the day, with strong momentum.

Bollinger Bands : The price (1.972) is close to the upper band (1.977), indicating that the price is at the top of a strong upward channel and faces short-term technical resistance. The middle band (1.960) provides intraday support.

MACD : DIFF (0.006) is slightly higher than DEA (0.005). Although both are positive, the difference is very small, indicating that while upward momentum exists, it may be accumulating or facing a directional decision. If DIFF can clearly cross above and widen the gap with DEA, it will confirm the strengthening of upward momentum.

USD/JPY (240-minute chart) :

Quote : Latest price is 155.491, up 0.50% on the day, fluctuating in the same direction as the yield on Japanese government bonds.

Bollinger Bands : The price is above the middle band (155.224), but there is still room before it reaches the upper band (156.137), indicating that the exchange rate has some room to rise, but has not yet entered the extreme overbought zone. The middle band provides initial support.

MACD : DIFF (0.202) is positive, but DEA (-0.238) is still negative, and DIFF is significantly higher than DEA. This usually indicates that the downtrend may have reversed, and new upward momentum is rapidly accumulating. However, caution is advised regarding potential fluctuations near the zero line.

Technical analysis shows that Japanese government bond yields are testing the upper Bollinger Band resistance, while the USD/JPY exchange rate is rising in tandem, with the MACD indicating stronger upward momentum. This positive correlation aligns with the traditional logic of "rising Japanese government bond yields -> easing pressure on the Japan-US interest rate differential -> increased pressure on yen depreciation (USD/JPY rise)." However, the current surge in yields carries a clear element of "testing policy limits" and "fiscal concerns," and its sustainability and central bank responses will be crucial for the next phase of this correlation.

Weekly Trend Outlook: Scenario Analysis and Logical Deduction

Looking ahead to the coming week, the 10-year Japanese government bond yield and the USD/JPY exchange rate will revolve around the following key variables, and the following probabilities may emerge:

High-probability scenario (baseline scenario): High-level consolidation, testing the 2% level . If market concerns about Japan's fiscal expansion persist and no strong verbal intervention signals from Bank of Japan officials to curb rising yields are released, the 10-year JGB yield will likely remain in its current high range (1.96%-1.98%), repeatedly testing the key psychological and technical level of 2.00%. During this period, any weaker-than-expected Bank of Japan bond-buying operations or further details regarding the budget could trigger a brief breakout. Correspondingly, the USD/JPY pair will be primarily driven by the movement of JGB yields. As long as yields do not fall sharply, USD/JPY will find support and is expected to test the upper Bollinger Band around 156.14, or even the upper edge of the recent trading range. However, year-end liquidity declines could amplify volatility and limit the smoothness of any unilateral trend.

Medium-probability scenario: Central bank intervention expectations rise, yields and exchange rates pull back . If the 10-year yield breaks through 2.0% rapidly and decisively, or if the yen shows signs of disorderly depreciation (e.g., USD/JPY surges rapidly towards the 157-158 area), market expectations for action from the Bank of Japan (including increased bond purchases or fixed-rate bond-buying operations) will rise sharply. Under this expectation, some short covering may push yields down from their highs. USD/JPY will also adjust accordingly, with key support levels at the Bollinger Band middle line at 155.22 and the previous dense trading area. The "buy on dips" operations by some accounts before the close of trading this week indicate that after significant market volatility, some institutions believe that current yield levels offer some investment value.

Low-probability scenario: Internal and external factors resonate, leading to a trend breakout . If external factors (such as significantly better-than-expected US economic data causing a resurgence in US Treasury yields) resonate with internal Japanese factors (such as more aggressive fiscal rhetoric or the central bank showing greater tolerance for rising yields), the 10-year Japanese government bond yield could effectively stabilize above 2.0%, opening up new upward potential. This would significantly alter the outlook for the Japan-US interest rate differential, potentially driving the USD/JPY exchange rate to break through its yearly high and form a new upward trend. Conversely, if global risk aversion suddenly intensifies (e.g., due to geopolitical tensions or global growth concerns), funds could flow into Japanese bonds for safety, rapidly depressing yields and significantly pushing up the yen, causing the USD/JPY exchange rate to fall. Currently, the triggering conditions for both of these extreme scenarios are not yet fully met.

Conclusion : In summary, the current rise in 10-year Japanese government bond yields has shifted from an initial "passive adjustment" following US Treasury yields to a more proactive upward trend driven by domestic fiscal concerns and testing the central bank's policy floor. This has increased its influence on the yen. In the short term, the attempt to push yields to the 2% mark will be the market focus, and its outcome will directly determine whether the USD/JPY pair can open up upward potential. Traders need to closely monitor the Bank of Japan's future operational details and any policy statements, as these will be key factors in breaking the current deadlock and determining the next stage of the market's direction. Amid year-end caution, the market is engaged in a fierce battle over the future path of Japanese monetary policy.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.