Wall Street's biggest fear: a "fake safe haven" in gold! What's the catch behind CME's three warnings in two weeks?

2026-02-06 18:35:28

Fundamental Analysis: A Fragile Environment Amidst Mixed Bullish and Bearish Factors

The current market fundamentals cannot be simply summarized as "increased risk aversion," but rather a "fragile" environment formed by the interplay of multiple forces. On the one hand, clear supporting factors exist: the widespread decline in global stock markets, especially the Wall Street sell-off spreading to Asian markets, directly stimulated investor demand for gold as a safe haven. Simultaneously, geopolitical tensions, particularly the crucial negotiations between the US and Iran in Oman, have created uncertainty and provided a potential geopolitical risk premium for gold prices. An analyst from a well-known institution pointed out that while some safe-haven inflows have indeed been observed, the shadow of last Friday's epic sell-off still looms over the market, making buying more cautious.

On the other hand, strong constraints and disruptive factors are equally prominent, even altering the market's operating logic. First, the US dollar is strengthening. The dollar index is hovering near a two-week high, as the news the previous week of former US President Trump's nomination of Kevin Warsh as the next Federal Reserve Chairman added uncertainty to the monetary policy outlook, putting direct pressure on dollar-denominated gold. Second, there is the reactive response of market infrastructure. The CME has repeatedly raised margin requirements, from January 30th, February 2nd, to this Thursday (February 5th), a frequency rarely seen in recent years. This move appears to be a standard operating procedure for exchanges to manage market volatility risk, but its deeper impact lies in the systemic cleansing of highly leveraged speculative positions. The increase in margin requirements raises the holding costs for short-term traders, forcing some funds out of the market, which in itself is one of the reasons for the sharp price fluctuations, forming a feedback loop of "volatility triggering margin increases, and margin increases exacerbating volatility." Renowned analyst Ole Hansen's view hits the nail on the head: before volatility subsides and price discovery mechanisms improve, gold, especially silver, is likely to continue trading in a volatile two-way market.

Finally, conflicting signals emerged on the physical demand side. With the Chinese Lunar New Year approaching, some analysts believed that a price correction might stimulate physical purchases in consuming countries. However, a different picture emerged from India, another important gold-consuming market: the local gold premium has fallen by more than half from its ten-year high this week, with high and volatile prices clearly dampening buyer interest. This reveals the suppressive effect of the current high price range on physical demand, and the divergence in demand logic across different regions.

Technical Analysis: Corrective Rebound Faces Key Resistance

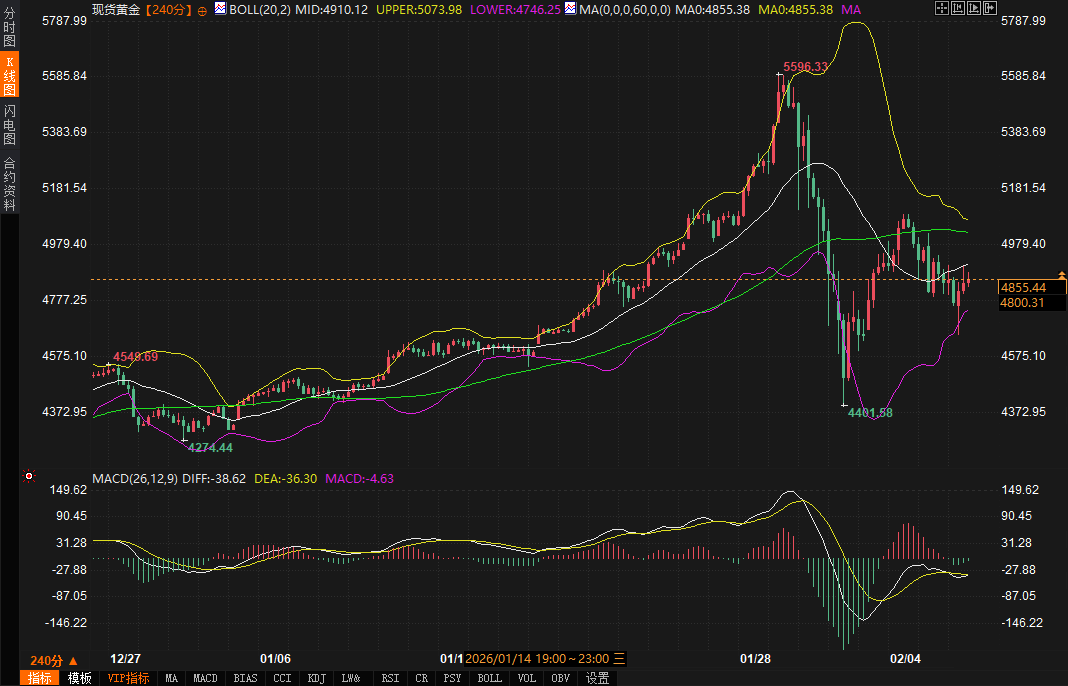

Observing the technical indicators on the provided four-hour chart, gold is currently in a critical phase of correction and decision-making. The price is currently trading near the middle Bollinger Band (approximately $4853), a key reference point for short-term bullish/bearish sentiment. The Bollinger Bands themselves are extremely wide, with the upper band at $5160 and the lower band at $4546, clearly reflecting the recent unusually high volatility in the market. After the previous sharp drop, the price has rebounded to near the middle band, testing its validity.

Although the MACD indicator remains below the zero line, indicating that the downtrend has not completely reversed, the negative difference between the DIFF line (-23.23) and the DEA line (-32.62) has narrowed, suggesting that the downward momentum is slowing and a short-term rebound is underway. Market analyst Kelvin Wang has identified $5169 as the key short-term resistance level and $4400 as the key support level, forming the upper and lower boundaries of the current wide trading range. Until gold prices effectively break through and hold above the middle band and higher resistance levels, the current rise can only be defined as a rebound within a downtrend.

IV. Future Trend Outlook

Looking ahead, the short-term trend of the gold market will depend on the outcome of the game on the following aspects:

1. Volatility Management and Structural Clearing : CME's margin policy has become a variable that cannot be ignored. When the frequent margin increases will slow down or stop will be an important indicator of whether market leverage clearing is nearing its end and volatility is expected to naturally decline. Until then, the market will remain highly "fragile," and rapid fluctuations in any direction are possible.

2. The sustainability and substitutability of risk aversion : Whether the global stock market downturn continues will determine the strength of the risk aversion demand. However, it should be noted that when gold's volatility is comparable to or even higher than that of the stock market, its traditional safe-haven function will be impaired, and funds may seek other alternatives. The market will shift from simply pursuing "safe haven" to weighing "safe-haven efficiency and stability."

3. Technical Consolidation and Confirmation : Gold prices need to consolidate at current levels for a longer period to digest the emotional impact of the previous sharp drop and rebuild a stable technical structure. Whether it can effectively stabilize above the Bollinger Band's middle line and test the upper limit of the $4800-$5000 range is key to determining whether the rebound can deepen into a higher-level consolidation. Silver, on the other hand, needs to first stabilize its price and stop these destructive extreme intraday fluctuations in order to regain investor confidence.

4. Recalibration of Macroeconomic Data : The US non-farm payroll data, postponed to February 11, will become a new benchmark for the market to assess the resilience of the US economy and expectations for Federal Reserve policy. After the disruption caused by the government shutdown, the impact of this data may be amplified, providing new directional clues for the gold market.

In summary, the gold market is currently in a chaotic period where old trends have been broken and a new equilibrium has yet to be established. Its fundamental safe-haven attribute provides a floor for its value, especially against the backdrop of geopolitical tensions and stock market corrections. However, the deleveraging process triggered by exchange intervention, and the resulting extremely high volatility, is temporarily suppressing and distorting its price discovery function. In the near future, the market is likely to continue its wide-range fluctuations until one of the aforementioned bullish or bearish factors gains a decisive advantage, or the market structure completes its self-clearing. Investors should prioritize managing volatility risk rather than simply trying to predict the direction of the market.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.