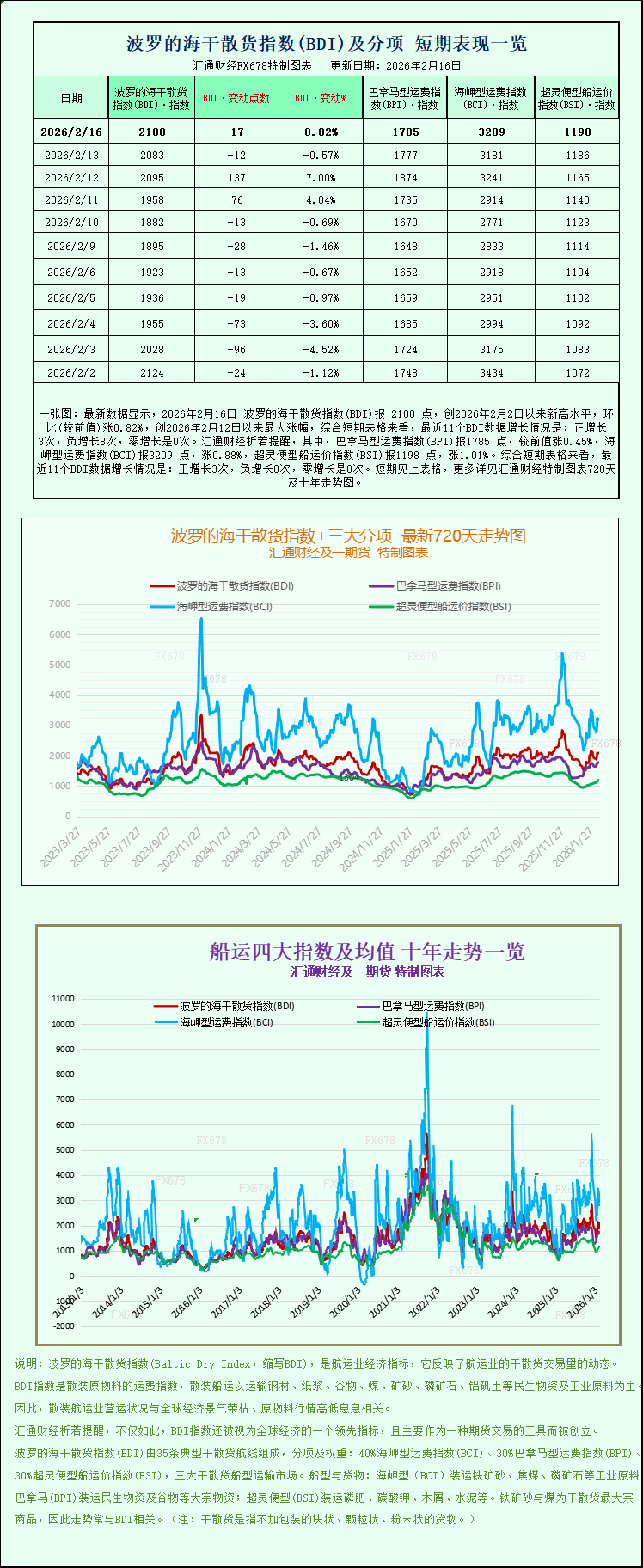

One chart: Baltic Dry Index rises across the board, shipping freight rates collectively increase.

2026-02-16 22:43:22

On Monday, the Baltic Dry Index, released by the Baltic Exchange, rose slightly, achieving a significant upward trend. As a core indicator of the global dry bulk shipping market, this index primarily measures the freight rates for various vessels carrying dry bulk commodities. The increase was mainly due to simultaneous gains in freight rates across all vessel segments on that day, indicating a significant rebound in market activity and a generally positive recovery. This provides a much-needed boost to the recently somewhat sluggish dry bulk shipping market.

Specifically, the performance of each sub-sector and core index is as follows, with a detailed breakdown of the market trend for the day:

The Baltic Dry Index (BDI) is a core indicator reflecting the overall health of the global dry bulk shipping market. It primarily tracks freight rates for the three main vessel types: Capesize, Panamax, and Supramax, covering the major segments of the dry bulk shipping market. On the day of the index's close, it rose 17 points, or 0.8%, to 2100 points. While this increase is small, considering recent market volatility, it reflects a marginal improvement in market demand and the effectiveness of optimized capacity scheduling by shipping companies, indicating that the dry bulk shipping market is gradually breaking free from its previous weak and volatile pattern.

Capesize Freight Index: As a core segment of the dry bulk shipping market carrying large commodities, Capesize vessels are mainly used to transport heavy dry bulk cargoes such as iron ore and coal. Their freight rate fluctuations are directly related to global heavy industrial production demand. On the day of the index's release, it performed strongly, rising 28 points, or 0.9%, to close at 3209 points. This upward trend is closely related to improved demand expectations in major iron ore importing countries worldwide. Although short-term factors such as holidays may cause disturbances, in the long term, the transportation demand brought about by the recovery of heavy industry supports the upward trend in Capesize freight rates.

Iron ore futures market performance: Notably, iron ore futures prices declined last Friday, primarily due to the pre-holiday effect of the Chinese Lunar New Year holiday. As the world's largest importer and consumer of iron ore, China is about to enter a week-long Lunar New Year holiday. During this period, related manufacturing and steel industries in China will undergo temporary shutdowns, leading to a significant drop in iron ore demand. Based on this expectation, market traders closed out their positions early to avoid market volatility during the holiday, thus putting downward pressure on iron ore futures prices last Friday. This change also had some indirect impact on the short-term dry bulk shipping market, but it did not alter the overall upward trend in freight rates on Monday.

Panamax Freight Index: Panamax vessels, a mainstay of the dry bulk shipping market, have a capacity between Capesize and Supramax, primarily carrying medium-volume dry bulk commodities such as coal and grain. Their freight rates are closely linked to the global trade activity in agricultural and energy products. On the day of the index, it steadily rose 8 points, or 0.5%, closing at 1785 points. This slight upward trend reflects the stable operation of global agricultural and energy product trade, providing stable support for Panamax freight rates.

Panamax Vessel Daily Profitability: In line with the freight rate index, the average daily profitability of Panamax vessels also increased. Statistics show that the average daily profit for Panamax vessels rose by $79, eventually reaching $16,068. These vessels typically have a standard capacity of 60,000 to 70,000 tons and mainly transport bulk commodities such as coal and grain. The improvement in their profitability directly reflects the improved operational efficiency of shipping companies and further confirms the recovery trend in the dry bulk shipping market, providing strong support for the continued operation of shipping companies.

Performance of Small and Medium-Sized Vessels: In the small and medium-sized vessel sector, the Supramax freight rate index stood out, becoming the sub-sector with the most significant gains on the day. The index rose 12 points, or 1%, to close at 1198 points. Supramax vessels, as the core force in small and medium-sized dry bulk shipping, are mainly used to carry small batches of dry bulk cargo and cover a wider area. The increase in their freight rates reflects the increased activity in global small and medium-sized dry bulk trade, further solidifying the foundation for a comprehensive recovery in the entire dry bulk shipping market. It also reflects a comprehensive recovery in market demand, rather than an isolated rise in a single sector.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.