Are the pricing anchors for gold and crude oil in disarray? We have identified three clear cross-market logical lines.

2026-01-05 20:54:46

Fundamental Focus: Policy Divergence, Geopolitical Risks, and Data Tests

The current market is unfolding around three main themes.

First, the core logic is the expected divergence in policy paths among major central banks. Despite the upcoming release of European inflation data, the market widely expects the European Central Bank (ECB) to hold rates steady. Economists from well-known institutions have pointed out that their models suggest core inflation in the Eurozone may remain at 2.4% in December, but downside risks exist. This reinforces the ECB's wait-and-see stance, limiting the upside potential for Eurozone bond yields. In contrast, the yield on Japanese 10-year government bonds broke through the key resistance level of 2.10% on the first trading day of the year, climbing to 2.125%, a new high since February 1997. This is directly due to the supply pressure from this week's 10-year and 30-year bond auctions. Traders point out that this 10-year auction will be crucial in testing investor demand. Meanwhile, market focus is shifting to Friday's US non-farm payroll report, which will have a more direct impact on expectations for Federal Reserve policy.

Secondly, sudden geopolitical events disrupted short-term risk sentiment. The US military action in Venezuela over the weekend, including the arrest of President Maduro, triggered risk aversion and concerns about oil supply. This led to sharp fluctuations in oil prices, with WTI crude oil briefly dipping to $56.31, its lowest level since December 19th, before rebounding due to supply uncertainty caused by the event.

Finally, the pressure from bond supply cannot be ignored. In addition to the Japanese government bond auction, the Eurozone is expected to issue approximately €33 billion in new bonds this week, from several core countries including Germany and France. Germany's recent political agreement to increase infrastructure and defense spending also foreshadows increased bond supply in the future, which will put pressure on Eurozone bond prices in the medium to long term.

Market linkage and technology situation analysis

The aforementioned struggle between fundamental factors is clearly reflected in the price trends of various assets.

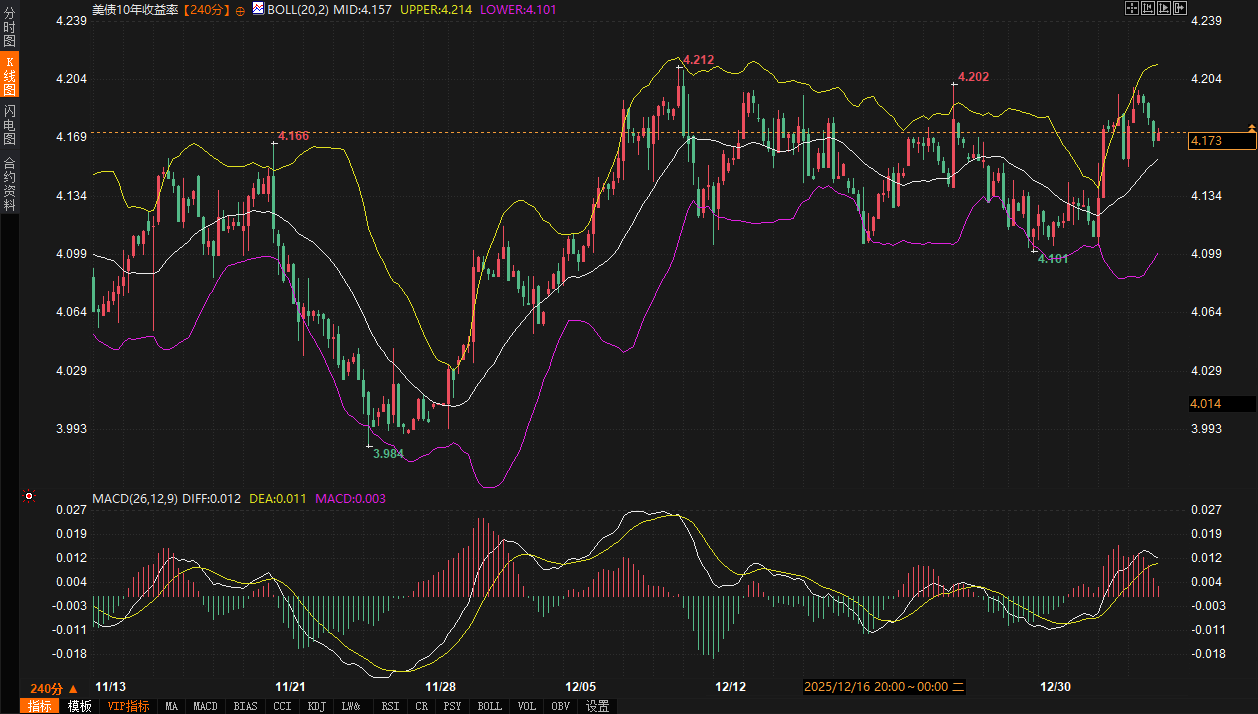

In the interest rate market, US Treasuries and Japanese government bonds diverged. The 10-year US Treasury yield fell 0.55% to 4.173%, technically remaining above the Bollinger Band middle line at 4.157, with the MACD indicator showing a slight weakening of upward momentum. In stark contrast, the 10-year Japanese government bond yield surged 1.88% to 2.111%, with its upper Bollinger Band rising to 2.130, and the MACD maintaining an upward trend, indicating strong upward momentum. The "bear market flattening" of the Japanese bond yield curve (i.e., both long and short-term yields rose, but the short-term yield rose more significantly) is noteworthy, reflecting market bets on future policy adjustments by the Bank of Japan. The benchmark 10-year German bond yield fell 1.5 basis points to 2.90%.

The foreign exchange market directly reflects interest rate differentials. The US Dollar Index (DXY) touched a high of 98.80, its highest level since December 10, and is currently trading around 98.64, indicating that the relative advantage of US Treasury yields and safe-haven demand are supporting the dollar. The euro is under pressure against the dollar, falling below the 1.1700 level. The dollar remains at 156.63 against the yen; the surge in Japanese bond yields has failed to effectively boost the yen, indicating that a strong dollar and carry trades still dominate.

The crude oil market was influenced by both geopolitical events and demand expectations. WTI crude oil rebounded to around $57.72 after hitting a new low, turning positive for the day. Technically, the 4-hour chart shows that the price rebounded after testing the previous low, and the MACD indicator shows signs of forming a golden cross at a low level. However, the resistance area formed by the Bollinger Band middle line and the 60-period moving average needs to be watched above.

As a traditional safe-haven asset, gold found support amid bond market volatility and geopolitical risks, with prices rebounding above $4,420 per ounce.

Future Trends Outlook and Key Observation Period

Looking ahead, the market will shift from being driven by geopolitical events to being validated by economic data.

For the interest rate and foreign exchange markets, Friday's US non-farm payroll data will be a new bellwether. Strong data could revive the rise in US Treasury yields, further supporting the US dollar. The key short-term resistance for the US dollar index is in the December high of 98.75-98.80; a break above this level could open up further upside potential. Support lies in the 98.30-98.40 range. For the euro/dollar pair, watch whether it can recover the 1.1700 level to alleviate its decline. The results of the Japanese bond auction will determine the short-term fate of the yen. Weak demand leading to a further surge in yields could force the Bank of Japan to respond, providing support for the yen. The 156.50-157.00 range for USD/JPY will be a key battleground for bulls and bears.

For the crude oil market, the premium for geopolitical risks may gradually fade, and the focus will return to supply and demand fundamentals. The first resistance level for WTI crude oil is in the $58.50-$59.00 area (including the 60-period moving average and the lower edge of the previous consolidation platform); a break above this level would reverse the recent weakness. Key support lies in the previous low area of $56.00-$56.30. Any new developments regarding the situation in Venezuela should be closely monitored during the trading session.

The gold market faces a dilemma: falling US Treasury yields and geopolitical risks are positive factors, but a stronger dollar is putting downward pressure on prices. Gold needs to break through the upper limit of its recent trading range (around $4430-$4440) to attract more buying; support lies in the $4380-$4400 area.

Overall, traders should focus this week on the combined effect of US and European economic data and the Japanese bond auction results. The divergent trends in the world's three major bond markets are reshaping the short-term trading logic for gold, crude oil, and foreign exchange through interest rates, currencies, and risk sentiment. Intraday traders should be wary of cross-asset volatility caused by unexpected data releases or events.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.