Gold ETFs hit their highest monthly performance in January; the plunge in gold prices did not deter ETF investors.

2026-02-09 11:15:46

The World Gold Council reported that global gold ETFs saw net inflows of 120 tons last month, worth nearly $19 billion, marking the strongest single-month in history . The report noted that total global gold ETF holdings rose to a record 4,145 tons, surpassing the previous high set in 2020; during the same period, gold prices rose 14%, pushing the total value of gold holdings to a record high of $669 billion.

Analysts point out that even after gold experienced its biggest drop in decades and continued selling, investors continued to buy gold ETFs.

Last month, Asian demand dominated global markets. ETFs in the region saw net inflows of 62 tons, worth nearly $10 billion, marking the fifth consecutive month of net inflows and the region's best monthly performance on record.

Analysts stated, "Asia accounted for 51% of global net inflows, a particularly noteworthy performance considering that Asian holdings are only one-fifth of North American holdings." "University of Tokyo once again led Asian inflows ($6 billion), ranking second globally, only behind the United States. Strong gold prices, continued geopolitical uncertainty, and robust institutional demand have collectively supported University of Tokyo's continued enthusiasm for gold ETFs."

North American-listed gold ETFs also performed well, with investors buying 43.4 tons of gold last month, worth nearly $7 billion.

Analysts noted, "Gold saw a significant pullback at the end of the month after Warsh's nomination as the new Fed Chair. Gold prices were clearly overbought in January, making a correction almost inevitable. Despite the price decline and increased volatility, the region still recorded net positive inflows on the last trading day of the month." "These inflows were driven by rising gold prices and escalating geopolitical tensions between the US and Iran, Greenland, and parts of Europe, factors that helped maintain investor interest in gold."

While European demand is positive, it still lags behind that of Asia and North America. European investors bought nearly 13 tons of gold, worth approximately $2 billion.

Analysts said, "The region faces broader market volatility, including the EU's preparation to impose retaliatory tariffs and pressure on export-oriented economies, which has strengthened demand for defensive assets such as gold." "The UK is leading European inflows, and persistently high inflation and renewed political tensions are further driving investors to use gold ETFs as a tool to hedge against domestic and international risks."

Although gold prices have retreated significantly from their January highs of nearly $6,000 per ounce, analysts at the World Gold Council believe that investment demand for gold will remain a key support for the market in 2026. In their monthly commentary, they noted that the low-interest-rate environment, persistent inflation, and renewed expansion of government spending make gold a more attractive safe-haven asset than bonds.

Analysts stated, "Gold prices may need a breather after the recent rapid rise, but we expect continued investment demand to be a key feature of 2026." "Geopolitics remains the main driver, and the macroeconomic environment is likely to further reinforce this trend. The most probable scenario is that fiscal stimulus ahead of the midterm elections will reignite inflation expectations, thereby increasing the correlation between the stock and bond markets."

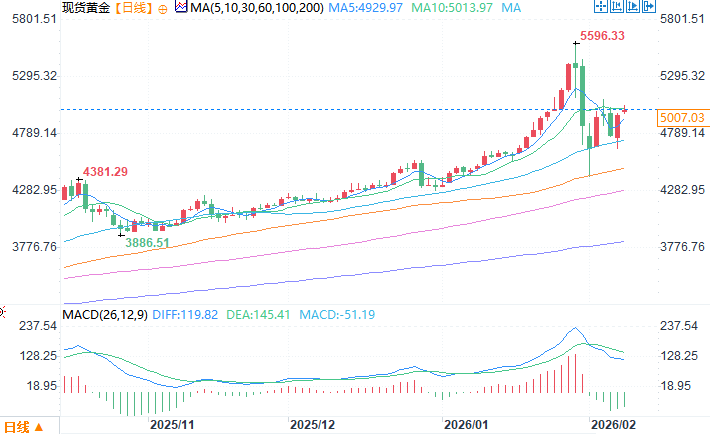

Spot gold daily chart source: EasyForex

At 10:55 AM Beijing time on February 9th, spot gold was trading at $5007.03 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.