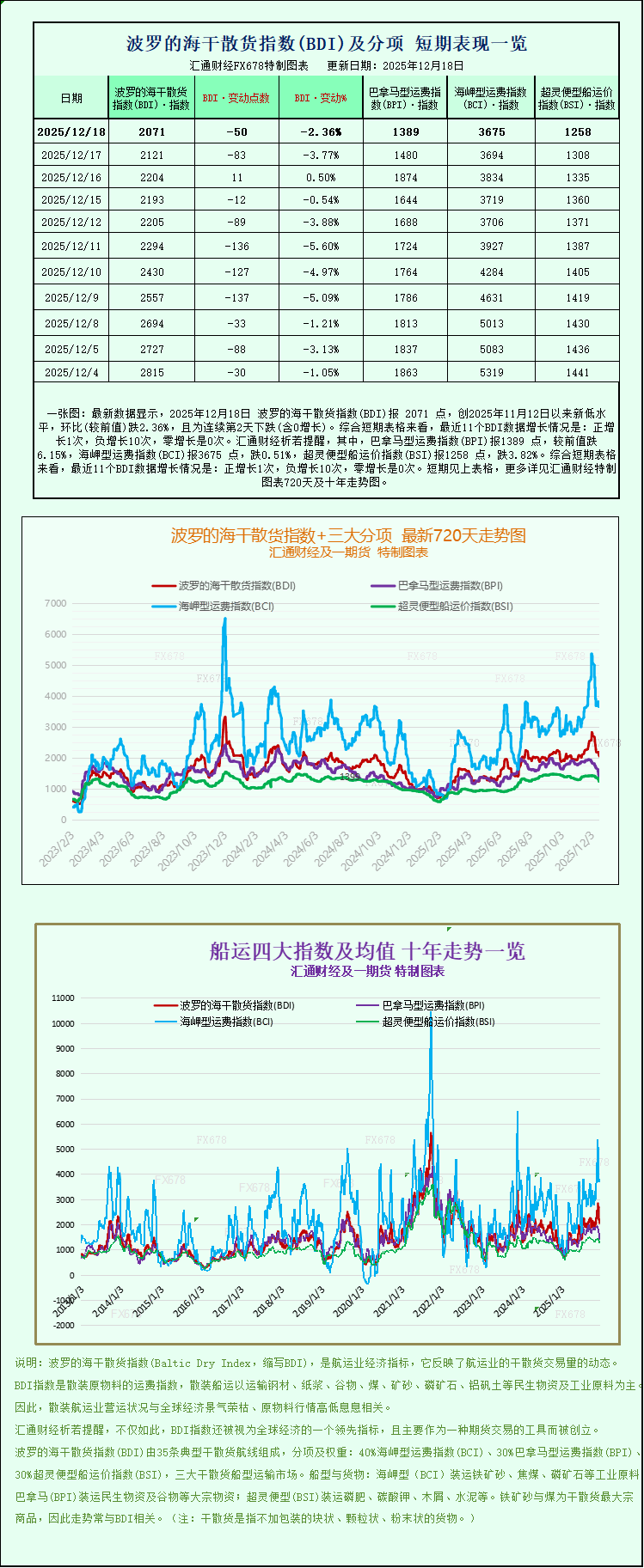

One chart: Baltic Dry Index falls across the board, hitting a new low in over a month.

2025-12-18 23:23:56

On Thursday, the Baltic Dry Index (a key indicator tracking rates for dry bulk shipping vessels) continued its downward trend, hitting its lowest level in over a month, mainly due to a broad decline in rates across all types of vessels. This trend reflects the current adjustment in the supply and demand structure of the global dry bulk shipping market, putting some pressure on the shipping industry's short-term operations.

The main index, which reflects rates for Capesize, Panamax, and Supramax vessels, fell 50 points, or 2.4%, to close at 2071, its lowest level since November 12. This continued decline highlights the overall weakness in demand in the dry bulk shipping market.

The Capesize shipping index fell slightly by 19 points, or about 0.5%, to close at 3675, near a one-month low. These vessels typically transport bulk cargoes of 150,000 tons or more, mainly including basic industrial raw materials such as iron ore and coal, and their rates fluctuate closely with the activity of global heavy industry production.

Capesize vessels saw their average daily earnings fall by $157 to $30,480. As the "main force" in global commodity transportation, changes in the earnings of this type of vessel directly affect the profitability of shipping companies, and this decline may have some impact on the short-term performance of related companies.

It's worth noting that despite lower dry bulk shipping rates, iron ore futures prices continued their upward trend on Thursday. This divergence was mainly driven by improved steel mill profit margins and expectations of restocking by steel mills in China, the world's largest iron ore consumer. The market's optimistic outlook for iron ore demand contrasts sharply with the current weakness in shipping rates, reflecting a supply-demand divergence across different segments of the industry chain.

Niels Rasmussen, chief shipping analyst at the Baltic International Shipping Council (BIMCO), stated, "Assuming a significant increase in the scrapping of older vessels and a decrease in average vessel speed, we predict that the average market conditions in 2026 will be similar to those in 2025, but the market environment in 2027 may weaken slightly." This forecast provides an important reference for the development trend of the shipping industry over the next two years and also reminds relevant companies to make advance preparations for capacity adjustments and risk management.

The Panamax shipping index fell sharply by 91 points, a drop of 6.2%, to close at 1389 points, its lowest level since June 24. These vessels typically carry between 60,000 and 70,000 tons of cargo, primarily transporting bulk commodities such as coal and grain. The significant decline in their rates may reflect a short-term contraction in global demand for energy and agricultural product trade transportation.

Panamax vessels saw their average daily earnings decline by $813 to $12,505. The decline was more pronounced for Panamax vessels compared to Capesize vessels, indicating greater competitive pressure in the medium-tonnage dry bulk shipping market.

In the small vessel sector, the Supramax index fell 50 points to close at 1258. These vessels, with their flexible operational advantages, primarily serve the regional dry bulk shipping market, and their decline in the index confirms that the weak global dry bulk shipping market has spread to vessels of all tonnages.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.