The Fed's 2026 outlook: Increasing political pressure and the impact of AI on employment reignite uncertainty about interest rate cuts.

2026-01-08 16:34:43

Looking back at 2025: Political turmoil continues, and the Federal Reserve is deeply embroiled in unrest.

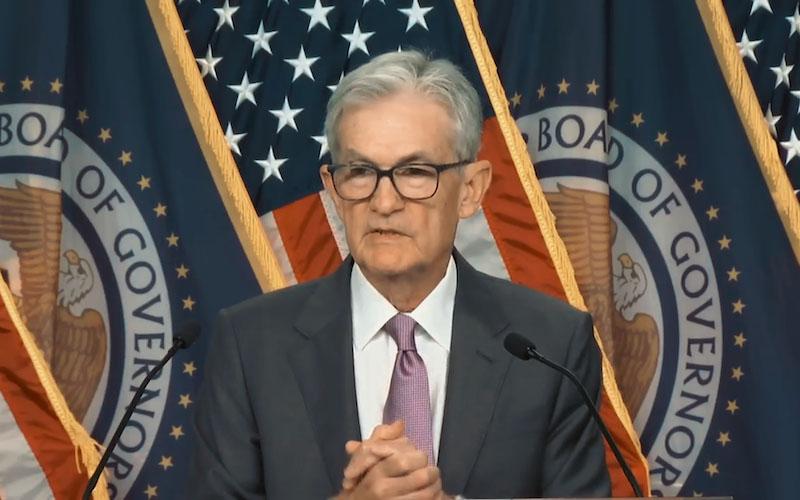

The Federal Reserve in 2025 can be described as a "turbulent year": After Trump began his second term in the White House, he repeatedly threatened to fire Federal Reserve Chairman Jerome Powell, dissatisfied with the slow pace of interest rate cuts; in the middle of the year, he was embroiled in a public opinion storm due to the out-of-control costs of the Washington headquarters renovation project; during this period, he also attempted to remove Federal Reserve Governor Lisa Cook from office by accusing her of "mortgage fraud" without solid evidence, and the related controversy has not yet been resolved - the Supreme Court is scheduled to hold a hearing on January 21 to rule on whether Trump has the legal power to remove Cook.

Meanwhile, Powell's term as chairman will expire in May, and the competition for his successor has been brewing for some time. During the selection process led by Treasury Secretary Scott Bessant, 11 people were shortlisted at one point, while Powell himself has not yet made it clear whether he will serve his term as a board member until January 2028.

The general consensus in the market is that after the dramatic upheaval in 2025, the Federal Reserve will still be in the spotlight and under intense scrutiny in 2026. Kathy Bosjancic, chief economist at National Insurance Company, bluntly stated that "the current high level of uncertainty is putting the Federal Reserve under constant pressure."

January FOMC Meeting Preview: Stable Interest Rates Become the Mainstream Expectation

As the first key event of 2026, the FOMC meeting on January 27-28 is attracting much attention for its interest rate decision. According to Polymarket data, the market currently expects a 90% probability that the Federal Reserve will maintain its current interest rate, with only a 10% probability of choosing to cut rates by 25 basis points.

This expectation was influenced by the stance of the newly appointed members of the voting committee.

Cleveland Fed President Beth Hammark and Dallas Fed President Lori Logan both hold hawkish positions and favor maintaining stable interest rates; Minneapolis Fed President Neal Kashkari has also recently turned hawkish, making it clear that the threshold for further rate cuts is high; only Philadelphia Fed President Anna Paulson is dovish, supporting a small rate cut later this year and focusing more on the performance of the job market than inflation data.

Furthermore, the new Federal Reserve chairman, who will take office in May, is widely regarded by the market as likely to bring a dovish policy stance, which foreshadows subsequent policy adjustments.

Policy disagreements become more pronounced: Controversy intensifies over the pace and scope of interest rate cuts.

The divergence in policy direction has become more pronounced within institutions and the Federal Reserve. Following three consecutive rate cuts, coupled with market expectations of economic stabilization and persistent inflationary pressures, the general consensus is that the Fed's rate-cutting pace will slow significantly in 2026, with limited room for further easing.

Most Wall Street institutions believe that the Federal Reserve will temporarily ignore external noise and continue along the path of small interest rate cuts until it anchors the benchmark interest rate at a neutral level of around 3%—the current federal funds rate is only 0.5 percentage points higher than the long-term neutral rate identified by most FOMC members.

Predictions on the specific number of rate cuts differ: Bosjancic believes there will likely be two rate cuts throughout the year, one in the middle of the year and the other at the end; the Fed's "dot plot" indicates only one rate cut.

Moody's Analytics chief economist Mark Zandi and other institutions, including Citigroup, predict three possible rate cuts this year due to signs of a weak labor market. Torsten Sloko, chief economist at Apollo Global Management, holds the opposite view, believing that the resilience of the US economy will limit the room for rate cuts, with only one rate cut expected throughout the year.

It is worth noting that Powell and his colleagues have repeatedly emphasized that they will not be swayed by external pressure to rashly cut interest rates, and that economic data will be the sole criterion for policy adjustments.

In addition, recent interest rate meetings have seen multiple disagreements among committee members, and the fact that many of the newly joined regional Fed presidents are hawkish will also create obstacles to further interest rate cuts.

Key variables: The dual impact of economic recovery and artificial intelligence

The economic fundamentals and the potential impact of artificial intelligence have added more variables to the Federal Reserve's policy-making.

The Federal Reserve's three preventative rate cuts at the end of 2025 are expected to have their effects gradually become apparent in 2026. Coupled with the recovery following the government shutdown and consumer tax rebates, economic growth is expected to rebound in the first quarter. Against this backdrop, the market generally expects the Federal Reserve to keep interest rates stable in the first half of the year and to continue to monitor economic data and the effects of policy transmission.

Artificial intelligence, as a key variable, is becoming a new challenge for the Federal Reserve: it is both a lever to boost productivity and a potential shock to the job market. Currently, massive amounts of capital are flowing into cutting-edge technology sectors, and the surge in related concept stocks is the core driving force behind Wall Street's double-digit stock index gains.

Joseph Brussula, chief economist at Rupert Hoop Management Consulting, pointed out that "the Federal Reserve must clearly communicate its core judgment on AI trends to the market this year, providing a clear strategic anchor for monetary policy during the economic transition."

The macroeconomy is rapidly transforming towards integrating cutting-edge technologies into the entire production and service chain, which could very well become a key watershed moment for the Federal Reserve's policy shift.

Conclusion: Amidst multiple game dynamics, the policy direction remains to be seen.

In 2026, the Federal Reserve will have to maintain its monetary policy independence amidst political maneuvering, balance economic recovery and inflationary pressures while also dealing with macroeconomic variables brought about by new technologies such as AI.

The interest rate decision and the appointment of a new chairman at the January FOMC meeting will be the key to unlocking the policy direction for the whole year, and the market will respond in real time to this central bank game through repeated fluctuations.

It should also be noted that although the probability of a Fed rate cut in January is very low on the surface, and the dot plot also indicates that rate cuts are nearing their end, the impact of US AI development on employment and Trump's intervention in the Fed have led to more optimistic market expectations for future rate cuts. This has boosted the strong performance of precious metals while continuously limiting the rebound of the US dollar.

Going forward, it is necessary to continue monitoring US economic data and the White House's attitude toward the Federal Reserve to verify the above assumptions. If situations arise that do not conform to the assumptions, it is easy to create expectation gaps and affect market trends.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.