One chart: The Baltic Dry Index ends a seven-day losing streak, with freight rates rising across all vessel types.

2026-02-11 23:26:48

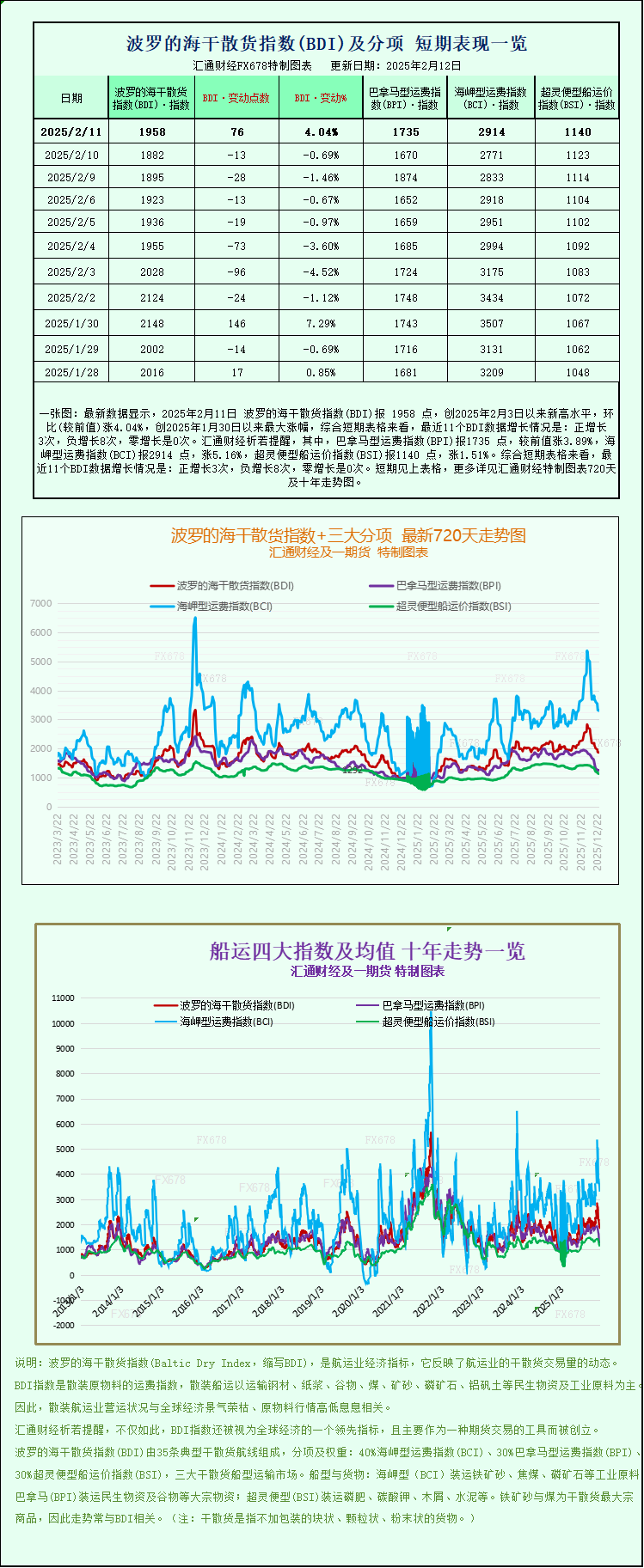

On Wednesday, the Baltic Dry Index (BDI), which measures freight rates for dry bulk vessels, rose, officially ending a seven-day losing streak. The rebound was primarily driven by a broad-based increase in freight rates across all vessel types. As a key indicator of the global dry bulk shipping market, the BDI directly reflects the demand for and market sentiment regarding the maritime transport of commodities such as iron ore, coal, and grains. Its recovery after seven consecutive days of decline has injected some vitality into the recently sluggish dry bulk market.

The Baltic Dry Index rose 76 points, or 4%, to close at 1958. This index primarily monitors freight rates for three core dry bulk carrier types: Capesize, Panamax, and Supramax. On the previous trading day (February 10), the index had fallen to its lowest level since January 26. This rise successfully reversed the short-term downward trend, indicating an initial recovery in market sentiment.

The Capesize freight index rose 143 points, or 5.2%, to close at 2914. Capesize vessels are among the largest dry bulk carriers, primarily responsible for transoceanic transport of bulk commodities such as iron ore and coal. Their freight rate fluctuations are closely related to the global steel industry's performance and export demand from major coal-producing countries. This 5.2% increase is the most significant among the three vessel types, highlighting a phased recovery in demand for large dry bulk shipping.

Capesize vessels saw their average daily earnings increase by $1,304 to $22,929. These vessels typically have a standard deadweight tonnage of 150,000 tons and primarily transport heavy commodities such as iron ore and coal. They are a core shipping force connecting major iron ore producing countries like Australia and Brazil with consuming countries like China and Europe. The rebound in average daily earnings indicates improved profitability for shipowners and also reflects the upward trend in freight rates in the large bulk shipping market.

However, despite China's pledge to provide financial support to boost domestic demand in related industries, iron ore futures prices failed to maintain their gains after an early morning surge on Wednesday, ultimately erasing all of their morning gains. This was primarily due to a series of weaker-than-expected consumption data highlighting the current weakness in iron ore demand. As the world's largest importer of iron ore, China's demand changes directly influence global iron ore price trends. This weaker-than-expected consumption data also puts some pressure on the long-term recovery of the dry bulk shipping market.

The Panamax freight index rose 65 points, or 3.9%, to close at 1735. Panamax vessels are the backbone of the dry bulk shipping market, with tonnage between Capesize and Supramax vessels, suitable for most major global routes, and play a particularly important role in the transportation of medium-volume bulk cargoes such as coal and grain. The rise in their freight rates further confirms the overall recovery of the dry bulk market.

Panamax vessels saw their average daily earnings increase by $588 to $15,615. These vessels typically have a standard deadweight tonnage between 60,000 and 70,000 tons and primarily transport bulk commodities such as coal and grain. Their routes cover short-to-medium distance transport across the Atlantic and Pacific Oceans. The steady recovery in average daily earnings indicates that demand in the medium-tonnage dry bulk shipping market is gradually improving, and the market recovery trend is quite widespread.

Among small dry bulk carriers, the Supramax freight rate index rose slightly by 17 points, or 1.5%, to close at 1140 points. Supramax vessels are smaller and more flexible, primarily handling dry bulk cargo transportation in near-sea and coastal areas, transporting small quantities of iron ore, coal, grain, and other miscellaneous bulk cargo. The moderate increase in their freight rates indicates that the small bulk shipping market is also showing signs of recovery, without exhibiting a divergent trend.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.