A chart shows the Baltic Dry Index recording a weekly decline, dragged down by Capesize and Supramax vessels.

2026-01-10 00:01:58

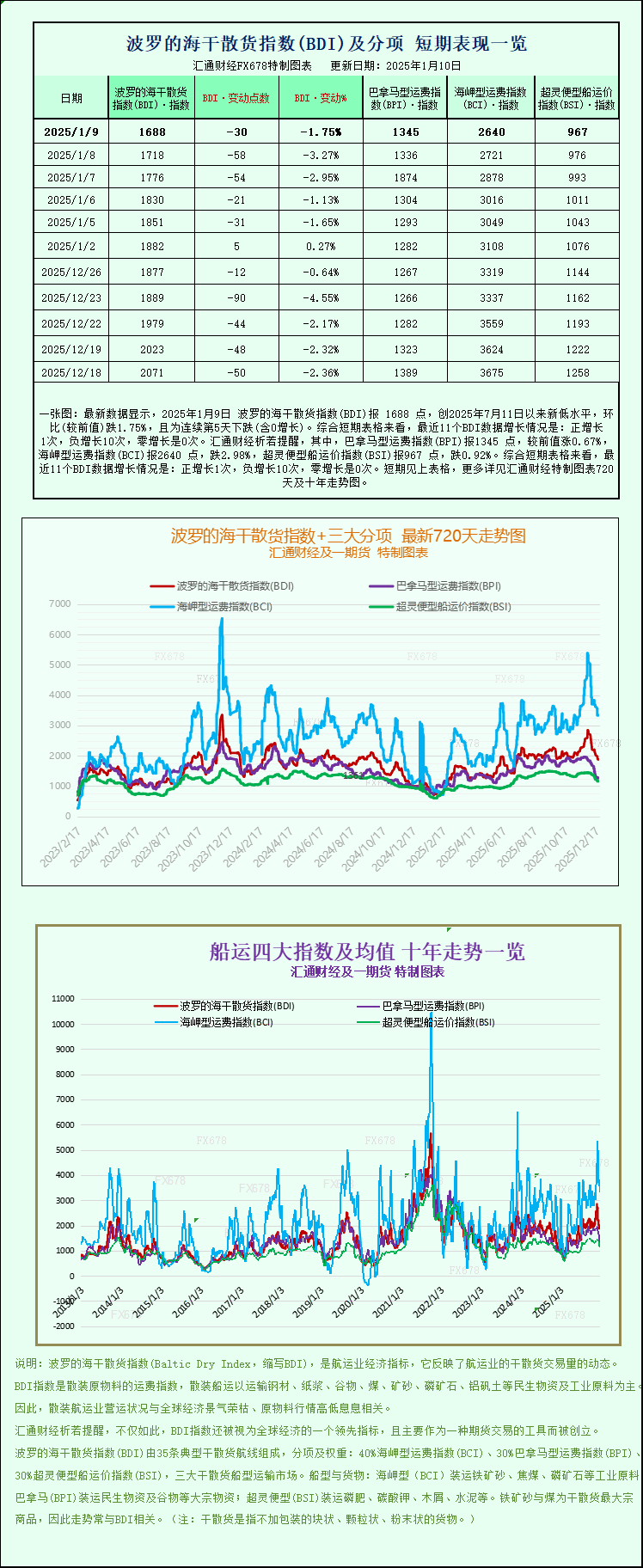

On January 9, the Baltic Dry Index (BDI), a key indicator of the global dry bulk shipping market, closed at 1688 points, down 30 points from the previous trading day. More importantly, the index fell by 10% this week, highlighting the downward pressure currently facing the overall dry bulk shipping market.

This weak performance was not caused by all ship types, but rather showed obvious structural differentiation. The continued weakness of the Capesize and Supramax ship types became the main force dragging down the index, while Panamax ships bucked the trend and achieved weekly gains, becoming a bright spot in the market.

As the "giant" of the dry bulk shipping market, Capesize vessels mainly handle long-distance transoceanic transportation of bulk commodities such as iron ore and coal. Their market performance is closely related to the global steel industry's prosperity and energy demand. On that day, the Capesize Index (BCI) fell sharply by 81 points, a drop of 3%, closing at 2640 points. The cumulative decline for the week widened to 15.1%, setting a new record for the largest weekly decline in recent times.

Correspondingly, the average daily earnings for Capesize vessels also declined, decreasing by $735 from the previous trading day to $20,444. This trend clearly echoes the fluctuations in the upstream iron ore market: Dalian iron ore futures fell for the second consecutive trading day, primarily due to a significant increase in iron ore inventories at Chinese ports. As the world's largest steel producer and iron ore consumer, changes in Chinese port inventories directly impact global iron ore shipping demand expectations. However, it is worth noting that, as the market generally expects iron ore demand to gradually improve with the recovery of China's steel industry operating rates, Dalian iron ore futures still rose overall this week, preserving some expectation of a recovery in the Capesize vessel market.

The market performance was also mixed in the small and medium-sized dry bulk vessel sector. Supramax vessels, an important transport capacity connecting major ports and feeder ports, mainly transport small batches of bulk cargo. Their index (BSI) fell 9 points to close at 976 points, with a cumulative decline of 10.1% this week, entering a downward trend along with Capesize vessels. Industry analysts believe that the weakening of the Supramax market is due to both the overall dry bulk market sentiment and the temporary weakness in regional feeder transport demand. Reduced orders for agricultural products and small-batch coal transport in some regions have directly led to a decline in freight rates for this vessel type.

In stark contrast to the weakness of the two aforementioned vessel types, the Panamax market bucked the trend and rose. On that day, the Panamax Index (BPI) rose 9 points, or 0.7%, to close at 1345 points, with a cumulative weekly increase of 4.9%, becoming the core driver of the overall index. Panamax vessels mainly transport 60,000 to 70,000 tons of cargo such as coal and grain, and their market performance is closely related to global food trade and energy supply transportation demand. On that day, the average daily earnings for this vessel type rose by $80 to $12,108, reflecting relatively strong market demand for this type of vessel. Analysts pointed out that recently, grain exports in some parts of the world have entered their peak season, while coal supply demand in Europe has increased, driving up transportation orders for Panamax vessels and supporting the rise in freight rates.

Overall, the weekly decline in the Baltic Dry Index (BDI) was mainly due to the combined drag from Capesize vessels (which have a large weighting) and Supramax vessels (where demand was weak). The counter-trend rise in Panamax vessels mitigated the decline to some extent. Going forward, market trends will focus on the actual recovery of Chinese iron ore demand, the sustainability of the peak season in global grain trade, and the impact of international energy price fluctuations on coal transportation demand. These factors will directly affect freight rates for different vessel types, thus influencing the overall performance of the BDI. For shipping companies, the current structural differentiation in the market means adjusting capacity allocation based on the market conditions of different vessel types to cope with market uncertainties. For commodity traders, fluctuations in freight rates will directly impact transportation costs, requiring close monitoring of market dynamics to optimize trade decisions.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.