Non-Farm Payrolls Preview: US non-farm payrolls data tonight, potentially a catalyst for a Fed policy shift.

2026-02-11 09:24:53

The timing of this jobs report release is particularly tricky for the markets. Investors are trying to determine whether the U.S. economy is slowing moderately to trend levels or whether the labor market is finally showing significant weakness, forcing the Federal Reserve to shift to an easing stance sooner than expected. With inflation data to be released later this week, the non-farm payroll data will be the first key factor to trigger significant market volatility and is likely to set the tone for interest rates, the dollar, stocks, and gold.

The core logic that the market needs to grasp is that the labor market does not need to collapse to disrupt the market .

Even if hiring activity is only slightly below expectations and the unemployment rate rises only slightly, the interest rate path could be quickly repriced—and this impact would be even more pronounced if historical data is significantly revised.

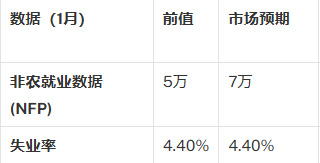

Preview of US January Non-Farm Payrolls Data

In short, the market is cautious in its predictions regarding new job creation and the unemployment rate.

Why Market Expectations Are So Cautious – Leading Indicator Analysis

(Leading indicator chart, source:)

First, let's look at the simplest signal the market is watching: the "pulse" of private sector employment. ADP's estimate for January employment was only +22,000, a very mild signal, which is usually inconsistent with the performance expected from strong non-farm payroll data.

ADP data is not a reliable point forecast of nonfarm payroll data (the two have significantly different statistical methods), but such a low reading often indicates downside risks —unless government hiring, seasonal factors, or adjustments to the baseline data can offset this weakness.

The key takeaway is not that "non-farm payrolls data equals ADP data," but that hiring momentum appears weaker than the prevailing market narrative suggests .

Secondly, observe the labor market "stress gauge" from unemployment claims. Throughout late January, initial jobless claims remained relatively stable, but in the week ending January 31, many tracking data showed the number rising to around 231,000, which reports often attributed to weather and seasonal disruptions.

In recent weeks, the number of continuing jobless claims has hovered around 1.88 million. This level does not necessarily indicate a recession, but it does suggest that the labor market is no longer tight enough to drive rapid wage growth without productivity improvements.

This context supports a narrative of " slow and steady wins the race, hiring slows down ": the economy is still running, but employers are no longer as eager to compete for labor as they were a year or two ago .

Furthermore, the number of job openings in JOLTS has also fallen to a multi-year low, which is significant because changes in job openings often lag behind trends in employment. If job openings decrease, the next step is usually a slowdown in hiring, rather than large-scale layoffs.

The ISM Manufacturing PMI rebounded strongly, but in the later stages of the economic cycle, its employment sub-index often struggles to remain above the 50-point threshold separating expansion from contraction.

Unemployment rate: Why is it expected to remain at the previous value of 4.4%?

The unemployment rate data is derived from the household survey. Given the decrease in job vacancies and the fact that unemployment benefit applications no longer show "extreme tension," the market is more inclined to believe that the unemployment rate will remain at the same level as the previous value of 4.4%.

Importantly, market reactions can be non-linear: if the unemployment rate remains at 4.4%, traders may downplay the weak overall employment data; but if the unemployment rate rises, it will reinforce the narrative that "the labor market is cooling" and tend to push yields down more quickly.

Data correction

At this point in time, a feature that has not been adequately emphasized in many employment reports is the presence (or imminent presence) of baseline and seasonal revisions.

If the revision significantly alters the level or trend of past job growth, the market may view the report as a structural revaluation event rather than simply a month's data point. This is why employment figures are ranked first among the "biggest surprise risks": the combination of the main data and the revised figure could trigger a fat-tail effect in interest rate and foreign exchange market reactions .

How might the market react?

Let's think about the market reaction after the non-farm payroll data release in a way that helps us understand it: "Interest rates lead the market." The front and middle sections of the US Treasury yield curve often react first, followed by the foreign exchange market. The general pattern is as follows:

Stronger-than-expected data (non-farm payrolls ≥ 100,000 and/or unemployment rate 4.3%): yields rise, the dollar strengthens, and risk assets fluctuate; gold typically comes under pressure.

As expected/“just right” (approximately 60,000-90,000, unemployment rate 4.4%): Risk sentiment is more stable, the dollar is mixed, and yields are stable or lower (depending on wage data and revisions).

A weak baseline scenario (45,000 jobs, 4.5% unemployment rate): yields decline, the dollar weakens, and gold is bought up; if recession fears are not triggered, the stock market may fluctuate before stabilizing.

Downside surprises (employment ≤ 0-20,000, and/or unemployment rate 4.6%+, and/or significant negative correction): risk aversion intensifies; yields plummet; the dollar's trajectory becomes more complex (potentially weakening against safe-haven currencies).

in conclusion

The baseline forecast is a weak but not catastrophic jobs report: approximately 70,000 nonfarm payroll jobs and an unemployment rate of 4.4%.

The greater risk is not a sharp collapse in the labor market, but a continuation of the cooling trend in the job market— if data revisions amplify this trend, it will force the market to reprice the Fed's policy path .

With inflation data yet to be released this week, the key to the non-farm payroll report lies not so much in the individual number itself, but rather in the economic momentum signals it reveals .

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.