Institutions: Recent gold price volatility should not be misinterpreted as the end of the bull market.

2026-02-03 11:39:36

After experiencing its largest single-day gain in history, gold prices almost immediately followed by its largest single-day sell-off, bringing the volatility typically seen in risk assets. However, Matthew Piggott, head of gold and silver at Metals Focus, said these moves were neither surprising nor structurally damaging. He stated, " Given the speed of the rise, a pullback was inevitable; the market needed to release some pressure. "

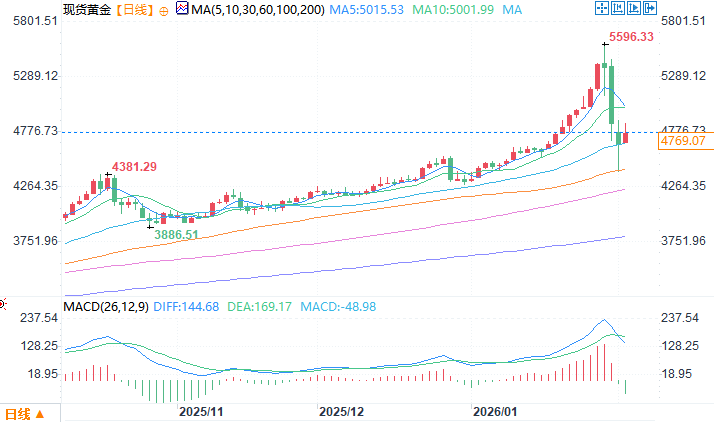

Gold hit an astonishing number of new highs in early 2026: more than a dozen all-time highs in less than three weeks, while silver surged 200% year-over-year at its peak. Piggott suggests that these extreme rallies not only have the potential to lead to a significant correction, but are actually healthy.

Although gold prices failed to hold the initial support level of $5,000 per ounce, overnight selling pressure pushed prices down to $4,402 per ounce, but gold has rebounded sharply from the lows.

Despite the extreme volatility in gold prices, Pigggott said he does not expect the price movements to damage gold's reputation as a stable store of value.

He explained, "Today, most gold buyers are not looking for capital appreciation; they buy because they want to protect their portfolios, mitigate currency devaluation, and mitigate geopolitical risks. Short-term volatility will not change that."

However, he warned that sharp price fluctuations could attract speculative capital, amplifying volatility at both extremes. He added that the true picture of market participation will only become clear after ETF and options data are fully reported.

Piggott added that gold and silver are likely to continue to benefit from FOMO (fear of missing out), particularly from buyers who stood by during last year's relentless rally. He stated, "There hasn't been a dip at all for over a year. Now there is, and that's precisely the time for physical buyers to step in. "

While substantial speculative interest and options trading created a liquidity event at Friday's highs, Pigggott stated that gold continues to benefit from solid fundamental demand, with central banks expected to remain stable buyers in 2026. Central bank gold demand is projected to slow from around 850 tonnes in 2025, but Metals Focus still forecasts official purchases of 700 to 800 tonnes this year, well above pre-pandemic levels.

At the same time, portfolio allocations to gold remain surprisingly low . Piggott points out: "On average, allocations are still in the low single digits, and even an increase from 3% to 4% would be enough to support a significant rise in gold prices."

He added that long-term investors, including pension funds, endowments, and family offices, are still underrepresented in the market, and there is significant upside potential if participation expands .

Despite the volatility, Pigggott stated that Metals Focus has not changed its core outlook after the pullback. The company expects the average gold price to be $5,500 per ounce by mid-year and around $5,800 per ounce for the full year.

While some banks have proposed bullish scenarios for gold at $6,000 to $8,000, Pigggott emphasized that structural drivers such as debt, fiscal imbalances, de-dollarization, and geopolitical risks are evolving slowly, not overnight. He said, "These factors don't emerge overnight; they take years to materialize."

In his view, the recent sell-off did not weaken the market, but rather strengthened it. He said, "This correction was justified and much needed; it reset sentiment, attracted buyers, and gave the market a stronger foundation."

As long as uncertainty remains high and confidence in fiscal discipline remains fragile, the long-term trajectory of gold will not change.

Piggott stated, "Volatility is unsettling, but in this market, it's not a warning sign, but rather the cost of repricing risk."

Spot gold daily chart source: EasyForex

At 11:39 AM Beijing time on February 3, spot gold was trading at $4,801.07 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.