Has the negative impact of the UK interest rate cut been fully priced in? Bulls are secretly planning a counterattack.

2025-12-18 20:30:55

Although the MPC vote met market expectations with a 5-4 split and did not provide any discrepancy, Governor Bailey stated that with interest rates approaching neutral levels, the room for rate cuts is more limited, causing the pound to rise rapidly by 30 points and currently trade at 1.3379 (0.02%). Meanwhile, the strengthening of the US dollar index during the same period slightly limited the pound's upside potential.

The core reason for the pound's rise, besides the fact that the uncertainty has been resolved, lies in the central bank governor's statement that current interest rates are close to the neutral rate and that further rate cuts may be slower, which provided support for the pound.

Despite negative factors, the fundamentals are boosted by the logic of interest rate cuts.

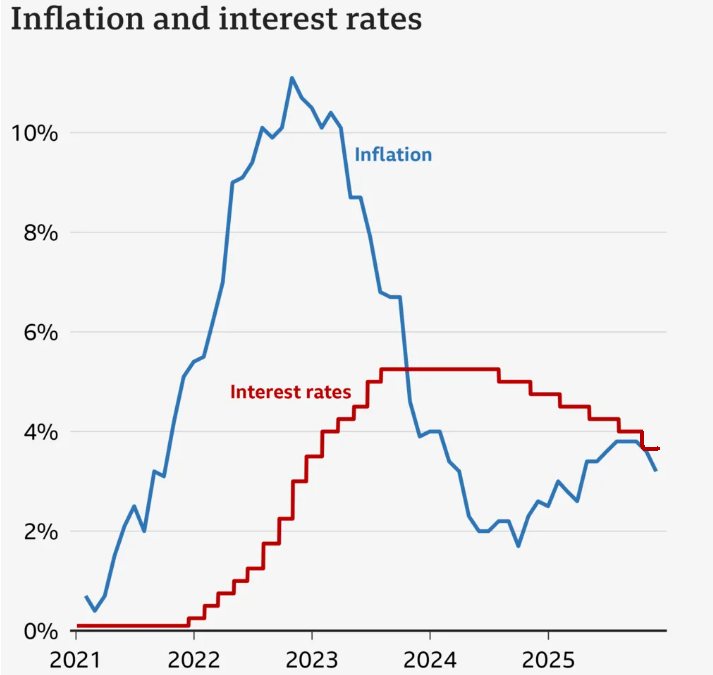

Despite current inflation still being above the Bank of England's 2% target, the combination of stagnant economic growth, rising unemployment, and cooling inflation led the Bank of England to announce a 25 basis point interest rate cut by a 5-4 vote. Compared to the previous 4-5 vote, Governor Bailey shifted his support to the rate cut this time, lowering the benchmark interest rate from 4% to 3.75%.

It is worth noting that this will be the fourth time the Bank of England has cut interest rates this year, and the easing of inflation has given the government more room to deal with fundamental issues.

Looking back at the last interest rate meeting in November, the four members who supported a rate cut were defeated by one vote by the five members who advocated keeping the rate unchanged.

From the perspective of the UK's domestic fundamentals, the triple resonance of economic downturn, deteriorating employment, and cooling inflation has laid a solid foundation for interest rate cuts.

Data released by the UK Office for National Statistics shows that the country's GDP fell by 0.1% month-on-month in October, marking the second consecutive month of contraction. Furthermore, the UK economy has not achieved positive monthly growth since June of this year.

The job market also sent strong negative signals. In the three months to October, the number of employed people in the UK decreased by 17,000, and the International Labour Organization's unemployment rate soared to 5.1%, the highest in nearly five years.

Meanwhile, the continued easing of inflationary pressures cleared the final obstacle to interest rate cuts. In November, the UK's overall consumer price index rose 3.2% year-on-year from 3.6% in October, while the core consumer price index also fell to 3.2% from 3.4%, a drop significantly exceeding market expectations.

(Inflation and interest rate trend chart)

Multiple factors on the US dollar front are suppressing the short-term performance of the British pound.

The pound's short-term movement is also directly pressured by the US dollar. During Thursday's European trading session, the pound fell 0.22% against the dollar, dipping to around 1.3355. The key driver behind this is the upcoming US November Consumer Price Index (CPI) data – the market expects overall inflation to rise to 3.1% year-on-year from 3.0% last month, while core inflation excluding food and energy is expected to remain at 3.0% year-on-year.

As a "weathervane" for the Fed's policy expectations, marginal changes in this data will dominate short-term fluctuations in the dollar index: if price stickiness exceeds expectations, traders will reduce their bets on short-term Fed rate cuts, thereby boosting the dollar; if inflation data is weak, it will strengthen expectations of rate cuts and suppress the dollar.

In addition, hawkish comments within the Federal Reserve have provided some support for the dollar. Atlanta Fed President Rafael Bostic recently stated that further monetary easing could exacerbate upward pressure on inflation, which is an unacceptable risk at the current stage, and bluntly stated that the urgency of the inflation problem far outweighs that of the employment problem.

However, in the long run, the policy inclinations of the successor to Federal Reserve Chairman Powell have created a potential downside risk for the US dollar. The US President has clearly stated that the new chairman will adhere to the stance of "significant interest rate cuts," which directly negatively impacts US Treasury yields and will also affect the medium- to long-term trend of the pound against the dollar.

European central banks' policies diverge; the Bank of England leads the pace of easing.

Meanwhile, the policy moves of other major central banks present a stark contrast. The market consensus is that the European Central Bank will maintain its deposit rate at 2%, a benchmark that has remained unchanged since June of this year; the central banks of Norway and Sweden will also announce their interest rate decisions around the same time, and the market anticipates that both central banks will also choose to hold rates steady.

Previously, European Central Bank Executive Board member Isabelle Schnabel had publicly stated that she had "no objection" to market expectations that the central bank's next policy move would be to raise interest rates.

In response, Deutsche Bank strategist Jim Reid pointed out that the market discussion on the ECB's interest rate hike has increased significantly. Last Wednesday, the market's intraday pricing probability of a rate hike in 2026 once surged to 50%. However, judging from the current situation, the latest economic data and the ECB's public statements have released clear signals that the current interest rate maintenance cycle will continue.

Summary and Technical Analysis:

The interest rate cut caused the UK gilt yield curve to shift downward, putting downward pressure on the pound. However, the improved fundamentals brought about by the rate cut also provided important support for the exchange rate. At the same time, as the rate is close to the neutral interest rate, the pace of further rate cuts may slow down, which also provides support for the pound.

Overall, the Bank of England's interest rate cut and the release of US inflation data have catalyzed market developments. In the short term, it is still necessary to keep a close eye on the wording of subsequent policy statements and marginal changes in US and UK inflation data.

The pound sterling has not yet confirmed a break below the upward channel, and there is significant support at 1.3344. If the closing price can stay above the upward trend line, the pound sterling remains under the control of the bulls. If it breaks below the upward trend line but holds above 1.3344, the pound sterling will shift from an upward trend to range-bound trading.

(GBP/USD daily chart, source: FX678)

At 20:27 Beijing time, the British pound was trading at 1.3381/82 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.