Political infighting engulfs the Federal Reserve, the dollar and US Treasury bonds "separate," and gold breaks through $4,600. How will the dollar, US Treasury bonds, and gold change course?

2026-01-12 19:40:29

The fundamental driver of this market movement was not the influence of a single economic data point, but rather a rare public clash between the independence of US politics and monetary policy. The Federal Reserve Chairman's tough stance on administrative intervention directly shook market confidence in the stability of the US system, triggering a series of chain reactions.

The controversy surrounding the Fed's independence is impacting US Treasury bonds and casting doubt on the dollar's credibility.

A key divergence has emerged in the dollar's performance: while the yield on 10-year US Treasury bonds, which typically supports the dollar, has risen, the dollar itself has fallen. This anomaly stems from growing market concerns about the Federal Reserve's independence and the integrity of the system .

Retail traders generally believe that the executive branch's attempt to influence interest rate decisions through irregular means undermines the Federal Reserve's independence. Institutional analysts, however, point out that this essentially forces investors to reassess the "political risk premium" of US assets. Looking at the bond market, long-term Treasury yields have risen sharply, while short-term yields have remained relatively stable. This "bear market steepening" yield curve is not due to growth expectations, but rather the market demanding compensation for potential long-term inflation risks and governance uncertainties.

When markets worry that monetary policy may be distorted by political factors, the dollar's credibility as the global reserve currency is eroded. Technical charts show that the dollar index has broken below key moving average support, and if it cannot recover quickly in the short term, downward pressure may continue. The upcoming Supreme Court ruling this week could further impact the fiscal outlook and exacerbate market anxieties.

The bond market confidence crisis is spreading, deepening the logic behind gold's breakthrough of $4600.

The surge in gold prices can no longer be explained solely by geopolitical conflicts. The deeper logic lies in its role as an asset to hedge against the risks associated with the US monetary policy framework.

Normally, rising US Treasury yields suppress gold prices. However, when US Treasuries themselves appear "less reliable" due to domestic political turmoil, gold's status as the ultimate credit substitute becomes fully apparent. Analysts believe that the current influx of funds into gold is both a hedge against known geopolitical risks and a preventative measure to guard against chaos in US macroeconomic policy-making.

Recent geopolitical events, from Europe to Latin America, coupled with the current policy controversies within the United States, have collectively reinforced market skepticism about the stability of the existing international order. This macroeconomic uncertainty provides a sustained catalyst for gold.

Technical indicators show strong bullish momentum in gold, and although there is a possibility of short-term overbought conditions, fundamental support is solid. Global gold ETF inflows and continued gold purchases by central banks provide long-term and robust underlying support for gold prices.

Short-term outlook and key price ranges for major commodities

Based on the current market logic, the following price ranges should be monitored for core commodities in the next 2-3 days:

US Dollar Index <br/>Core Logic: Dragged down by domestic political and monetary policy conflicts, it is in a phase of credit downgrade.

Resistance range: 98.86 - 99.21. Whether it can recover 98.86 is key.

Support range: 98.35 - 98.51. A break below this level could lead to further declines.

Key focus: The Supreme Court's ruling and the subsequent response from the executive branch.

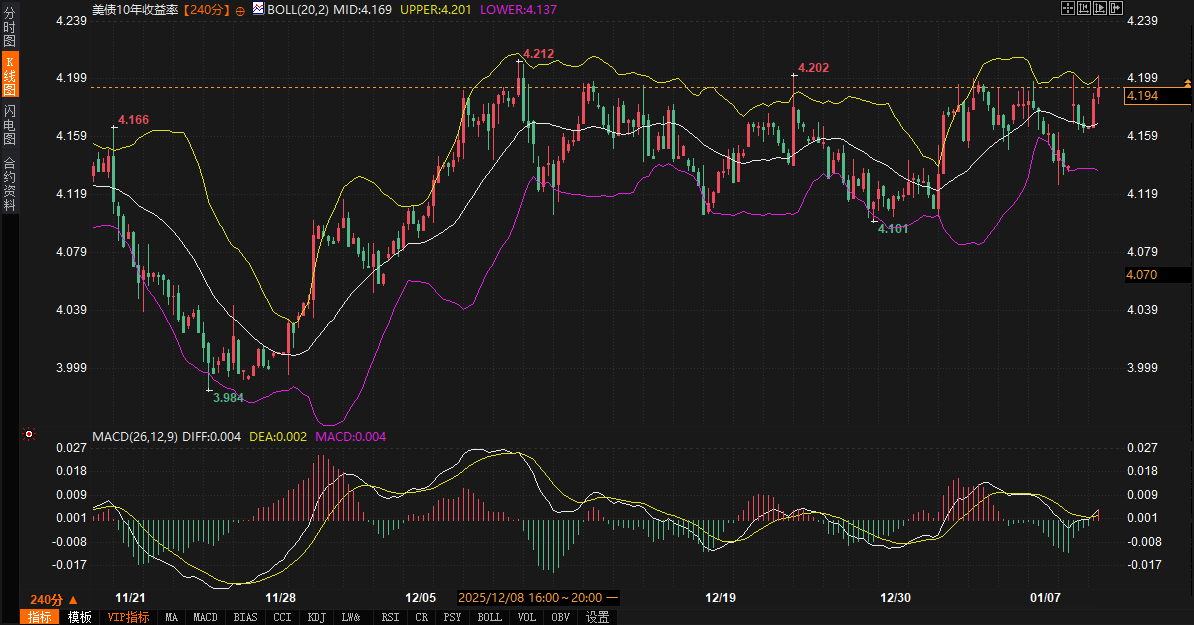

10-year US Treasury yield <br/>Core logic: Due to rising term premium and political risk compensation, yields remain high and are unlikely to fall.

Resistance range: 4.20% - 4.24%.

Support range: 4.14% - 4.17%.

Key areas of focus: changes in demand for long-term government bonds and expectations of fiscal deficit.

Spot gold : The core logic is driven by both institutional trust crisis and geopolitical risks.

Resistance range: $4600 - $4615. Be wary of profit-taking after breaking through this psychological level.

Support range: $4487 - $4520. The bullish trend remains above $4500.

Key concerns: whether geopolitical tensions will escalate, and whether risk aversion will spread further.

Trend Outlook: A Shift in Market Logic

Looking ahead to the next few days, market focus has shifted from economic data itself to the stability of the institutional framework shaping economic policy. The Supreme Court ruling could be the next key turning point. If the ruling exacerbates concerns about fiscal sustainability, it could push long-term bond yields further up, thus continuing to benefit gold through the "safe haven-credit substitution" chain while putting pressure on the US dollar.

Meanwhile, how the Federal Reserve responds to political pressure will determine the bottom line of the dollar's credibility. In the short term, the market may continue to digest the uncertainty brought about by this turmoil, and the dollar may remain weak and volatile, while gold, after breaking through key levels, will play a more prominent role as a "non-political" reserve asset.

Overall, the market is in a transitional period where traditional pricing anchors are being challenged. The "institutional risk premium" stemming from the US Treasury market is transmitting to the currency and precious metals markets, reshaping valuations. At this stage, understanding the path of risk transmission is more important than chasing price fluctuations.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.