ACCA report interprets a false recovery, suggesting the dollar's credibility may be sacrificed.

2026-02-12 21:26:57

According to the Association of Chartered Certified Accountants (ACCA)’s “Global Economic Outlook 2026”, the global economy is expected to grow at a rate of over 3% this year, continuing its steady recovery, but it is unlikely to achieve strong explosive growth.

In 2025, the global economy encountered large-scale trade disruptions and frequent policy swings, but it showed unexpected resilience and did not experience the recession that the market had widely worried about.

The report indicates that this economic resilience will continue until 2026, with global GDP expected to grow by about 3% year-on-year, roughly the same as last year's growth rate. However, downside risks to the economy will still dominate.

Experts warn: The economy is stable but harbors long-term risks.

Former IMF chief economist Ken Rogoff described the current global economy as "robust but lacking growth highlights," while warning that financial markets have not fully priced in various uncertainties, and that there is a possibility of a significant stock market correction over the next three years, even though there may still be room for upward movement in the short term.

He also emphasized that the current US policies harbor many hidden dangers, and the negative effects may become concentrated in 2027-2028. The short-term benefits brought by populist policies will eventually face a turning point of failure.

ACCA Chief Economist Jonathan Ashworth stated that, under the baseline scenario, a loose monetary environment, the implementation of fiscal policies, and the continued growth of the artificial intelligence industry will jointly support a steady expansion of the global economy in 2026.

The United States is expected to become the fastest-growing economy among the G7 economies, and the US government is also likely to increase economic stimulus before the midterm elections.

However, the global economic fundamentals remain relatively fragile. Risks such as escalating geopolitical conflicts, intensified trade frictions, and questions about the independence of the Federal Reserve will significantly constrain economic recovery.

Political Landscape: The Key 2026 Election Will Impact Economic Trends

Ashworth further points out that in the current volatile global environment, accurately grasping the interconnected logic of economic, geopolitical, policy trends and technological changes is a core task for businesses and policymakers.

The US midterm elections in November 2026 are a key political event, as the Republican Party may lose its majority in the House of Representatives due to its narrow advantage, thus limiting the policy options available to President Trump for the remainder of his term.

In addition, local elections in France, Germany, and the United Kingdom are also attracting much market attention, with the rising support for right-wing populist parties directly impacting regional policy stability.

2025 in Review: Trade Barriers Rise but Economic Resilience Remains Strong

2025 can be considered a pivotal year for the international trade landscape.

In April of last year, the United States imposed import tariffs far exceeding market expectations, directly pushing the U.S. trade policy uncertainty index to a record high. Its average effective tariff rate rose to 17%, a new high since the 1930s, far higher than 2.4% in 2024. Countries such as Brazil and India faced high tariff barriers.

Despite the initial sharp decline in stock markets and various risk assets caused by large-scale trade disruptions, the global economy's resilience in 2025 has significantly exceeded market expectations.

Ashworth points out that the IMF’s forecast adjustments since January 2025 fully confirm this: the global growth forecast was sharply lowered in April 2025, but by October it had recovered to the initial level before Trump’s inauguration.

Institutional forecasts: Growth will be stable, but the foundation for recovery remains fragile.

Ashworth added that the global economy is likely to maintain steady expansion in 2026, but the foundation for economic recovery remains fragile amid high uncertainty and multiple risks. The World Bank projects full-year economic growth of 3.1%, a slight decrease from 2025; the IMF forecasts growth of 3.3%.

Meanwhile, the World Bank projects that growth in advanced economies and emerging market and developing economies excluding China will remain roughly the same as the previous year.

Summarize:

ACCA's report shares many similarities with the conclusions of the World Economic Forum previously held in Davos, namely that the global economic outlook for 2026 remains pessimistic.

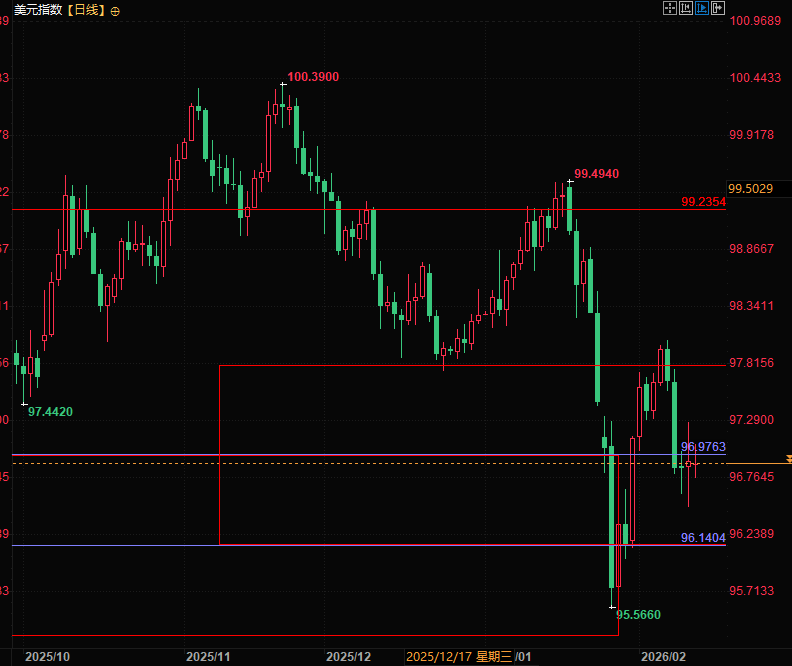

The US economy may stand out due to capital expenditure, but the article points out that behind the high US economic growth lies government-led economic stimulus for the central district elections. This, coupled with government intervention in the Federal Reserve, could lead to the spread of the US debt crisis, with the dollar exchange rate as a consequence, and potentially significant risks to the equity market after the stimulus ends.

In a weak dollar environment, selling the US narrative and looking for opportunities to buy precious metals on dips remains the core of market trading.

(US Dollar Index Daily Chart, Source: FX678)

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.