A chart shows that the Baltic Dry Index fell slightly, with the Capesize and Supramax vessel sectors dragging down the market.

2026-02-17 22:41:03

The Baltic Dry Bulk Freight Index, published by the London Baltic Exchange, edged lower on Tuesday. As a key indicator of the global dry bulk shipping market, the index primarily measures freight rates for vessels carrying various dry bulk commodities. Its decline was mainly driven by weak freight rates in the two core vessel segments, Capesize and Supramax, offsetting slight gains in other sub-segments and ultimately leading to an overall decrease in freight rates. Dry bulk shipping, an indispensable part of international trade and global logistics, primarily carries unpackaged bulk cargoes such as iron ore, coal, and grain. Fluctuations in the dry bulk freight index directly reflect changes in global commodity trade activity and the supply and demand relationship in the shipping market.

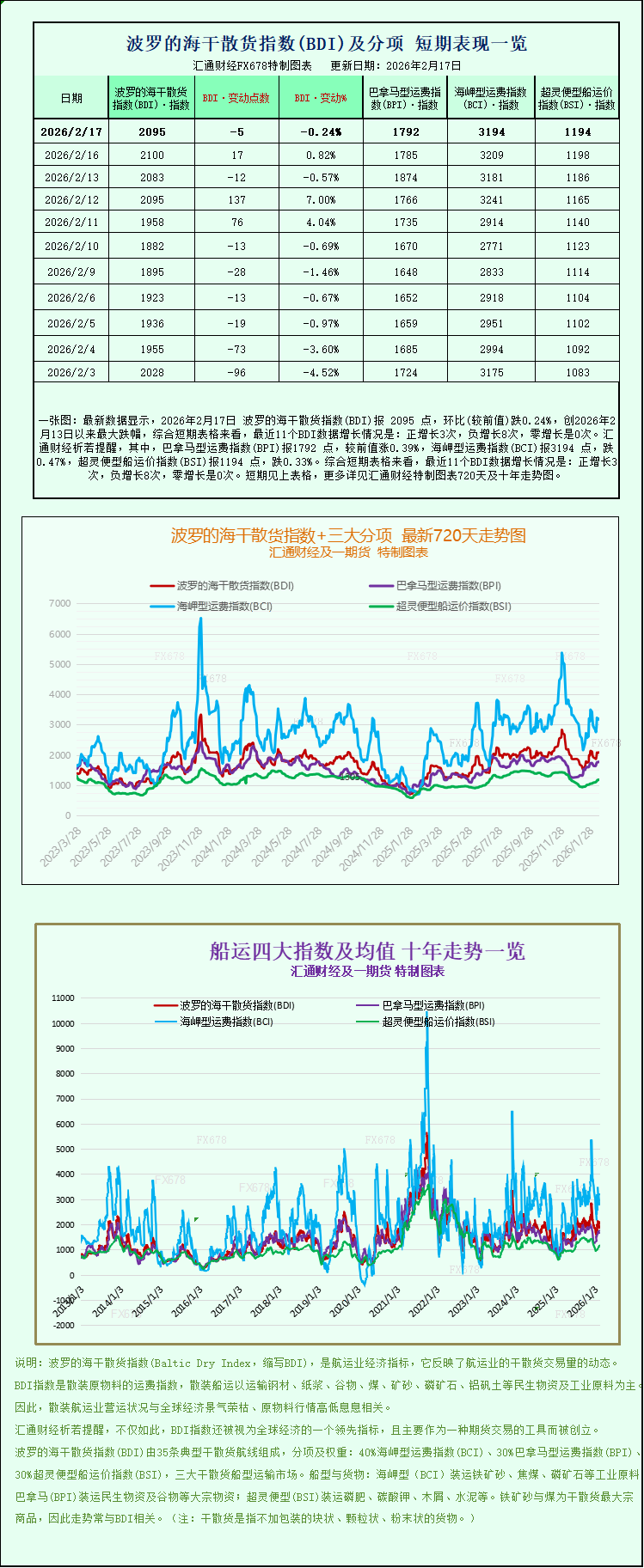

The Baltic Dry Index (BDI) fell 5 points, or 0.2%, to close at 2095. This index comprehensively tracks freight rates for the three major vessel types: Capesize, Panamax, and Supramax, covering the main segments of the global dry bulk shipping market. Even minor fluctuations in the index reflect changes in the overall health of the dry bulk shipping market. Notably, the index had climbed slightly to 2100 points on the previous trading day (February 16th), reaching a new high since February 2nd. Today's slight pullback breaks the short-term upward trend, indicating that the market is still in a period of consolidation.

The Capesize freight index was weak, falling 15 points, or 0.5%, to close at 3194. Capesize bulk carriers, the "juggernauts" of the dry bulk shipping market, typically have a deadweight tonnage of around 150,000 tons. Due to their massive size, they cannot pass through the Panama Canal or the Suez Canal (although some qualified vessels can pass through the Suez Canal fully loaded), and must detour around the Cape of Good Hope or Cape Horn. They primarily handle long-distance, large-volume transport of heavy dry bulk cargo such as iron ore and coal, and their freight rate fluctuations are directly related to global heavy industrial production demand and the purchasing pace of commodity-importing countries.

Correspondingly, the average daily earnings of Capesize vessels also declined, decreasing by $141 to $25,464 on that day. These vessels have a standard carrying capacity of 150,000 tons and primarily transport iron ore exported from countries such as Australia and Brazil to major steel-producing countries like China and Japan, as well as energy shipments to major global coal-exporting countries. Their earnings are highly correlated with freight rate indices, directly impacting the operational efficiency of shipping companies. This decline in earnings was mainly due to weakened market expectations for short-term demand for commodities such as iron ore, coupled with relatively ample vessel capacity supply, leading to downward pressure on freight rates and consequently dragging down earnings.

The Panamax freight index was the only sub-sector to rise on the day, gaining 7 points, or 0.4%, to close at 1792. Panamax bulk carriers, a mainstay of the dry bulk shipping market, have a capacity between Capesize and Supramax. Their design conforms to the Panama Canal's navigation standards, primarily carrying medium-volume dry bulk commodities such as coal and grain, ranging from 60,000 to 70,000 tons. Their freight rates are closely linked to the global trade activity in agricultural and energy products. This increase reflects the stable operation of global agricultural and energy product trade, providing stable support for freight rates in this sector.

Panamax vessels also saw their average daily earnings rise in tandem with the freight rate index, increasing by $64 to $16,132 on the day. These vessels, with their moderate capacity and flexible navigation capabilities, operate extensively on major global routes, handling both near-sea cargo transport and transshipment on some long-haul routes. They primarily transport grains such as wheat and corn, as well as energy products like coal. The increase in their earnings directly reflects the improved operational efficiency of this sector and, to some extent, alleviates the downward pressure on the overall market.

In the small and medium-sized vessel sector, the Supramax freight rate index declined slightly, falling 4 points, or 0.3%, to close at 1194 points. Supramax bulk carriers, a core force in small and medium-sized dry bulk shipping, typically have a deadweight tonnage between 40,000 and 60,000 tons and a length of approximately 180 to 200 meters. Some vessels are equipped with their own loading and unloading equipment, making them highly adaptable to waterways, canals, and ports. They can berth at some smaller ports with less favorable conditions and mainly carry small batches of dry bulk cargo such as iron ore, grain, fertilizer, and cement, covering a wider area. The slight decline in freight rates was mainly due to a slight decrease in short-term trading activity in small and medium-sized dry bulk cargo, indicating slightly weaker market demand.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.