A chart shows the Baltic Dry Index falling to a one-month low, dragged down by weaker shipping rates.

2025-12-17 22:33:40

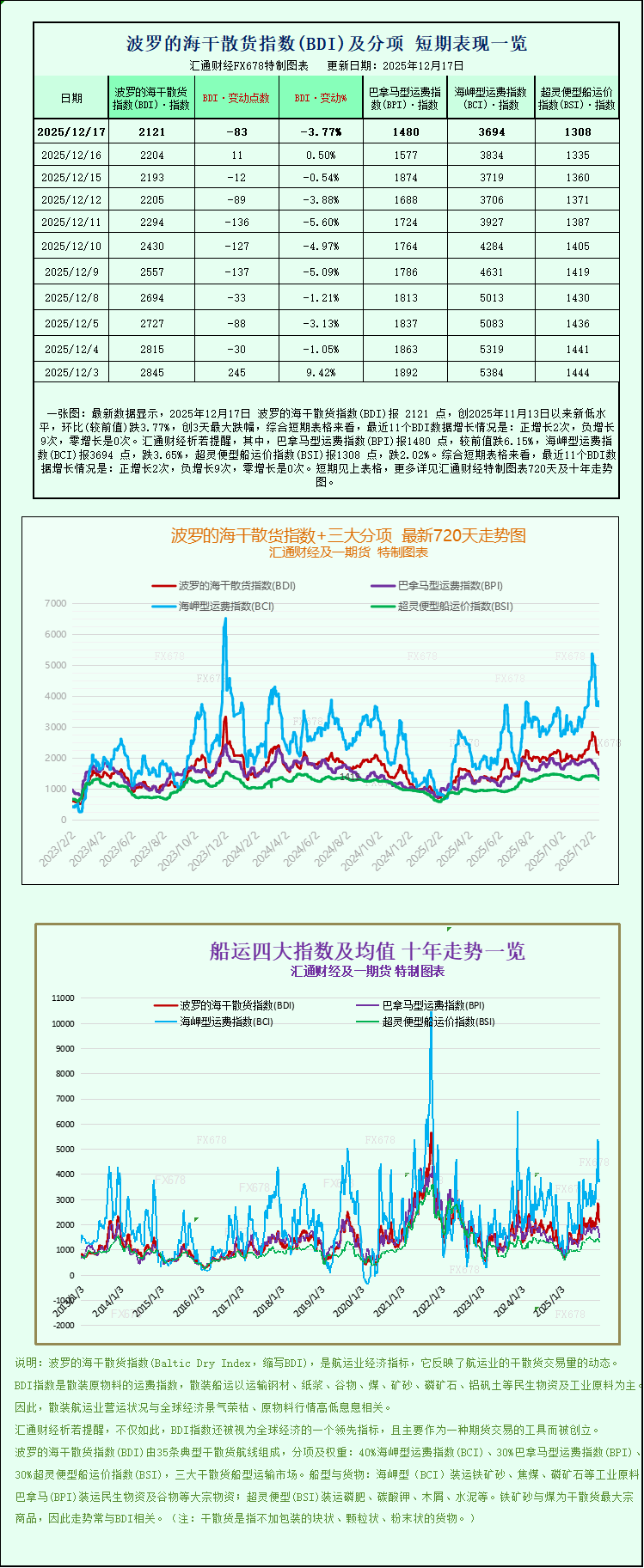

On Wednesday, the Baltic Dry Index fell to its lowest point in over a month, with weakening freight rates across the board being the main downward pressure. This index primarily tracks global sea freight rates for dry bulk commodities, and its trend directly reflects the health of the international dry bulk shipping market.

The Baltic Dry Index, which covers freight rates for the three main vessel types—Capesize, Panamax, and Supramax—fell 83 points, or 3.8%, to close at 2,121 points, its lowest level since November 13.

The Capesize freight index fell 140 points, or about 3.7%, to 3694 points, near a one-month low. These vessels are the "main force" in the dry bulk shipping market, with large deadweights and primarily responsible for the ocean transport of bulk commodities such as iron ore and coal.

Capesize vessels saw their average daily earnings fall by $1,163 to $30,637. These vessels typically carry cargoes up to 150,000 tons, with iron ore and coal being their core commodities.

It is worth noting that iron ore futures prices climbed to a one-week high on the same day. This surge was driven by accelerated purchasing in the spot market. As the world's largest iron ore consumer, China's steel companies have begun stockpiling raw materials in advance to meet production demands during the Lunar New Year holiday in February next year.

The Panamax freight index continued its downward trend, falling sharply by 97 points, or 6.2%, to close at 1480 points, marking its lowest level since June 26 this year.

Panamax vessels saw their average daily earnings decrease by $871 to $13,318. These vessels have a deadweight tonnage of 60,000 to 70,000 tons and primarily transport coal and grain, with routes mainly focused on short- to medium-haul regional transport.

Breaking down the smaller vessel market, the Supramax freight rate index fell 27 points to 1308.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.