One chart: The Baltic Dry Index rises as shipping freight rates remain firm.

2026-01-20 23:31:50

The Baltic Dry Index (BDI), which tracks freight rates for dry bulk carriers, continued its upward trend on Tuesday, primarily driven by strong demand across all vessel segments. As a key indicator of the global dry bulk shipping market, the BDI's fluctuations directly reflect the activity of maritime transport of commodities such as iron ore, coal, and grains; its sustained rise is generally seen as a positive signal of improving global industrial demand and trade liquidity.

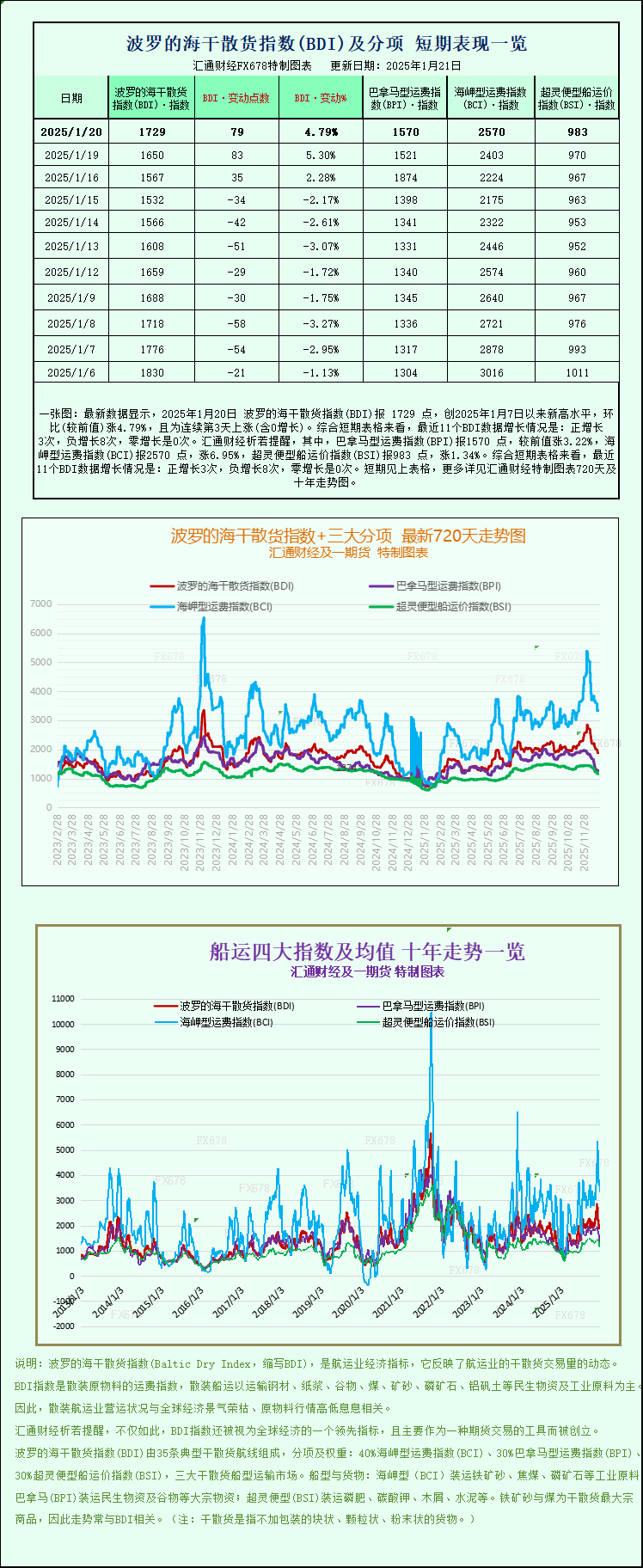

The main index tracking freight rates for Capesize, Panamax, and Supramax vessels rose 79 points, or 4.8%, to close at 1729. This marks the third consecutive trading day of gains for the index, demonstrating the strong momentum of the overall recovery in the dry bulk shipping market and breaking the previous brief period of consolidation.

The Capesize shipping index rose 167 points, or 7%, to close at 2570. Capesize vessels are the "juggernauts" of dry bulk shipping, mainly undertaking long-distance transoceanic bulk cargo transportation tasks. The sharp rise in its index directly reflects the surge in global demand for the transportation of core industrial raw materials.

The average daily charter rate for Capesize vessels increased by $1,511 to $19,804. These vessels typically have a deadweight tonnage of 150,000 tons and primarily transport basic industrial raw materials such as iron ore and coal. They are key transport carriers in the supply chains of industries such as steel and electricity, and the increase in charter rates indicates strong demand for cross-regional allocation of these commodities.

It is worth noting that iron ore futures prices have fallen for the fourth consecutive trading day.

The Panamax index rose 49 points, or 3.2%, to close at 1570. Panamax vessels, with their seaworthiness advantage and ability to pass through the Panama Canal, are the mainstay vessels on routes connecting the Americas, Europe, and parts of Asia. The rise in the index reflects increased activity in inter-regional bulk cargo trade.

The average daily charter rate for Panamax vessels increased by $442 to $14,130. These vessels typically have a deadweight tonnage of 60,000 to 70,000 tons and are mainly used to transport bulk commodities such as coal and grain. They are widely used in energy supply and food trade, and the increase in charter rates reflects the steady recovery in transportation demand in the global energy and food supply chain.

In the small vessel sector, the Supramax vessel index rose slightly by 13 points to close at 983. Supramax vessels have smaller carrying capacities and greater maneuverability, mainly serving near-sea and coastal routes, undertaking short-haul bulk cargo transportation within the region. The steady rise in its index indicates that regional trade restocking demand is effectively supporting the small vessel market.

Meanwhile, shipping companies are reconsidering their return to the crucial Asia-Europe trade corridor. In late 2023, the Houthi rebels in Yemen launched attacks on Red Sea shipping (the group claimed its motives were related to the Gaza war and the plight of the Palestinian people), forcing many ships to divert to southern South Africa, significantly increasing transport time, costs, and uncertainty. As the security situation in the Red Sea gradually eases, the return of capacity to the Asia-Europe route has become a crucial variable influencing the global dry bulk and container shipping market. An orderly return of capacity could further optimize the allocation of global shipping resources and alleviate freight rate volatility pressures on some routes.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.