Countdown to the Fed's Rate Cut! 25bp or 50bp? Where are the hidden opportunities in the US Treasury and foreign exchange markets?

2025-09-12 15:23:49

At the same time, inflation remains high, and tariff-driven price increases are expected to keep inflation above the 2% target in 2026.

Based on this, the Federal Reserve determined that monetary policy should be maintained in a "mildly restrictive" range. This stance began to change at the July Federal Open Market Committee (FOMC) meeting: Fed Governors Chris Waller and Michelle Bowman agreed with President Trump that the weak job market warranted a resumption of easing policy.

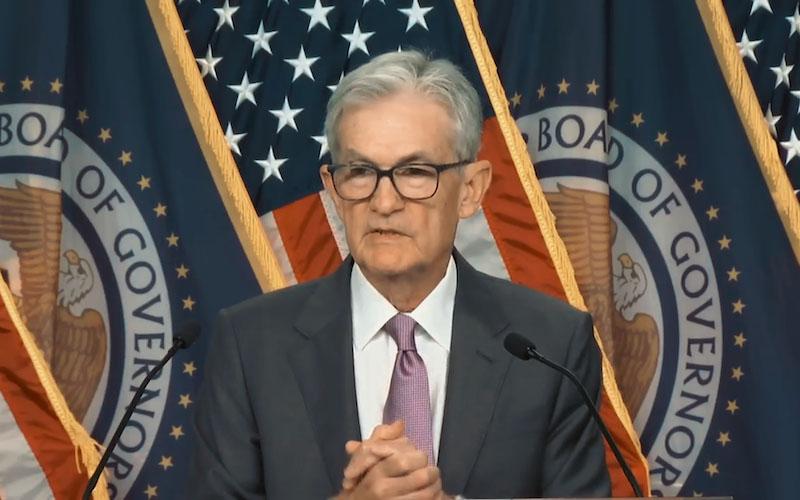

While most officials opposed the idea at the time, it's now widely accepted within the Fed. Fed Chairman Jerome Powell explicitly stated at last month's Jackson Hole symposium that changing economic conditions may soon require a rate cut. ING has provided the following analysis.

The weak job market has become a core concern, and multiple data confirm that fundamentals are under pressure

U.S. gross domestic product (GDP) grew by 3.3% year-on-year in the second quarter, but this growth was primarily driven by a significant improvement in net trade conditions, which masked weak underlying consumer demand. Real consumer spending essentially stagnated in the first half of the year, with households adopting a cautious approach to consumption. Factors contributing to this include concerns about reduced purchasing power due to tariffs, a cooling job market, and fluctuating wealth.

The Federal Reserve's latest Beige Book confirms this trend, noting that "economic activity in most of the 12 Federal Reserve Districts remained little changed or declined," and that "respondents in all districts reported that consumer spending remained flat or declined." Furthermore, the Beige Book noted that 11 of the 12 Federal Reserve Districts had no new hiring over the past seven weeks, while hiring declined in another district.

This is highly consistent with the August jobs report released last Friday: the US added only 22,000 jobs that month, and the unemployment rate climbed to 4.3%. Meanwhile, the revised preliminary non-farm payroll data for the first 12 months of March 2025 released on Tuesday showed that the US economy added less than half the number of jobs previously reported by the US Bureau of Labor Statistics!

Inflation concerns are gradually easing, and a cumulative interest rate cut of 75BP is expected this year.

While inflation remains above target, the Fed is likely to continue to signal that inflation will remain elevated in the short term due to tariffs. However, the downside risks to the current employment target now outweigh the upside risks to price stability. The Fed has long viewed the impact of tariffs on prices as a one-time spike, but previously hoped that this assessment would be confirmed in inflation data. Now, it appears the Fed believes there is no time to wait and needs to act immediately to move monetary policy closer to neutral.

Institutions agree with this view. After all, the three core factors that pushed inflation to 9% in 2022—doubling oil prices, soaring housing rents, and sharp wage increases—have clearly subsided, and these factors may even become a force restraining inflation in the coming quarters. A cooling economy coupled with rising unemployment will further push inflation back to around 2% by the end of 2026.

The agency predicts that the Federal Reserve will adopt a similar stance, and therefore will likely lower its economic growth and inflation forecasts while raising its unemployment rate forecasts. Specifically, the agency predicts that the Federal Reserve will cut interest rates by 25 basis points on September 17, and will cut them by another 25 basis points at the FOMC meetings in October, December, January, and March 2026.

There's also the possibility that the Fed will follow its September approach and cut interest rates by 50 basis points for the first time. Chris Waller and Michelle Bowman are likely to vote for a larger rate cut, arguing that the Fed should have started easing in July, but the continued deterioration in the job market since then necessitated a larger rate cut to fill the gap.

Newly appointed Federal Reserve official Stephen Milan, aligning with the president's stance (who has called for more aggressive easing), could even vote for a rate cut exceeding 50 basis points , but institutions expect him to ultimately favor a 50 basis point cut. However, given that most Fed members remain cautious about the impact of tariffs on inflation, a 25 basis point cut remains the most likely outcome, which is consistent with current market expectations.

The short-term U.S. Treasury yields are anchored to policy expectations, while the long-term volatility may intensify in the coming months.

The current 2-year Treasury yield remains around 3.5%, fully pricing in market expectations for a series of rate cuts. To lower the federal funds rate below the 2-year Treasury yield, the Fed would need to cut rates by a cumulative 100 basis points.

Judging from actual pricing, the current 2-year Treasury yield also implies an expectation of a further 25 basis point cut (a total of 125 basis points). To justify the current 2-year Treasury yield, the Federal Reserve would need to maintain this rate for another year.

In fact, if the Fed eventually lowers the federal funds rate to 3%-3.25% and keeps it unchanged, the reasonable valuation of the 2-year Treasury yield should be 3.4% - the current 3.5% yield includes a 10 basis point term uncertainty premium.

Therefore, unless the Fed lowers interest rates below 3%, the current 2-year Treasury yield is already in a reasonable valuation range. For example, if the Fed lowers interest rates to 2.75%-3%, the reasonable valuation of the 2-year Treasury yield should be 3.3% (3.2% base rate plus a 10 basis point premium).

The 10-year U.S. Treasury yield is currently just over 4%, corresponding to a 10-year Secured Overnight Financing Rate (SOFR) of approximately 3.5% (including a 50 basis point swap spread). When the Federal Reserve cuts interest rates by 50 basis points in September 2024, the 10-year SOFR briefly dips to 3.15%. However, this level is clearly too low given the Fed's plan to lower the federal funds rate to around 3% and maintain it there. Even if the 10-year SOFR remains at 3.5%, the spread above the future federal funds rate floor will only be 50 basis points.

Driven by the "interest rate cut frenzy," the 10-year SOFR may fall back to around 3.25%, but institutions believe this level represents a downward overshoot. The fair valuation for the 10-year SOFR is closer to 3.75% (corresponding to a 75 basis point spread), which implies that the fair value of the 10-year US Treasury yield should be 4.25%. This is the institution's multi-month view, driven by the belief that future inflation could rise to around 3.5% due to tariffs.

"Interest rate cut fever" is a comprehensive phenomenon characterized by highly concentrated expectations of central bank interest rate cuts in the financial market, a surge in discussion heat, and the resulting sharp fluctuations in market behavior and asset prices.

The Federal Reserve may release a signal of reserve management, and the current liquidity is relatively ample and the risk is temporarily controllable.

Regarding liquidity management, the Federal Reserve may comment on bank reserve management. The current context is that the US Treasury is increasing cash balances by accelerating the issuance of short-term Treasury bills, which in turn is putting downward pressure on bank reserves. While institutions are currently optimistic about this, it remains to be seen whether the Fed will officially announce its stance.

Foreign exchange market outlook: The US dollar continues to depreciate moderately, and the path of commodity currencies and major currency pairs is clear.

Since the release of the key July U.S. jobs report on August 1, the U.S. dollar has fallen by approximately 2.5%. While the market has largely priced in a cumulative 125 basis points rate cut from the Federal Reserve, the resulting rate cut will still lower the three-month U.S. dollar interest rate—a key factor in foreign exchange hedging—and allow foreign asset managers to increase the hedge ratio of their U.S. assets.

The agency maintains its previous forecast: the euro will rise to 1.20 against the US dollar by the end of this year and to 1.22 by the end of 2026. Starting in October, seasonal factors will suppress the US dollar, and the intensive speculation about the composition of the FOMC next year will not provide support for the US dollar.

The Federal Reserve will lower interest rates to a neutral level while avoiding a recession. This operation will be beneficial to both economic activities and commodity currencies.

The Australian dollar is currently the most favored commodity currency by institutions, which could receive additional support if China's consumption situation shows marginal improvement. In an environment of moderate US dollar depreciation, the USD/JPY exchange rate may lag behind: uncertainty over the next leader of Japan's Liberal Democratic Party is suppressing the yen's performance.

At present, the agency still predicts that the Bank of Japan will raise interest rates in October (about 26 days after the end of the Liberal Democratic Party leadership election), but it should be noted that if the new government restarts policies similar to those of the Abe era, it may break the agency's current forecast (that the USD/JPY exchange rate will fall to 140 by the end of the year).

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.