From history to the future, the power game of the Federal Reserve.

2025-12-17 21:40:11

This is especially crucial in 2026 – Jerome Powell’s term as Federal Reserve Chairman will end in May, giving the White House an opportunity to reshape central bank leadership and policy direction, which could have a profound impact on interest rates, stock market performance, and investment portfolios.

While media headlines often focus on the Federal Reserve's next interest rate decision, the core dispute between Wall Street and Washington actually revolves around the Fed's functional positioning.

As financial crises and business cycles evolve, the Federal Reserve's mandate continues to develop, a topic that remains highly controversial for many investors. There are naturally differing opinions regarding the Fed's scope of authority and the appropriate interest rate and money supply policies to be adopted.

Looking ahead to next year, these issues are important because they will not only determine short-term policy direction but also the long-term development of the Federal Reserve. With Fed-related news dominating headlines in the coming months, what background information should investors have?

The functions of the Federal Reserve have continued to expand throughout history.

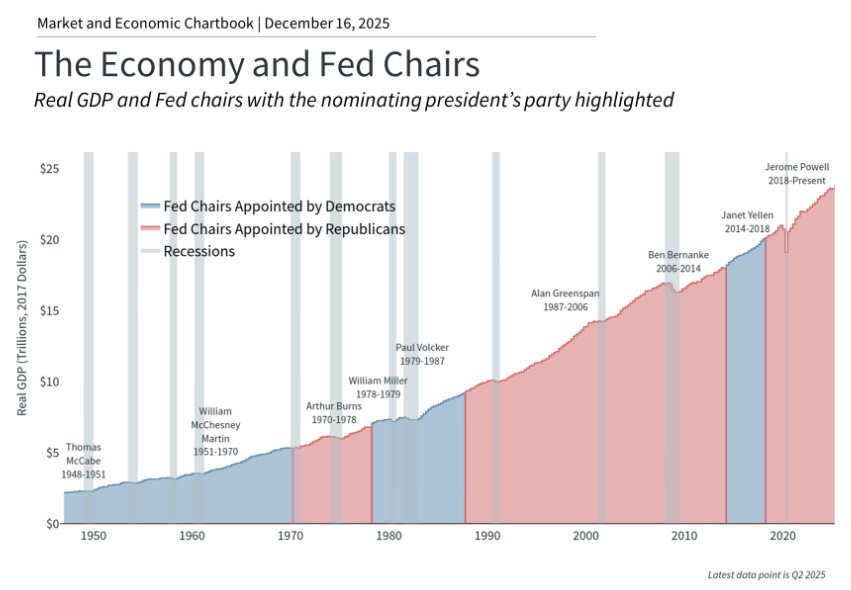

(Red represents Republican elections, gray represents Democratic elections, and dark gray represents periods of economic recession.)

The Federal Reserve's establishment can be traced back to the enactment of the Federal Reserve Act of 1913, which was the third attempt by the United States to establish a central bank.

The Federal Reserve is not a branch of the federal government, nor was it established by the Constitution.

Therefore, the debate over the independence of the Federal Reserve often revolves around three core challenges: first, its scope of responsibility has expanded significantly over time; second, Federal Reserve officials are not directly elected by voters; and third, elected politicians typically tend to maintain low interest rates to support economic growth and employment.

When Congress initially established the Federal Reserve, its core mission was to prevent bank panics.

Such panics occurred frequently in the 19th and early 20th centuries, causing huge shocks to businesses and ordinary people. The most serious crises at that time included the Great Depression, the Panic of 1907, and the Panic of 1893.

Such crises often arise or worsen from "bank runs"—depositors lose confidence and rush to withdraw their funds, thereby threatening the stability of the banks themselves and the entire financial system.

While economic and financial challenges have not disappeared, such specific crises are now less frequent. The Federal Reserve's core responsibilities include ensuring banks hold adequate capital reserves, and more fundamentally, it acts as the "lender of last resort."

In other words, the Federal Reserve acts as a safety net when panic is likely to occur. The market knows that the Fed is ready to intervene at any time, which helps maintain the stability of the financial system and ensures that transactions proceed in an orderly manner. This was fully demonstrated during the 2020 pandemic and the regional banking crisis in 2023.

However, the Federal Reserve's responsibilities have expanded over the decades. The Federal Reserve Reform Act of 1977 was enacted against the backdrop of high inflation and high unemployment, requiring the central bank to commit to "achieving full employment, stable prices, and moderate long-term interest rates."

The Federal Reserve typically views the first two objectives as a “dual mandate” and considers the third objective a natural consequence of achieving the first two.

This evolution is often described as "mission spread"—the Federal Reserve is now seen not only as an institution that regulates banks, financial transactions, and the dollar's exchange rate, but also as having the responsibility to regulate the overall state of the economy.

Whether this shift is justified or not, this is precisely why every interest rate decision by the Federal Open Market Committee (FOMC) is closely watched—the market not only focuses on the path of interest rates but also tries to glean signals from the Fed's assessment of the overall economy.

The trade-offs behind the Fed's independence

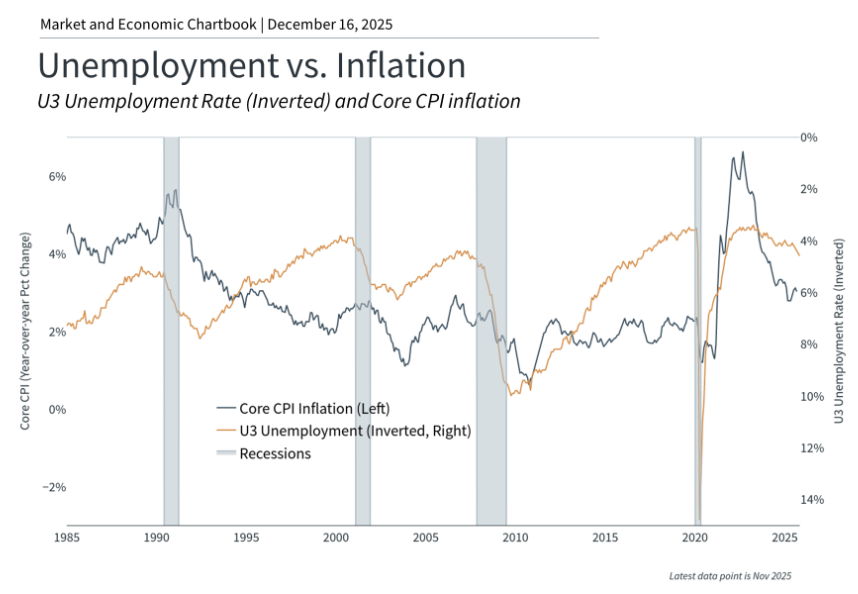

(PCE price trend on the left, unemployment rate on the right; recessions are often accompanied by deflation)

Federal Reserve officials are appointed by the president and approved by Congress, but are not directly elected by voters.

Critics argue that the Federal Reserve is essentially an unelected institution with enormous economic power, whose decisions affect all Americans.

Supporters argue that the Federal Reserve often has to make unpopular decisions, including slowing economic growth in the short term to maintain long-term economic growth.

Both viewpoints have their merits, making it challenging to maintain a balanced perspective.

The period from the 1970s to the early 1980s is generally regarded as a positive example of this trade-off.

During that period, the economic shock and the political pressure of loose monetary policy together led to "stagflation"—a situation where high inflation and high unemployment coexisted.

Ultimately, Federal Reserve Chairman Paul Volcker's sharp interest rate hikes, while triggering a recession, successfully broke the stagflation cycle and laid the foundation for the Fed's independence for decades to come.

Of course, the Federal Reserve does not have the ability to predict the future, and its judgments are not always accurate.

Former Federal Reserve Chairman Ben Bernanke once frankly told economist Milton Friedman, "You're right, we caused it"—referring to how the Fed's inappropriate policies a century ago exacerbated the Great Depression.

A more recent example is that many economists and investors believe the Federal Reserve was slow to react when inflation first appeared after the pandemic in 2021, ultimately having to resort to a sudden interest rate hike.

Even if the Federal Reserve has perfect foresight, its policy tools are still limited.

The Federal Reserve primarily controls short-term interest rates through the federal funds rate, a tool often referred to as a "blunt instrument"—adjusting a single policy rate cannot solve many deep-seated problems in the economy, such as supply chain issues that triggered inflation in 2020, trade uncertainty caused by tariffs, and labor market challenges that artificial intelligence may bring.

Furthermore, the Federal Reserve can only indirectly influence long-term interest rates, which are more critical for mortgage lending, corporate financing, and investment decisions. Long-term interest rates are determined by market forces such as inflation expectations, fiscal policy, and economic growth.

Therefore, although the Federal Reserve is often regarded as the controller of the economic and financial system, it actually influences the market or responds to events more than it dictates the direction of the market.

Leadership changes may shape policy direction in 2026 and beyond.

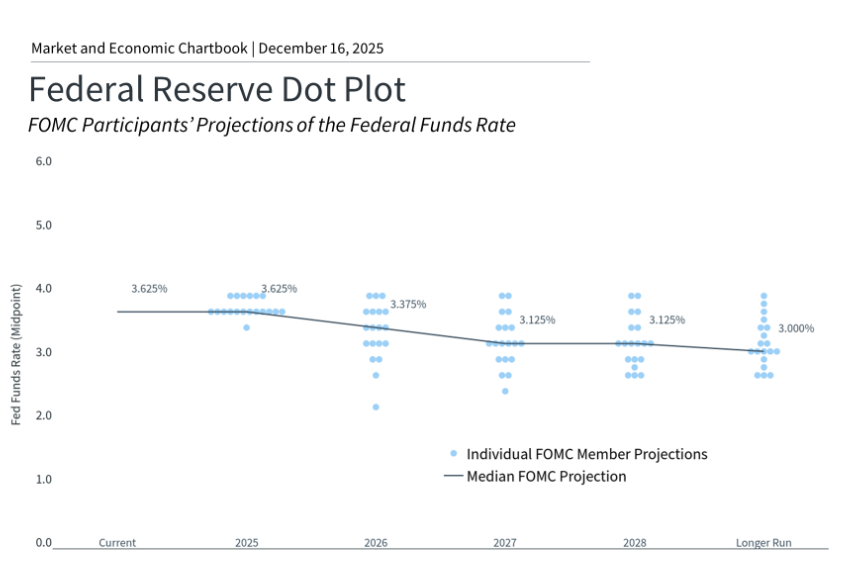

(The dot plot suggests another rate cut in 2026, and the overall neutral interest rate is biased downward.)

With Federal Reserve Chairman Jerome Powell's term coming to an end, the White House is expected to nominate a successor in early 2026.

Currently, leading candidates include former Federal Reserve Governor Kevin Walsh, White House National Economic Council Director Kevin Hassett, and Federal Reserve Governor Christopher Waller.

Kevin Walsh leads the pack with a 46% chance of winning, his core advantage being the balance between Trump's demands for interest rate cuts, Wall Street's expectations for stability, and the Fed's institutional independence. Director Kevin Hassett's chance of winning plummeted from 77% to 39% due to controversy over independence and opposition from Trump's close associates. Christopher Waller, with his professional reputation and the addition of interview arrangements, holds a solid second place with a 44% chance of winning, becoming a dark horse candidate. Trump plans to announce the final selection in early January next year, and the selection process is currently in the final interview and final weighing stage.

From now until the final decision is made, the situation may change in many ways, and the ranking of the top candidates has already been adjusted in the past few months alone.

The chart above shows the Federal Open Market Committee's latest Summary of Economic Projections, which indicates that the Fed may cut interest rates only once a year in 2026 and 2027.

Regardless of who the next Federal Reserve Chair candidate is, the current administration will most likely appoint someone who is inclined to maintain low policy rates, meaning these projections could change in the coming months.

At the same time, do not overreact to potential policy changes. Although the Federal Reserve Chair has influence over policy direction and speaks on behalf of the Federal Open Market Committee at press conferences, the committee consists of 12 voting members with differing views, including the president of the New York Fed, seven Federal Reserve governors, and four regional Fed presidents who rotate annually.

Historically, the Federal Reserve has always strived to reach a consensus. Therefore, even a chairman whose goals align with those of the government needs to persuade other committee members through economic and policy arguments.

From a broader perspective, this is not the first time the Federal Reserve has experienced a leadership change.

The first chart above shows that the U.S. economy maintained stable growth during the tenure of each Federal Reserve Chairman appointed by a different political party.

It is also worth noting that Jerome Powell was nominated during President Trump's first term and continued to serve as Federal Reserve Chairman during President Biden's term.

More important than any particular chairperson's personal style is whether monetary policy is appropriate for the economic situation. To reiterate, the Federal Reserve typically addresses external shocks beyond its control, rather than directly dictating the direction of the economy.

Economic trends are more important than individual decisions by the Federal Reserve.

In the coming months, there will be a lot of news about the leadership of the Federal Reserve, but what is really key is the overall trend of the economy.

The next Federal Reserve chairman may generally favor maintaining low interest rates, but whether this preference will materialize largely depends on whether the job market continues to be weak and whether inflation continues to stabilize.

For investors, the key is to build a portfolio that aligns with their financial goals, rather than reacting emotionally to daily speculation about the Federal Reserve.

Ultimately, history shows that markets have performed well under different Federal Reserve chairs and policy frameworks.

For investors, focusing on long-term trends remains the best path to achieving financial goals.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.