The government faces challenges in resolving the bond crisis, policy limitations are evident, and core risks remain.

2025-09-04 17:04:38

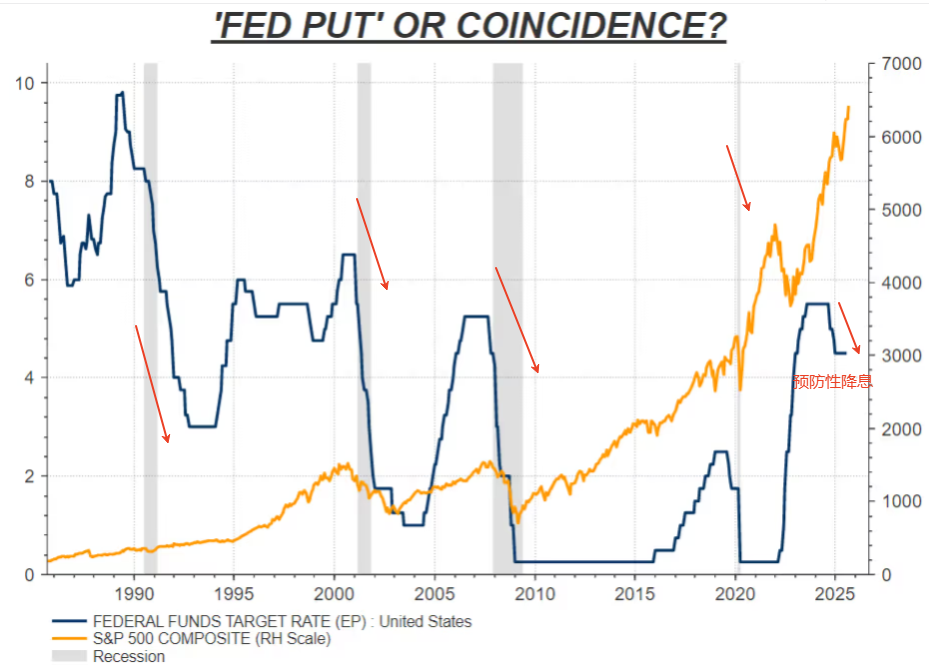

For decades, stock investors have often mentioned the so-called central bank "put options" (that is, hedging the risk of stock declines by purchasing put options with a value far lower than the stock's market value. The convenient supply of put options makes it possible to avoid losses when the stock price falls without rushing to sell the stock).

This options market term is actually a metaphor for the central bank's policy safety net: when the stock market falls sharply, the central bank will curb the decline through restorative interest rate cuts, liquidity injections, and other means.

Over the past decade, such operations have not only gradually made Wall Street stocks appear "risk-free" and distorted market pricing logic, but also helped the United States and many governments accumulate more debt (especially in the context of the Federal Reserve's continued large-scale absorption of bonds).

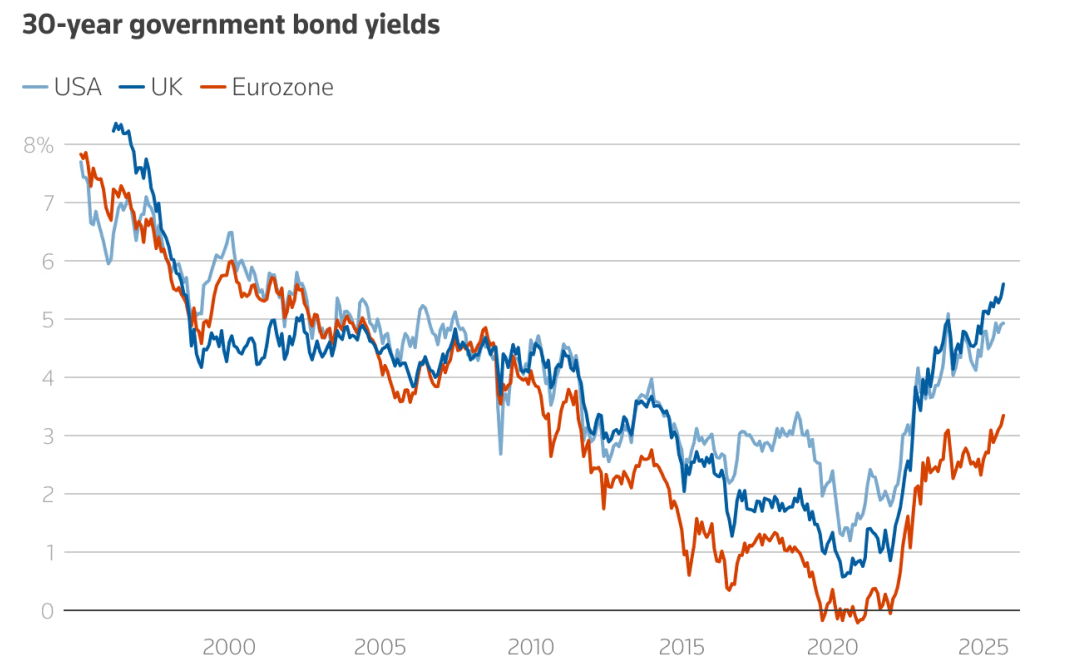

However, judging from the performance of long-term government bonds this year (especially this week), the market has been sending signals of "stopping debt accumulation" (the trends in 30-year government bond yields in the United States, Britain, and the eurozone all confirm this).

(Long-term government bonds in Europe and the United States suffered a collective sell-off)

In short, the Fed's "put option" is to ensure that investment products develop in the way expected by the central bank through monetary and fiscal policies, and to provide a guarantee for investment products. In the bond market, the government hopes to control the trend of treasury bond yields so that they do not develop too steeply . Because long-term treasury bonds will increase their yields due to selling, the issuance costs of long-term treasury bonds and corporate bonds will be too high. At the same time, the selling of long-term treasury bonds will cause the capital market to worry about the country's economy.

With the US government already running a deficit of approximately $1.9 trillion, fiscal intervention is not easy. Furthermore, there are "bond vigilantes" in the market. These individuals profit from buying short-term bonds (due to lower interest rates, which drives up their prices) and shorting long-term bonds (because government debt repayments are often accompanied by money printing, which triggers inflationary concerns and drives down long-term bonds) when a country faces a significant debt burden and is about to initiate interest rate cuts. These individuals act as counterparties to US fiscal intervention, thus impacting its effectiveness .

(The Fed’s “put option” chart, meaning it will cut interest rates if a recession occurs, or is it a coincidence?)

At this point, some may wonder: Should the central bank initiate "put options," or fiscal intervention in the bond market, to achieve debt sustainability and safeguard government solvency? After all, rising long-term bond yields are putting greater pressure on governments and businesses to maintain long-term debt. The answer is "not so fast, not so easy"—and traditional "put options" are inherently inappropriate for long-term bonds. Even if the Federal Reserve increases its short-term bond reserves and hedges against the risk of a steepening interest rate curve by selling short bonds and buying long bonds, it will be difficult to change this situation. The root cause of the problem isn't just debt.

Debt isn't the only problem

Rising debt is only part of the current market predicament. If debt were the sole issue, lowering policy interest rates might alleviate some of the pressure on debt sustainability. However, the real concern lies in the fact that the "crisis" facing the Federal Reserve today is unlike most periods over the past 20 years—one that cannot be easily resolved through conventional means.

On the one hand, US inflation remains well above target ; on the other, President Trump's administration's political attempts to control the Federal Reserve are increasingly undermining the Fed's ability to address inflation . If the Fed were to implement substantial easing policy as Trump demands (even with current US economic growth exceeding 3%, ample credit, and the loosest financial conditions in years), the bond market would inevitably price in the possibility of future inflation well above 2% (the current market baseline is an average inflation rate of 2.5% over the next 10 years).

This uncertainty will push up the risk premium in the U.S. Treasury market, and given the extremely low probability of fiscal tightening in the foreseeable future, even if interest rates are cut, long-term bond yields may rise.

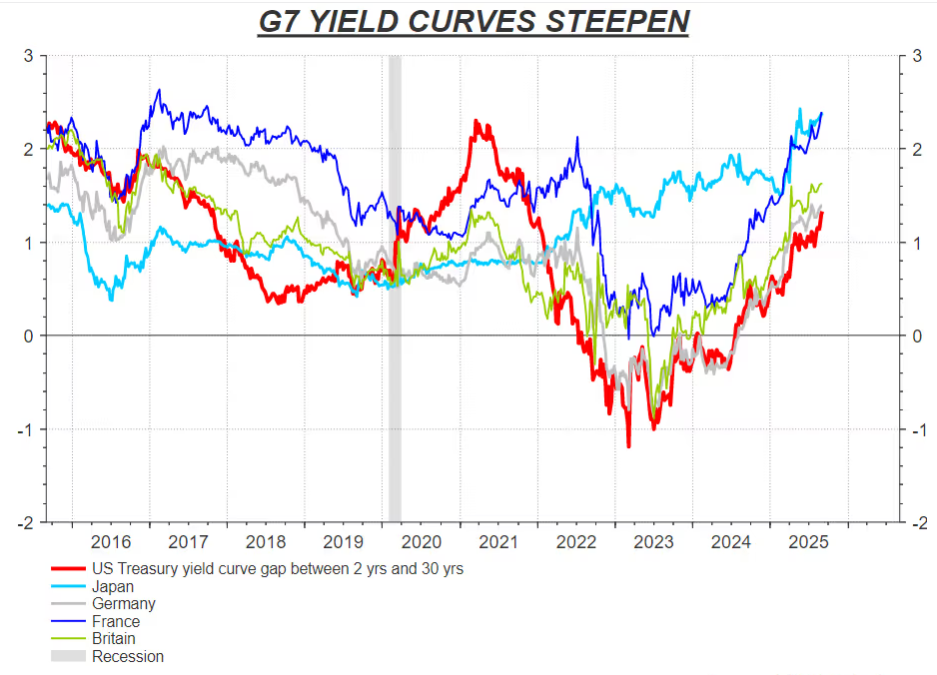

(The difference between long-term and short-term yields widens)

“Selling short and buying long” can only superficially alleviate the steepening of the interest rate curve

It's worth noting that the current steepness of the US yield curve has reached its highest level in nearly a decade, and the negative impact of interest rate cuts on long-term bonds is already evident. The Federal Reserve's previous increase in short-term bond reserves has paved the way for a "sell short-term bonds, buy long-term" strategy—a move that directly regulates supply and demand in the long-term market by selling short-term bonds and buying long-term bonds, thus mitigating the risk of an overly steep interest rate curve and, to some extent, alleviating the pressure of soaring long-term interest rates.

There have been rumors in the market before: The Ministry of Finance is adjusting the maturity structure of its huge debt, relying more on "short-term bonds that can benefit from benchmark interest rate cuts" and reducing "holdings of long-term bonds that are vulnerable to inflation concerns."

This coordinated operation of "debt maturity adjustment" and the Federal Reserve's "short selling and long buying" may constitute a new and more complex policy tool, but its essence is "risk hedging" rather than "put options" in the traditional sense - it requires extremely cautious arrangements and execution, and the slightest carelessness may lead to cyclical failures.

Even if the coordinated "short selling, long buying" strategy and the Treasury's debt restructuring are successful, it won't resolve the core contradiction: it won't alleviate market concerns that inflation may not return to target in a sustainable manner over the investment cycle. As long as these concerns persist, risk premiums will continue to rise, and long-term bond yields will continue to face upward pressure.

Summarize

The Fed's "put options" have proven their stabilizing effect on the stock market. However, for long-term bonds, even with the "short selling, long buying" strategy to hedge against the risk of a steepening interest rate curve, it's difficult to create a similar "policy safety net"—this operation is more of a short-term risk buffer than a long-term "safeguard." For the long-term bond market, so-called "put options" remain riddled with loopholes, and market concerns about long-term inflation and debt still require more fundamental policy solutions .

Traders need to closely monitor the steepness of various countries' government bond yield curves, the practical problems faced by each country, and the subsequent employment data released by the United States.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.