The European and American central banks are "going against each other", the euro is rising every day, can we still catch up

2025-08-11 14:07:21

What is happening with central banks?

The divergence between the Federal Reserve and the European Central Bank remains significant: the US maintains its interest rate at 4.5%, while Europe's deposit rate remains at 2.00%. However, what is beginning to shift is the outlook for future policy. The Fed has begun to signal that it may enter a rate-cutting cycle in the near term, which could significantly reduce the dollar's relative appeal.

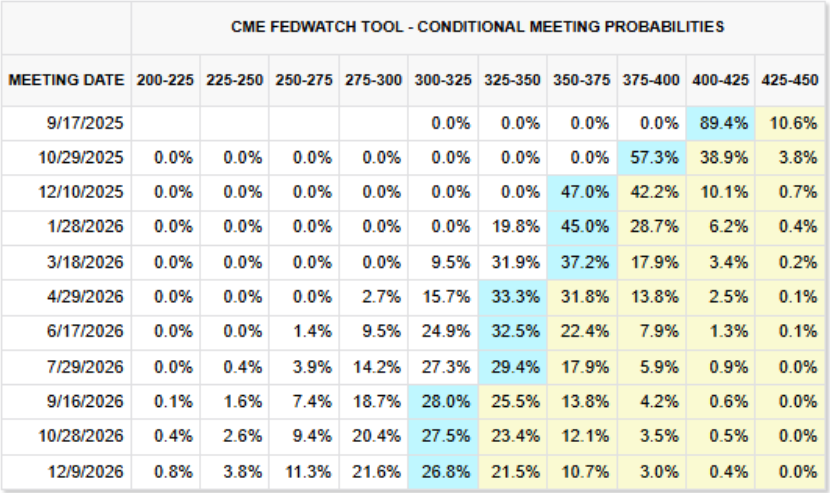

This expectation is already priced into the market. According to CME Group data, the probability of a rate cut to 4.25% on September 17 has risen to 89.4%. Furthermore, the probability of a further rate cut to 4.00% at the October 29 meeting is 57.3%.

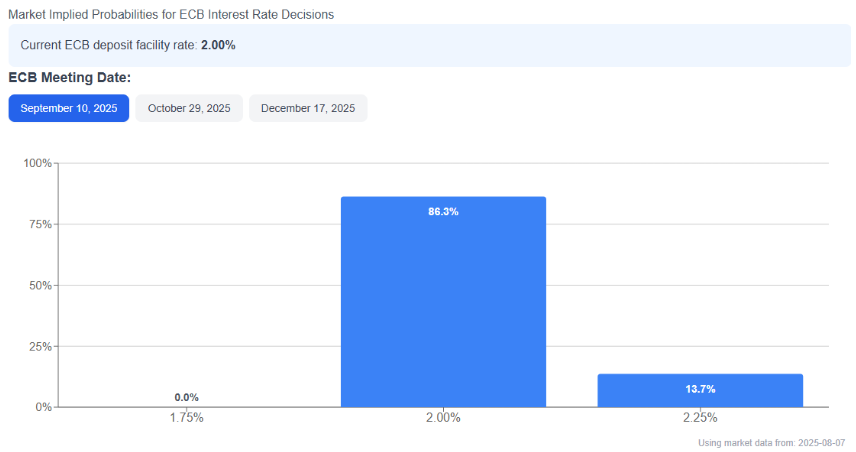

By contrast, the European Central Bank appears to have ended its long cycle of rate cuts. At its next meeting on September 10, there is an 86.3% probability that the deposit rate will remain at 2.00%, suggesting that after several rate cuts earlier this year, the ECB now believes a neutral monetary policy stance is appropriate.

(Overview of interest rate probabilities as displayed by the Federal Reserve's interest rate tool)

This shift in outlook is beginning to impact the dollar's strength. While U.S. interest rates remain higher than in Europe, markets are pricing in a lower expected yield environment in the U.S., which could reduce demand for dollar-denominated assets. If expectations of a Fed rate cut solidify, the euro could continue to make gains, especially if the European Central Bank maintains its more stable policy path.

Is the weakness of the US dollar becoming a structural problem?

The dollar's weakness is more evident by tracking the performance of the dollar index against a basket of currencies. The index has recently fallen below the 100 mark and is currently hovering around 98, suggesting that the dollar may be entering a new bearish trend.

This decline appears to be directly related to market expectations of a more accommodative Federal Reserve policy, and selling pressure could intensify if the US dollar index continues to fall. In this scenario, EUR/USD is likely to maintain its upward momentum, benefiting from a rotation of capital out of the US dollar and into currencies with more stable outlooks.

(Overview of the ECB's September interest rate outlook)

Euro trend analysis

Euro prices are attempting to consolidate their bullish trend: Despite a notable pullback in recent weeks, new bullish momentum has begun to build, aiming to reclaim the highs of recent months. If buying pressure persists, the pair could successfully develop a larger upward trend.

Relative Strength Index: The RSI has risen back above the 50 level, suggesting that bullish momentum is resuming. If this trend continues, it could strengthen the short-term upside bias.

Average Directional Index: The Average Directional Index line remains below 20, indicating low market volatility. Unless this technical picture changes, the market is likely to continue alternating between short-lived rallies and sideways trading until a stronger catalyst emerges.

Support and Resistance

The main resistance level is 1.1806, which marks the yearly high and is the most important hurdle for buyers. A sustained break above this level could open the door to new highs and confirm a stronger bullish phase.

Initial support: 1.1609, which coincides with the 50-day moving average. This area may act as a temporary technical barrier in the event of a short-term pullback. Holding above this level is crucial to maintaining the bullish bias.

Key support level: 1.1452, which corresponds to the 23.6% Fibonacci retracement level and needs to be watched in case of a downward trend. A return to this area could signal a structural shift and pave the way for a short-term bearish trend if buying momentum fails to recover.

(Euro/USD daily chart, source: Yihuitong)

At 13:43 Beijing time, the euro was trading at 1.1672/73 against the US dollar.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.