The battle between bulls and bears at the 158 mark: verbal intervention, interest rate hike rumors, and divergence in the bond market – which one is the real trump card?

2026-01-16 17:38:08

Fundamental Drivers: The Struggle Between Expectations of Intervention and Interest Rate Hikes

Japanese Finance Minister Satsuki Katayama's series of statements on Friday sent a clear official signal to the foreign exchange market. He reiterated that "no option is ruled out" in dealing with excessive yen volatility, and specifically mentioned the Japan-US joint statement signed last September, which provides a framework for actions including joint intervention. These remarks directly targeted the current unilateral depreciation pressure in the currency market, aiming to strengthen policy deterrence and curb speculative selling. While the short-term direct effectiveness of verbal intervention is often questioned, such clear warnings near key psychological levels can effectively increase market volatility, compress profit margins for one-way trading, and pave the way for potential substantive intervention.

Meanwhile, deeper drivers from the policy center are taking shape. According to reports from prominent media outlets, some Bank of Japan policymakers are seriously considering the possibility of raising interest rates earlier than the market generally expects, potentially as early as April. The core logic behind this assessment is that the persistently weak yen (which has depreciated significantly since last October) is continuously injecting cost-push inflationary pressures through import channels. Japanese companies are already in an environment of actively passing on costs; further yen weakness could provide them with further justification for price increases, thus increasing the risk of deeply entrenched inflation. Although the Bank of Japan is expected to maintain interest rates at its meeting this month, and Governor Kazuo Ueda emphasized the need for careful assessment of economic resilience, "inflationary pressures caused by yen depreciation" have been explicitly listed as a key monitoring factor. The April meeting is seen as a crucial juncture by some market participants because it coincides with the start of the new fiscal year, the clear outcome of the spring labor negotiations, and the release of the central bank's new long-term economic and price outlook report. Katsutoshi Inadome, senior strategist at Sumitomo Mitsui Trust Asset Management, holds a representative view: he believes that the central bank may have fallen behind in dealing with inflation risks, and that a rate hike in April is quite likely, with further actions not ruled out.

Technical Analysis and Market Structure: Divergence Signals from the Yield Curve

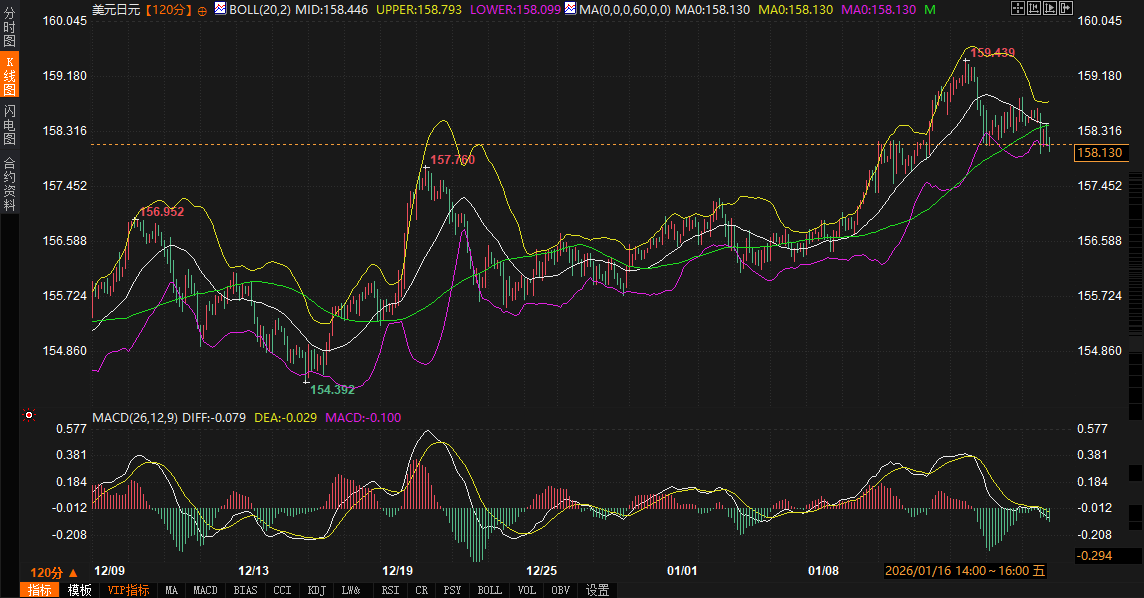

The USD/JPY 240-minute chart shows the price currently oscillating around the Bollinger Band (parameter 20,2) middle line at 158.45, with the upper band at 158.79 and the lower band at 158.10. In the MACD indicator (parameter 26,12,9), both the DIFF and DEA are below the zero line, at -0.078 and -0.029 respectively, indicating a weak consolidation, but no strong downward momentum has yet formed. The current exchange rate is at a short-term equilibrium point between bulls and bears.

A more in-depth analysis is needed of the performance of the Japanese government bond market, as it provides a reflection of the yen's intrinsic valuation. On Friday, Japanese government bonds (JGBs) encountered renewed selling pressure, driven primarily by three factors: external pressure from rising US yields, weak results from the Treasury's auction of some non-core maturities, and the aforementioned reports about a possible earlier-than-expected interest rate hike by the Bank of Japan. The selling pressure was concentrated on 5- to 20-year bonds, causing the benchmark 10-year yield to rise to 2.185% at one point during the day, near its recent high.

However, a subtle structural divergence emerged in the market: contrary to the rise in short- and medium-term yields, yields on 30-year and longer-term government bonds declined. The 30-year yield fell to 3.45% in early trading, causing a noticeable flattening of the yield curve. This phenomenon reveals the complex sentiments of market participants: on the one hand, expectations of early tightening by the central bank pressured short- and medium-term bond prices; on the other hand, some long-term allocation funds (such as pension accounts) may have perceived a valuable allocation opportunity at relatively high yields, thus actively buying ultra-long-term bonds. This divergence between short- and long-term yields reflects different pricing in the market regarding long-term economic prospects and short-term policy shocks, and also implies that the logic of a broad bearish view on Japanese government bonds solely based on expectations of interest rate hikes is not robust. Historically, the flattening of the yield curve has often been seen as a signal of concern about future economic growth or inflation prospects.

Future Trends Outlook and Key Ranges

Looking ahead, the yen's trajectory will depend on the dynamic balance of several forces. Fundamentally, "policy deterrence" and "policy shift" constitute the two major potential supports for the yen. Verbal intervention by the Ministry of Finance will continue to set a "policy ceiling" for the USD/JPY exchange rate; any unilateral rapid upward movement could provoke a stronger official response or even concrete action. Meanwhile, the anticipated interest rate hike by the Bank of Japan may weaken the dollar's attractiveness from the fundamental logic of narrowing interest rate differentials.

However, the obstacles are equally clear. Market fluctuations in expectations for a Fed rate cut and volatility in global risk aversion could both revitalize the dollar. Furthermore, despite increasing discussions about an earlier rate hike, a consensus has not yet formed within the Bank of Japan, and Governor Ueda's cautious stance means that any policy adjustments will be data-driven, and the process may be iterative.

Based on a combination of technical charts and market sentiment, the key short-term support and resistance range for USD/JPY has begun to emerge.

The upper resistance zone is 158.70-159.00. This area not only represents the recent high of the trading range but also approaches the upper Bollinger Band and a significant psychological level. Any upward attempt to test this zone will face the severe test of potential intervention warnings from the Ministry of Finance.

Support level: 157.80-158.10. The area around 158.10 is currently the lower Bollinger Band and also the intraday low from Friday. A break below this level would shift market attention to the previous high-volume trading area around 157.50.

The following key points need close attention during trading:

1. Further changes in the Japanese government bond yield curve: If the 10-year yield breaks through recent highs (e.g., 2.20%), while the 30-year yield no longer follows suit or even falls, the flattening of the curve will intensify, which may suggest that the market's long-term view of the Japanese economy is turning cautious, or weaken the boost the yen has gained from expectations of interest rate hikes.

2. The density and intensity of official Japanese statements: Subsequent statements from officials of the Ministry of Finance and the Bank of Japan will be the most direct indicator of the policymakers' bottom line of tolerance.

3. Market pricing volatility in the probability of an April rate hike: This will be clearly reflected in the yen cross rates and interest rate derivatives markets.

In summary, the yen is at a crossroads amid intense debate surrounding policy expectations. The flattening of the Japanese government bond yield curve reflects both an early market reaction to a potential policy shift and underlying concerns about long-term economic resilience. Trading logic has shifted from purely political transactions to pricing in a deeper level of monetary policy inflection points. In this process, exchange rate volatility is likely to increase significantly, and any one-sided bet carries extremely high policy risk. In the coming week, the market will be holding its breath awaiting the Bank of Japan's policy meeting statement and its latest economic forecasts for more definitive clues about the "timing of the shift."

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.