From the US debt crisis to ETF inflows, three pillars are supporting gold prices, potentially pushing them towards $5,800.

2026-02-17 10:40:51

ANZ's commodity analysts said in their latest gold analysis report that they expect gold prices to reach $5,800 per ounce in the second quarter, a significant increase from their previous forecast of $5,400 per ounce.

Analysts said, "While recent market volatility has raised questions about whether gold prices have peaked, we believe the current rally is not enough to reverse anytime soon."

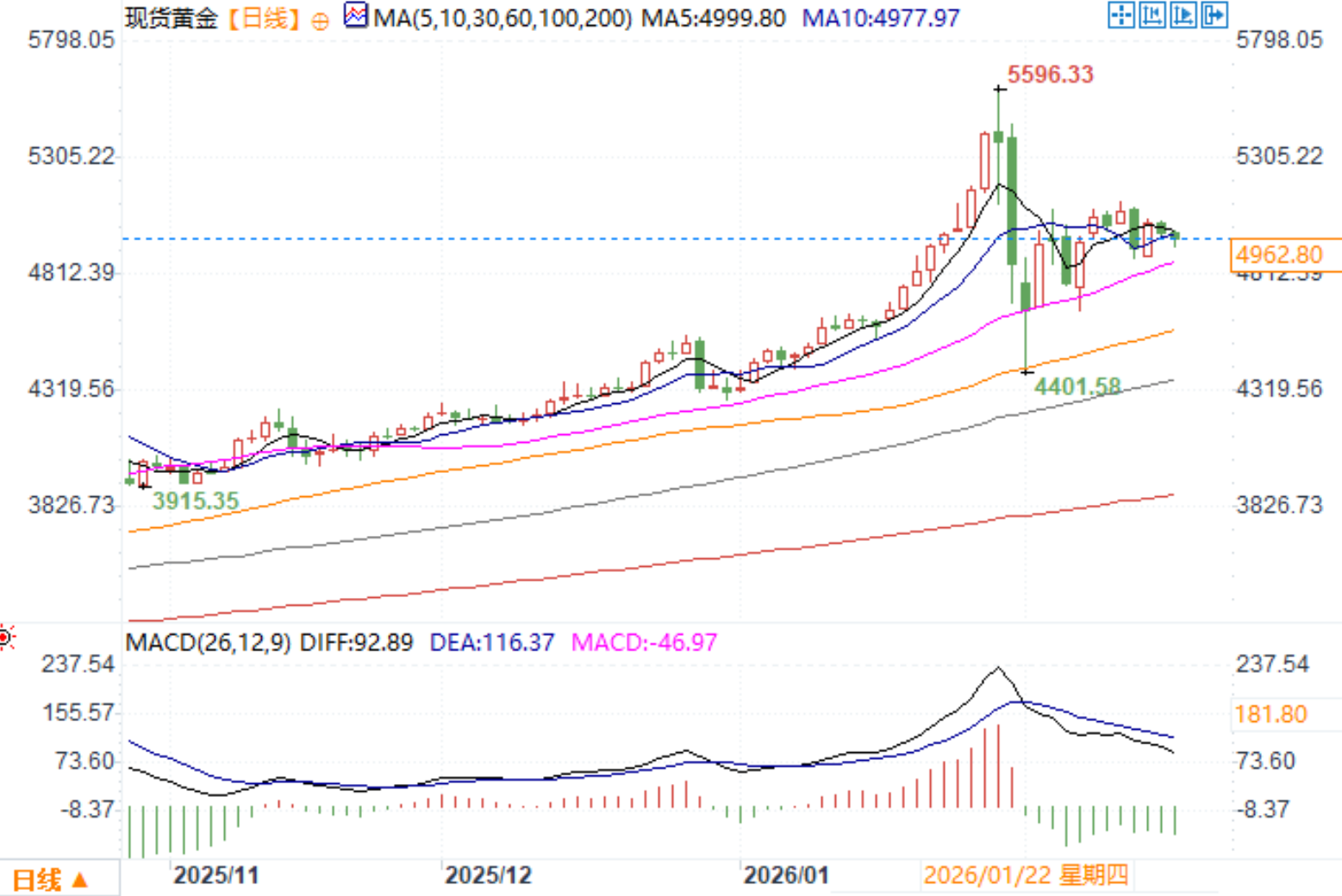

Gold prices have fallen sharply from their record high of nearly $5,600 last month, raising concerns among some investors that prices could plummet, similar to previous cycles such as the 1980 peak or the 2011 high.

However, ANZ Bank points out that current market conditions are significantly different. Gold prices have been strongly supported by the Federal Reserve's expectation of at least two rate cuts this year, and declining inflationary pressures have also prompted the market to anticipate a third rate cut by December.

Analysts stated, " We anticipate two 25-basis-point rate cuts, one in March and the other in June. This will lead to a sustained decline in real interest rates, thereby promoting capital inflows into gold. Geopolitical and economic uncertainties are likely to persist, with Trump continuing to threaten tariffs. Market attention is gradually shifting towards the potential impact of tariffs, an impact not yet fully reflected in economic and inflation data, and lingering doubts about the Fed's future credibility. This backdrop will enhance investor interest in physical assets such as gold. "

The bank stated that, looking beyond US monetary policy, gold remains the most reliable safeguard against increasing uncertainty in global financial markets.

Analysts added that gold remains an attractive safe-haven asset due to the declining appeal of US Treasuries. However, this is not a problem unique to the US, as rising global debt levels have reduced the attractiveness of global bonds, including Japanese bonds.

They stated, "The global financial system is undergoing a structural transformation. The U.S. Treasury, once considered the foundation of the world's largest risk-free asset and interest-bearing, tradable financial instruments, now faces a crisis of confidence. Soaring debt levels, concerns about the Federal Reserve's independence, and increasing risks of sanctions have fundamentally altered its position. Consequently, investors are demanding higher premiums for long-term U.S. Treasuries, as evidenced by the widening gap between long-term and short-term yields."

"Gold is a transitional asset that provides stability and diversification when conventional assets face stress. This is why a strategic allocation to gold remains important, at least until geopolitical tensions stabilize, the structural fiscal problems in the United States are resolved, and the credibility of the Federal Reserve is restored—a scenario unlikely in the short term. In this context, gold's role as a store of value and a risk hedge becomes particularly crucial."

Looking at the different segments of the gold market, ANZ Bank said that while central bank demand is expected to remain strong through 2026, they believe that broader investor demand will play a major role this year.

Analysts point out that even if prices rise, investors still have plenty of opportunities to switch to investing in gold ETFs.

Analysts stated, " We expect inflows into gold ETFs to continue, with total holdings potentially exceeding 4,800 tons this year. While Western markets continue to support ETF demand, significant growth from major Asian countries and emerging markets such as India is also anticipated, with these regions expected to account for more than 10% of global ETF holdings currently. "

They added, "The potential risk is that if geopolitical or political risks escalate, funds could shift from stocks and bonds to gold. Gold ETFs account for less than 3% of total stock and bond holdings. This means that even the smallest asset allocation adjustment could have a significant positive impact on gold prices. "

Spot gold daily chart source: EasyForex

At 10:35 AM Beijing time on February 17, spot gold was trading at $4962.80 per ounce.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.