A sharp downward revision in employment data triggered expectations of a September rate cut, with the market focusing on US CPI data.

2025-08-11 15:15:25

Employment data was significantly weak

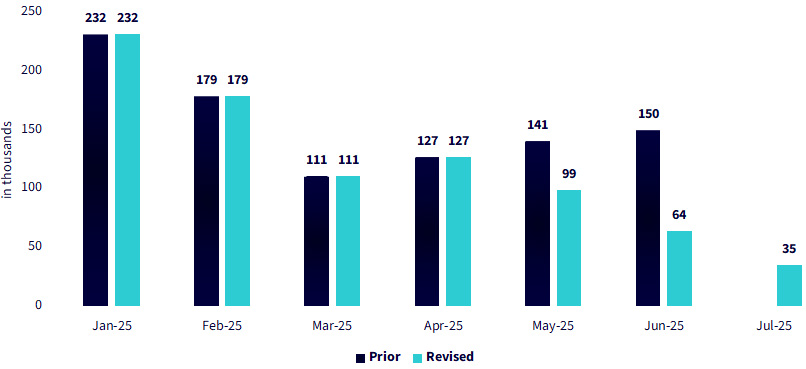

In July, non-farm payrolls increased by 73,000, significantly lower than the market expectation of 104,000; the data for the first two months were revised downward by a total of 258,000, the largest downward revision since 1979 (not related to the epidemic); affected by this, the three-month moving average employment growth rate dropped sharply to only +35,000.

(Three-month moving average of U.S. non-farm payrolls, data source: Bureau of Labor Statistics)

The unemployment rate, a key focus for Powell, edged up 0.1 percentage point to a still-low 4.2%, in line with expectations.

Although there will be a jobs report and two rounds of inflation data released before the September FOMC meeting, this report has changed the labor market basis for Powell to formulate policy.

The Jackson Hole annual symposium later this month (held from August 21 to 23) will be a key window for Powell to adjust his forward guidance.

Based solely on the non-farm payroll data, a September rate cut is already a policy option. If subsequent inflation reports show a deepening pass-through from tariffs, this will create a policy dilemma of "weak employment and high inflation."

Following the release of the non-farm payroll data, 2-year and 10-year yields fell by over 20 basis points and 10 basis points, respectively, reflecting a market repricing of policy expectations following last week's hawkish FOMC meeting. U.S. Treasury yields rebounded last week, but are still far from recovering the losses of August 1st.

Whether U.S. Treasury yields can continue to rise (especially the 10-year bond) will depend on key inflation data such as the CPI on August 12.

CPI Outlook

The market generally expects the overall CPI in the United States to increase by 0.2% month-on-month and 2.8% year-on-year, and the core CPI to increase by 0.3% month-on-month and 3.0% year-on-year.

Goldman Sachs economists predict:

The core CPI is projected to rise 0.33% month-over-month in July (consensus forecast: +0.3%), corresponding to a year-over-year increase of 3.08% (consensus forecast: +3.0%). The overall CPI is projected to rise 0.27% month-over-month (consensus forecast: +0.2%), driven by rising food prices (+0.3%) and restrained by falling energy prices (-0.6%). Our forecast is consistent with the expectation of a 0.31% increase in the core PCE in July.

In the coming months, we expect tariffs to continue to push up monthly inflation, with core CPI projected to rise between 0.3% and 0.4% on a monthly basis. Beyond the impact of tariffs, we expect underlying inflation to decline further this year, reflecting weakening contributions from housing rents and the labor market.

Bank of America predicts:

We forecast a 0.24% month-over-month increase in the headline CPI and a 0.31% month-over-month increase in the core CPI in July. If our forecasts hold true, the year-over-year increase in the core CPI will rise from 2.9% to 3.1%. Key drivers include higher commodity prices due to tariffs and core service inflation driven by airfares.

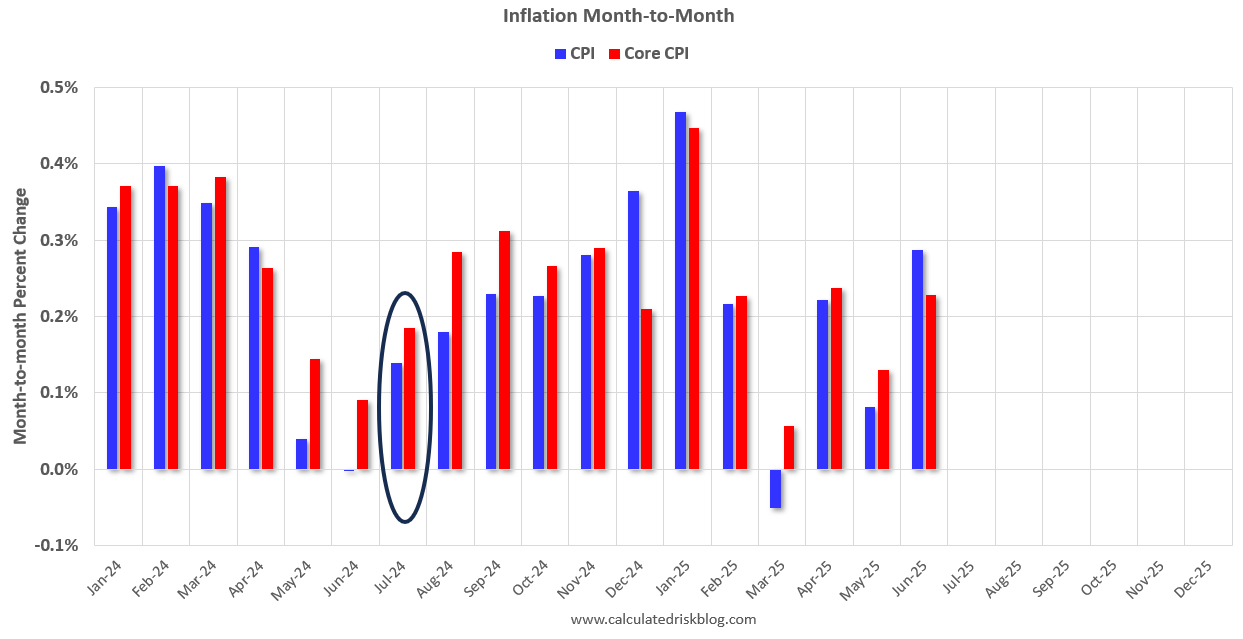

(Figure: Month-on-month changes in headline and core inflation)

The circled area shows the change from July of last year. In July 2024, the CPI rose by 0.14% and the core CPI rose by 0.19%. Therefore, any figure higher than the July figure will push up year-on-year inflation.

Faced with structural shifts in the labor market and a potential shift in the Federal Reserve's monetary policy, how should fixed-income investors position their bond portfolios? If the Fed indeed enters "rate-cutting mode," the front end of the yield curve is expected to exhibit relative strength. Investors may consider investing in short-duration strategies such as SHAG and USSH. These assets are expected to generate excess returns if the Fed shifts to a rate-cutting cycle this year, while also retaining some cash for tactical opportunities following the release of August data.

In the short term, weak employment is driving the market, fueling expectations of rate cuts and exerting downward pressure on the US dollar (the strength of the front end of the yield curve also suggests a downward trend in short-term interest rates). The medium-term outlook hinges on data such as the CPI on August 12th. If inflation remains elevated, the US dollar could rebound; if a rate cut cycle is confirmed, the US dollar may remain under pressure.

At 15:13 Beijing time, the US dollar index is currently at 98.14.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.