Will "de-dollarization" save the European market? Eurozone interest rates may need to be raised further to attract demand in 2026.

2026-02-10 10:30:05

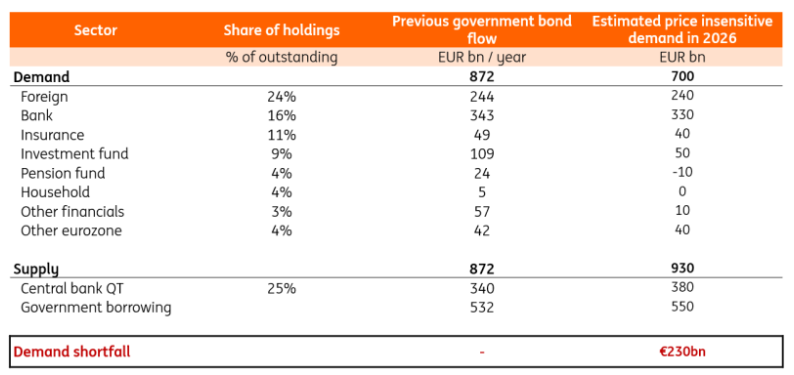

Supply will exceed price-insensitive demand in 2026.

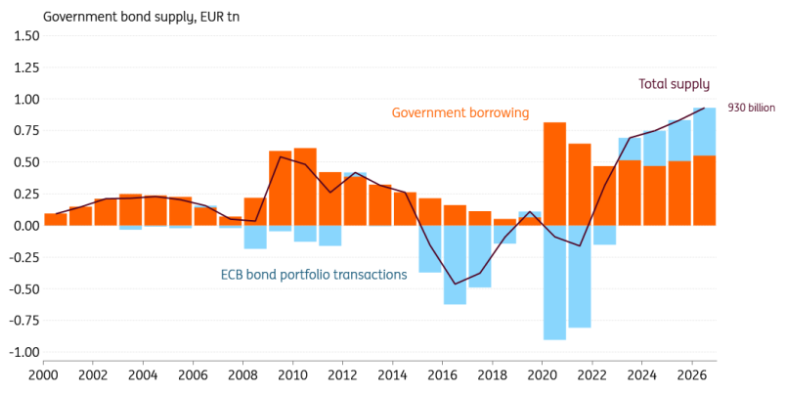

The market successfully absorbed the first wave of issuance in January, but analysis suggests that interest rates may need to rise further. Net supply of European government bonds will reach a record €930 billion in 2026. Government issuance in 2026 is estimated at around €550 billion, while the European Central Bank's quantitative easing (QT) program is expected to bring an additional €380 billion to the market.

A record number of government bonds are expected to enter the market in 2026.

Price-sensitive demand and price-insensitive demand

In our analysis, we categorize demand into price-sensitive and price-insensitive demand. Price-sensitive buyers expect higher yields before entering the market. In contrast, price-insensitive demand is often driven by the regulatory framework.

For example, for banks and pension funds, we found that their demand for government bonds is closely related to asset growth, and this demand is likely relatively unaffected by prices. On the other hand, for investment funds, which are less constrained by regulatory frameworks, their demand is more likely to be driven by yield levels.

Bottom-up industry analysis shows that the demand gap for government bonds is €230 billion.

We estimate that price-insensitive demand for government bonds is around €700 billion, meaning the remaining €220 billion needs to be absorbed by more price-sensitive buyers. Banks will continue to be the largest price-insensitive buyers in the Eurozone, as they need to replenish outflows from central bank reserves. However, to find additional demand from more price-sensitive investors such as investment funds, yields may need to be more attractive. This supports our view that the 10-year German government bond yield will continue to gradually rise, reaching 3.1% by the end of 2026. In the following analysis, we will delve into the demand drivers for each sector.

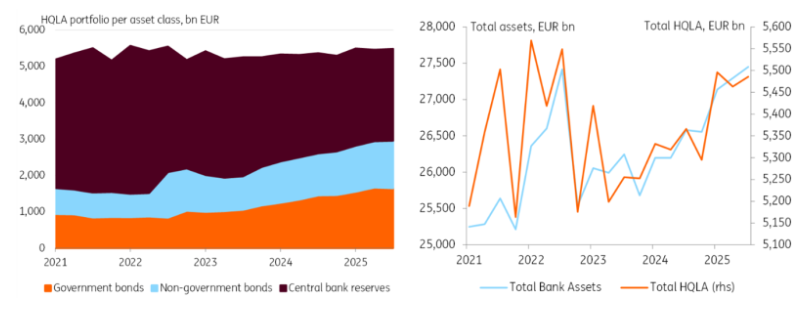

Banks continue to play a key role in absorbing government bonds.

Latest data shows that banks purchase approximately €340 billion in government bonds annually and will continue to be the largest buyers in the Eurozone. Regulatory requirements for banks to hold high-quality liquid assets (HQLA) to cover liquidity outflows have increased demand for government bonds. As QT (Quick Transfer) leads to the withdrawal of central bank reserves from the system, banks must supplement their liquidity portfolios with other HQLA to maintain a constant liquidity coverage ratio (LCR). Approximately 55% of non-reserve HQLA is government bonds. Therefore, replacing €380 billion in reserves will generate a demand for approximately €210 billion in government bonds .

As central bank reserves decrease and assets increase, banks purchase government bonds.

To maintain a stable liquidity coverage ratio, the required size of high-quality liquid assets increases with the expansion of the balance sheet. In fact, in the long run, the proportion of high-quality liquid assets in a bank's total assets has remained stable at around 20% . By extrapolating asset growth and changes in central bank reserves, we can model the demand for government bonds. In the past few years, asset size has increased by approximately €1.1 trillion annually, which equates to an additional demand of €120 billion for government bonds.

The combined demand of €330 billion from eurozone banks will help absorb the large supply, especially since these purchases are relatively insensitive to price. Demand for government bonds stems from regulatory constraints and a relatively limited pool of alternatives to high-quality liquid assets.

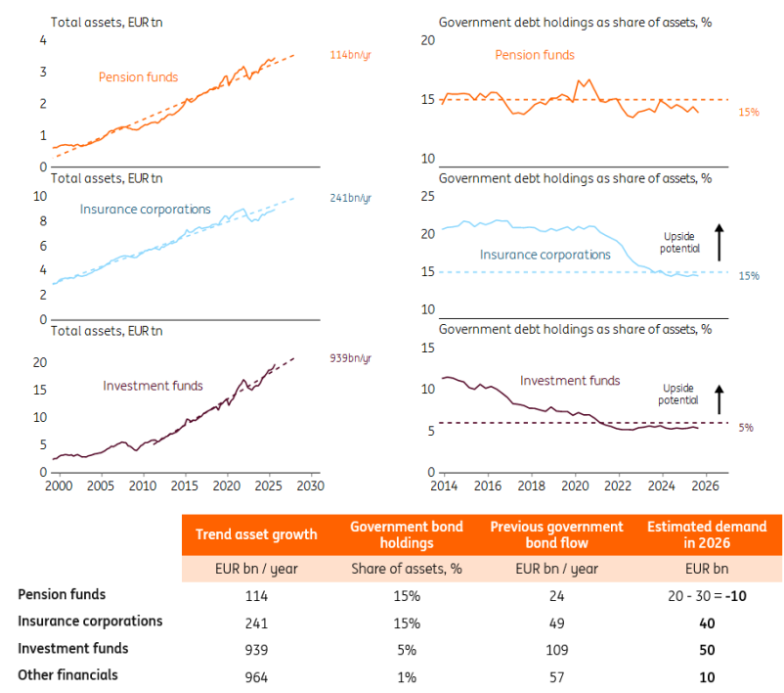

Financial investors' demand, which is insensitive to price, is estimated by inferring asset growth trends.

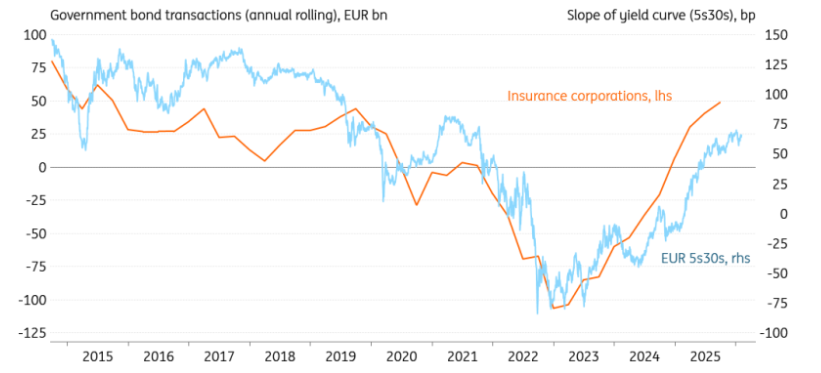

Insurance companies are another major investor, but may seek a steeper yield curve to increase their purchasing activity. The insurance sector again ramped up its buying in 2025, with the latest data showing net annual purchases of €49 billion. Prior to 2021, approximately 20% of assets consisted of government bonds, but this proportion is now only 15%. This implies significant upside potential, but the chart below shows that insurance companies are price-sensitive buyers. Purchases of government bonds appear to correlate with the steepness of the 5s30s curve. Therefore, while we project a baseline demand of €40 billion for 2026, higher yields may be needed to see further marginal purchases.

Insurance companies may seek a steeper curve to further stimulate demand.

Due to the ongoing transformation of the Dutch pension system, demand for pension funds will decrease significantly, and we even expect the sector to become a net seller by 2026. The relationship between asset holdings and government bond holdings is very stable, accounting for approximately 15% of assets, which typically generates an additional demand of around €20 billion.

However, Dutch pension reforms have triggered a structural decline in demand for government bonds, estimated at around €100 billion. A large portion of this may not occur until 2027, but in 2026, we expect net sales by Dutch pension funds to be around €30 billion. Therefore, total demand in 2026 will decrease by approximately €10 billion . That said, pension funds have considerable flexibility in increasing government bond purchases, but this certainly requires attractive yields compared to other asset classes.

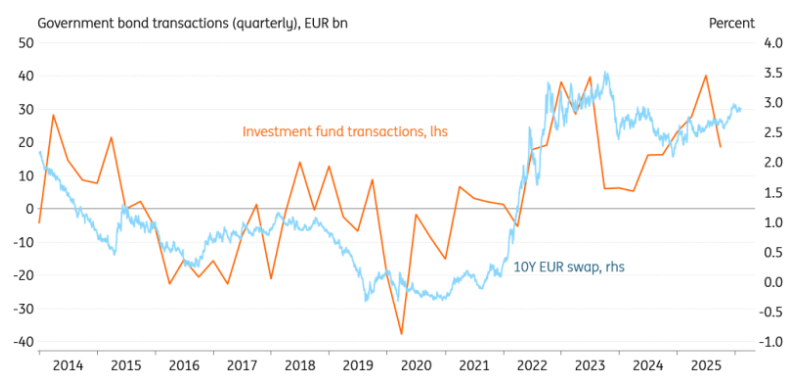

The greatest potential may come from investment funds, but these funds are also highly price-sensitive. The positive correlation between trading volume and 10-year swap rates suggests that investment funds buy when interest rates are high and sell when they are low. That said, holdings of government debt securities as a percentage of assets have stabilized at around 5% over the past few years. Based on this assumption, a further 5% increase in assets in a single year would generate an additional €50 billion in demand for government bonds. This could depend more on equity prices, as equities constitute the majority of fund assets. Again, if yields rise to sufficiently high levels, investment funds may tend to shift more towards government bonds.

Investment funds are potential major buyers, but they are very sensitive to yield levels.

Buyers from other countries could step in to help, but fiscal concerns still pose a risk.

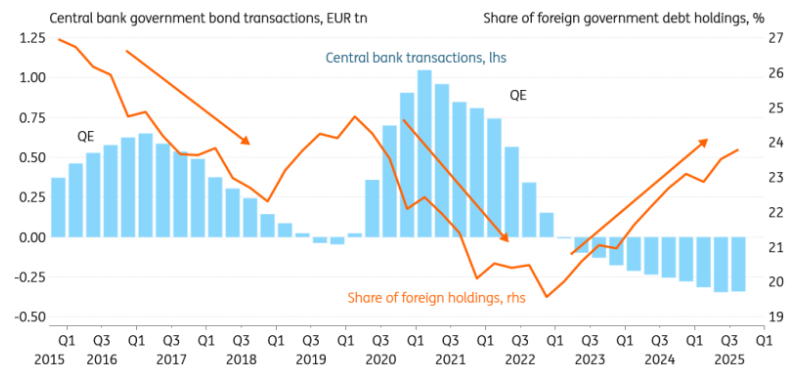

Strong demand from foreign investors is likely to continue, as current holdings remain well below pre-quantitative easing (QE) levels. Before QE, foreign investors held over 27% of total outstanding debt, a significant increase from the current 24%. Latest data shows annual demand at €245 billion, second only to eurozone banks.

Predicting demand from foreign investors is more challenging because the investor base can be highly diversified. Official foreign exchange reserve managers are key buyers of eurozone government bonds and are relatively insensitive to price. As the dollar's global dominance is challenged, we expect demand for euro assets to increase. In our assumption of price-insensitive demand, we only refer to the latest available capital flow data.

Other foreign investors, such as private financial companies, may be more price-sensitive buyers. When the European Central Bank buys large amounts of government bonds, yields are suppressed, thus crowding out foreign buyers from the market. Conversely, in the current phase of quantitative tightening, foreign investors are being attracted back as yields rise.

Investors from other countries help absorb the additional supply resulting from quantitative tightening.

With QT already stable at around €350 billion annually, foreign buyers are expected to remain a significant source of demand in 2026. However, this is contingent on yields potentially needing to continue rising to sustain these inflows.

On Tuesday (February 10) in Asian trading, the euro traded around 1.1905 against the dollar, after the pair had risen sharply the previous trading day due to a significant drop in the dollar.

Speculation surrounding “de-dollarization” suggests that demand for European assets as an alternative could unexpectedly surge . With the US failing to resolve its fiscal problems, European debt may become increasingly attractive to foreign investors seeking safety. On the other hand, parts of Europe also face fiscal challenges, and any fear of another eurozone sovereign debt crisis could quickly scare away foreign investors.

(Euro/USD daily chart, source: FX678)

At 10:29 Beijing time, the euro was trading at 1.1907/08 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.