February 11 Financial Breakfast: Gold prices hold steady above $5,000, awaiting non-farm payroll data; US-Iran negotiations support oil prices.

2026-02-11 07:22:57

Key Focus Today

OPEC released its monthly oil market report, and Federal Reserve Chairman Schmid spoke on the economic outlook and monetary policy.

stock market

U.S. stocks traded mixed on Tuesday, with the Dow Jones Industrial Average rising slightly by 0.10%, marking its third consecutive day of record closing highs; while the S&P 500 and Nasdaq Composite fell 0.33% and 0.59%, respectively. The market is digesting weaker-than-expected retail sales data and awaiting a key jobs report.

Retail sales data showed flat in December, falling short of growth expectations and raising concerns about a slowdown in consumption. Meanwhile, the technology sector came under pressure, with communication services being the weakest performing sector on the S&P 500. Alphabet's stock price fell 1.8% due to its bond issuance plan, exacerbating market concerns about the massive investments required in AI. The four major tech giants are expected to invest hundreds of billions of dollars in AI by 2026.

Interest rate-sensitive sectors such as utilities and real estate performed relatively well. Traders' expectations for a Federal Reserve rate cut in April rose slightly, but the market still expects rates to remain unchanged until June. Investors are cautious ahead of the non-farm payroll report.

In terms of individual stocks, Walt Disney and Home Depot rose, supporting the Dow Jones Industrial Average; Coca-Cola fell 1.5% due to revenue falling short of expectations; S&P Global plunged 9.7% due to earnings forecasts falling short of expectations, dragging down the share prices of peer rating agencies.

Gold Market

Gold prices fell more than 1% on Tuesday to $5,013 an ounce. U.S. April gold futures, however, closed up about 1% at $5,031 an ounce, mainly as investors took profits and adjusted positions ahead of key U.S. employment and inflation data releases. These data are expected to provide important guidance for the Federal Reserve's future interest rate policy.

David Meger, head of metals trading at High Ridge Futures, said that a slight pullback or consolidation in gold prices ahead of a host of key economic data releases is normal market behavior. He also pointed out that a weak dollar, geopolitical tensions, and market expectations of a Federal Reserve rate cut continue to support gold prices, with the psychological level of $5,000 per ounce also providing some support.

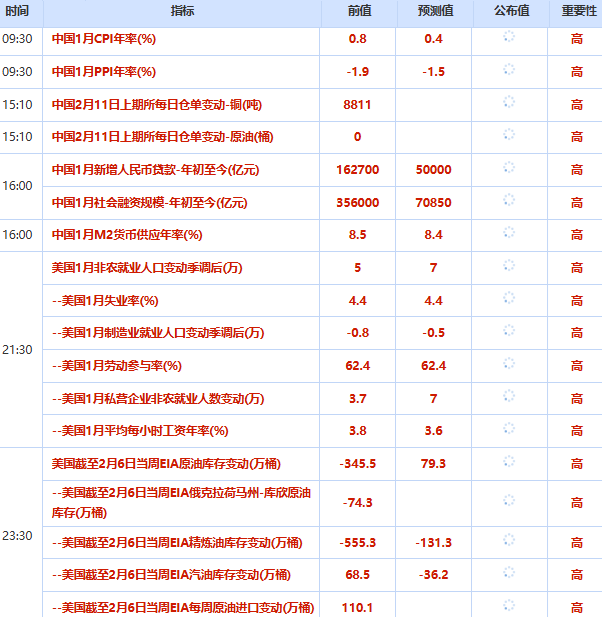

Regarding specific data, the January non-farm payrolls report will be released on Wednesday, with the market expecting 70,000 new jobs added; the January Consumer Price Index (CPI) is scheduled for release on Friday. Furthermore, the latest data shows that US retail sales unexpectedly remained flat in December, suggesting that consumer spending and economic growth may be slowing.

Market concerns about the economic outlook have reinforced expectations of interest rate cuts. Traders now widely anticipate two 25-basis-point rate cuts by the Federal Reserve this year. Since gold itself does not generate interest, lower interest rates will reduce the opportunity cost of holding gold, thus benefiting gold prices.

In other precious metals, spot silver fell 3.3% to $80.63 per ounce. Standard Chartered Bank noted in a report that outflows from silver exchange-traded products (ETPs) could lead to increased price volatility in the short term, but tight supply fundamentals suggest a potential rebound in the coming months. Spot platinum fell 1.8% to $2084.42 per ounce; palladium fell 2.1% to $1709.82 per ounce.

oil market

Oil prices fell on Tuesday as markets awaited guidance from progress in negotiations between Iran and the United States, developments in Ukraine, and U.S. economic data and crude oil inventory reports. Brent crude futures settled down 0.3% at $68.80 a barrel, while U.S. crude futures settled down 0.6% at $63.96 a barrel.

Traders remained cautious ahead of the diplomatic situation, focusing on shipping security in the Strait of Hormuz. Iran stated that nuclear negotiations showed sufficient consensus to move forward. The EU plans to make concessions to Russia to end the war in Ukraine.

On the US economic data front, December retail sales unexpectedly remained flat, and the market is focused on the upcoming non-farm payrolls and inflation data. Regarding crude oil inventories, analysts expect a slight increase of 100,000 barrels in US crude oil inventories last week.

Foreign exchange market

The dollar weakened on Tuesday as data showed a slowdown in U.S. economic growth, while the yen rose for a second straight session after Japanese Prime Minister Sanae Takaichi won the election.

Data from the U.S. Commerce Department showed that retail sales unexpectedly remained flat in December, putting pressure on consumer spending. Shaun Osborne, chief foreign exchange strategist at Scotiabank, noted that the data reinforced the view that investors are shifting from dollar assets to safe-haven assets and emerging markets, and the dollar may weaken further.

The dollar index, which measures the dollar against a basket of currencies, fell 0.15% to 96.805. Markets are focused this week on upcoming U.S. employment and inflation data to assess the economic situation.

The yen rose 1% against the dollar to 154.285. Analysts believe that Sanae Takashi's fiscal stimulus policies may prompt the Bank of Japan to adopt a more hawkish stance, thus supporting the yen. Furthermore, the stronger yen has sparked speculation that Japanese authorities may intervene in the foreign exchange market.

The euro fell 0.12% against the dollar to $1.19075 after a surge on Monday. European Central Bank President Christine Lagarde downplayed the impact of exchange rates on policy, but their movements remained a focus of market attention. The dollar edged up 0.21% against the Swiss franc, while the Swedish krona rose 0.16% against the dollar.

International News

Trump says he will take tough action if negotiations with Iran fail.

On February 10, local time, US President Trump, in a telephone interview with Israel's Channel 12 television, stated that if the US and Iran fail to reach an agreement in the near future, he is prepared to "take military action as was done during the conflict between Israel and Iran last June." Trump said Iran "very much wants an agreement," but if negotiations fail, the US will take "very tough action." Trump stated that the US military deployment in the region provides significant leverage for pressuring Iran and confirmed that he is considering sending another aircraft carrier and its strike group to the Middle East. Trump confirmed that his meeting with Israeli Prime Minister Netanyahu on February 11 will primarily discuss the Iranian issue. He anticipates that the second round of US-Iran talks will be held next week. He emphasized that any agreement reached with Iran must "not only address the nuclear issue, but also the issue of Iran's ballistic missiles." (CCTV International News)

The probability of the Federal Reserve keeping interest rates unchanged in March is 78.4%.

According to CME's "FedWatch": The probability of the Federal Reserve cutting interest rates by 25 basis points by March is 21.6%, and the probability of keeping rates unchanged is 78.4%. The probability of a cumulative 25 basis point rate cut by the Fed by April is 36.9%, the probability of keeping rates unchanged is 57.3%, and the probability of a cumulative 50 basis point rate cut is 5.8%. The probability of a cumulative 25 basis point rate cut by June is 48.6%.

The National Governors Association cancels its annual meeting with the President.

According to US media reports on the 10th, the National Governors Association has decided to cancel its annual formal meeting with President Trump at the White House because the White House plans to invite only Republican governors to the event. The report stated that Kevin Stitt, president of the National Governors Association and Republican governor of Oklahoma, said in a letter to other governors on the 9th that the White House plans to limit invitations to its annual business meeting scheduled for February 20th to Republican governors. Since the association's mission is to represent all governors and governors of US territories, it will no longer organize the meeting or include it on the official schedule. White House Press Secretary Carolyn Levitt responded to this at a press conference on the 10th, saying that Trump "can invite anyone he wants to have dinner or attend an event at the White House," and that "he welcomes all invitees, and if they don't want to come, that's their loss." (Xinhua)

The Israeli military plans to launch a new offensive to disarm Hamas.

According to Israeli sources on the 10th, the Israel Defense Forces (IDF) is developing plans to launch a new offensive in the Gaza Strip to disarm Hamas by force. It is understood that the IDF's Southern Command is formulating a series of operational plans in the Gaza Strip in preparation for a government order to disarm Hamas by force, but the prospects for implementation remain unclear. Israel believes that Hamas will be "unlikely" to disarm if the IDF does not take action. (CCTV News)

With the addition of new clauses, the European Parliament is closer to approving the EU-US trade agreement.

The European Parliament is one step closer to approving a trade deal with the United States, with senior members agreeing to make adjustments ahead of a planned vote this month. Members of the European Parliament's Trade Committee confirmed on Tuesday that they will vote on the deal on February 24. They also agreed to include a sunset clause in the agreement—which expires in March 2028 unless extended—giving the United States six months to reduce its current 50% tariffs on products using steel and aluminum. If the United States fails to reduce tariffs on products using these metals to 15%, the EU will consider reinstating tariffs on US industrial imports and some agri-food products. Sources indicate that large political groups, including the center-right European People's Party and the Progressive Social Democratic Union, support these amendments. The European Parliament plenary session still needs to vote on the amendments, and the changes must be agreed upon in negotiations with member states.

Iranian official: If US-Iran nuclear negotiations succeed, dialogue may expand to other areas.

It was learned on the evening of the 10th local time that Ali Larijani, Secretary of Iran's Supreme National Security Council and Advisor to the Supreme Leader, stated in an interview that the previous phase of US-Iran negotiations had made gradual progress. He pointed out that Iran is willing to continue participating in relevant negotiations as long as they are realistically feasible. Larijani stated that Iran's position in the first round of negotiations was positive, and indicated that the next phase might bring an opportunity for strategic détente, or at least a readjustment of political stances, depending on the final outcome of the dialogue. When asked whether these negotiations signify a substantial shift in how Iran and the US handle their differences, or merely remain at the level of "crisis management," Larijani stated that the US has put forward many demands, and if the nuclear negotiations are successful, the dialogue could potentially expand to other areas, but it is currently impossible to say whether it will enter a stage of discussion on other points of contention. (CCTV News)

The United States no longer supports climate loans from the International Monetary Fund.

The United States has stopped supporting climate-related lending projects from the International Monetary Fund (IMF). Following a shift in priorities signaled by the Trump administration, the US voted against or abstained from previously supported financing projects. According to data released by the US Treasury Department covering meetings up to September of last year, in 12 votes held by the IMF Executive Board since President Donald Trump took office last year, the US has not supported any new or existing credit arrangements under the Resilience and Sustainability Loan (RST). This new stance reflects Trump's opposition to advancing global initiatives on environmental issues, as exemplified by his withdrawal from the Paris Agreement. This contrasts sharply with the policies of the Biden administration, which supported all RST-related projects. The RST, established in October 2022, aims to help poorer countries address the climate crisis. (CCTV)

Domestic News

The report shows that 76 Chinese scientific journals have entered the ranks of the world's top journals.

The "World Journal Impact Index (WJCI) Report (2025 Edition)" released by the China Association for Science and Technology on the 10th shows that 76 Chinese journals rank among the top 5% globally in their respective disciplines according to the WJCI index. The overall influence of Chinese journals continues to rise, reaching international top levels in some fields. The 2025 edition of the report includes 1,906 Chinese science and technology journals, an increase of 480 from the 2020 edition; the average WJCI index per journal is 1.490, ranking 7th globally, up 5 places from the 2020 edition; the average impact factor per journal reached 2.434, a 1.2-fold increase from 1.105 in the 2020 edition. (Xinhua News Agency)

my country achieves a breakthrough in calibrating optical clocks to international standard time.

On the 10th, the NIM-Sr1 strontium atom optical lattice clock, developed by the National Institute of Metrology (NIM), was officially approved for calibration of international standard time, achieving a breakthrough for my country in participating in the calibration of international standard time with its optical clocks. This is a milestone in my country's optical clock research process and will lead to more Chinese optical clocks participating in the calibration of international standard time, comprehensively enhancing my country's influence in the field of international time and frequency research. (CCTV News)

The People's Bank of China: Further optimize the MPA framework to facilitate the implementation and transmission of monetary policy.

The People's Bank of China (PBOC) released its Q4 2025 China Monetary Policy Implementation Report. The report states that the Macroprudential Assessment (MPA) will focus more on serving the implementation and transmission of monetary policy. Based on its role in serving monetary policy implementation, the MPA framework will be further optimized to facilitate the implementation and transmission of monetary policy, guide financial institutions to effectively implement monetary policy, maintain reasonable growth in money and credit, and strengthen support for key areas such as technological innovation and small and medium-sized enterprises (SMEs).

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.