US CPI data was moderate, dragging down gold and silver prices due to profit-taking.

2025-12-19 01:52:30

Data released by the U.S. Bureau of Labor Statistics shows that the Consumer Price Index (CPI) rose 2.7% year-on-year in December 2025, the lowest level since July, falling below both the market expectation of 3.1% and the 3.0% year-on-year increase in September. Meanwhile, core inflation (excluding food and energy prices) rose 2.6% year-on-year, the lowest since March 2021, also below the expected 3.0%. Due to the U.S. government shutdown, the Bureau of Labor Statistics was unable to collect relevant data for October 2025, resulting in the absence of October CPI data, and the November monthly data was also not released. However, the agency stated that the CPI rose a cumulative 0.2% between September and November. This CPI data release undoubtedly provides strong support for the dovish camp within the Federal Reserve, whose officials advocate for further interest rate cuts. Expectations of interest rate cuts typically benefit precious metals while weakening the U.S. dollar.

It's worth noting that the unexpected decline in US CPI data not only boosted gold prices but also significantly increased market expectations for further easing by the Federal Reserve in 2026. Traders currently anticipate two possible rate cuts next year, with US interest rate futures pricing indicating a rate cut of approximately 62 basis points in 2026. However, the market still widely expects the Fed to keep rates unchanged at its January meeting, with the CME FedWatch Tool showing only a 28.8% probability of a rate cut that month.

Other key external market performances today are as follows: the US dollar index edged lower; crude oil prices stabilized, currently trading around $56.50 per barrel; the benchmark 10-year US Treasury yield declined after the CPI data release, currently at 4.116%. The weaker dollar further supported precious metal prices, with the dollar index trading around 98.47 during the session, reaching a daily high of around 98.56.

Escalating tensions between the US and Venezuela have fueled safe-haven flows. Meanwhile, developments regarding changes in the Federal Reserve leadership are also closely watched by the market, with President Trump's repeated calls for interest rate cuts raising questions about the Fed's independence. Trump stated on Wednesday, "I will soon announce my nominee for the next Fed Chair, someone who advocates for significant interest rate cuts." Last week, he revealed his preference for appointing White House economic advisor Kevin Hassett or former Fed Governor Kevin Warsh to the position; media outlets also reported on Tuesday that Fed Governor Christopher Waller would be interviewed for the role. Waller stated on Wednesday that policymakers are not in a hurry to implement significant easing, believing that with inflation still above target, the Fed can proceed cautiously, and interest rates may gradually decline to a neutral level (he estimates 50-100 basis points lower than current levels).

The US labor market data presented a mixed picture: initial jobless claims fell to 224,000, slightly lower than the expected 225,000 and lower than the previous value of 237,000; continuing jobless claims rose to 1.897 million, lower than the expected 1.94 million, but higher than the previous value of 1.83 million; the four-week moving average rose slightly from 217,000 to 217,500.

Goldman Sachs expects gold to have further upside potential in 2026. Goldman Sachs Research stated that the momentum of gold futures surging to record highs in 2025 could continue into next year. In its 2026 outlook released on Thursday, the bank believes that the base scenario of a 14% rise in gold prices to $4,900 per ounce by December 2026 faces upside risks. Central bank demand for gold is expected to continue into next year, with Goldman Sachs predicting that central banks will purchase an average of 70 tonnes of gold per month, driven by geopolitical instability and a desire to hedge related risks. In terms of immediate market performance, the most actively traded gold futures fell 0.3% to $4,358 per ounce, after rising for most of the morning session.

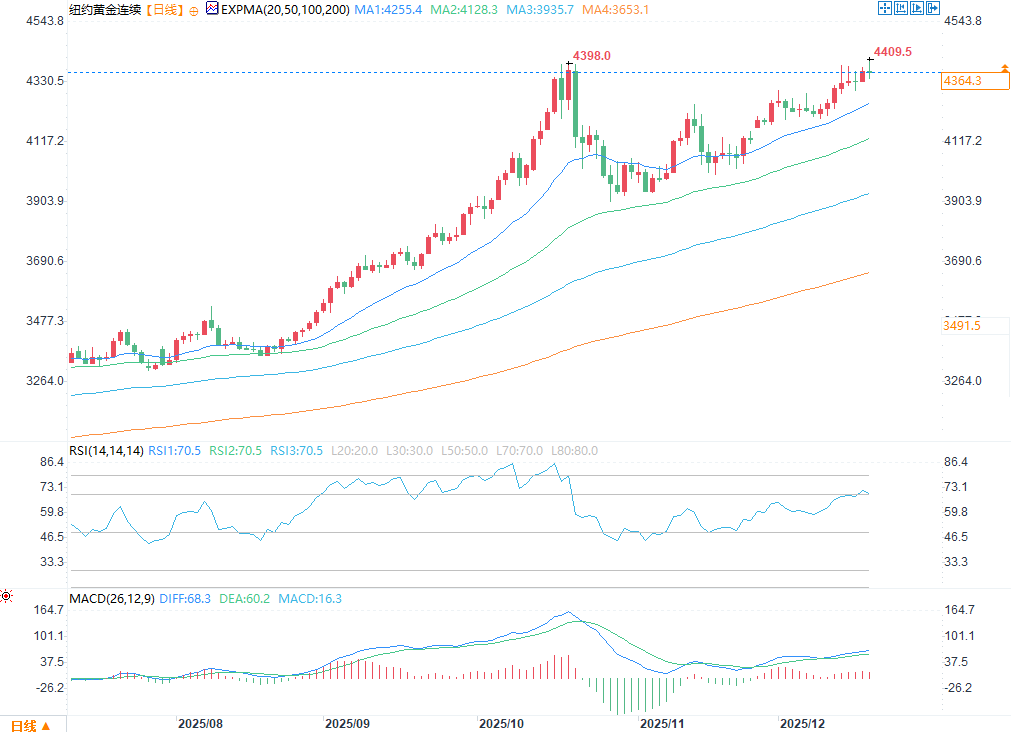

Technical Analysis

(COMEX Gold Daily Chart Source: FX678)

February gold futures: The bulls' next target is to push the price to close above the key resistance level – the contract's all-time high of $4433.00; the bears' short-term target is to push the price below the key technical support level of $4200.00. The first resistance level is at $4433.00, with further resistance at $4450.00; the first support level is today's low of $4338.00, with further support at this week's low of $4297.40.

March silver futures: The bulls' next target is to push the price to close above the key resistance level of $70.00; the bears' short-term target is to push the price below the key support level of $60.00. The first resistance level is the historical high of $67.18, with further resistance at $67.50; the first support level is today's low of $66.825, with further support at $66.00.

Note: The gold market operates primarily through two pricing mechanisms: the spot market, which provides quotes for immediate buying and selling and immediate delivery; and the futures market, which determines the price of gold for delivery on a future date. Due to year-end position adjustments and market liquidity, the most actively traded gold futures contract on the Chicago Mercantile Exchange (CME) is currently the December contract.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.