The Bank of Japan is caught in the eye of a debt crisis! Is a collapse in the yen imminent?

2025-09-16 10:16:55

Government debt puts Japan in a dilemma

Japan's total government debt currently stands at 240% of GDP. This high debt ratio is not new—it reached 210% as early as 2010. Given that Japan has been able to stay afloat for over a decade without a crisis, why is it a problem now?

There are two reasons for this: First, the sharp rise in global debt levels following the pandemic has significantly reduced market tolerance for runaway fiscal policies. After all, the UK and France, whose debt levels are much lower than Japan’s, are now struggling with earlier debt crises.

Second, pre-pandemic inflation seemed to remain permanently low, meaning the yield curve would remain low and flat – an assumption that has now been completely overturned.

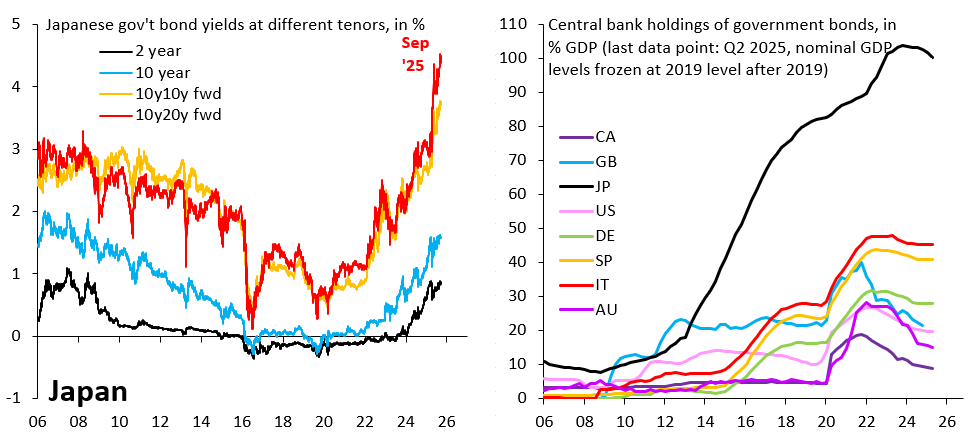

The left-hand chart above illustrates the dynamics of Japan's yield curve. It shows the two-year yield (black line), the ten-year yield (blue line), the 10-year forward 10-year yield (orange line), and the 20-year forward 10-year yield (red line). The latter two are derived from 10-, 20-, and 30-year government bond yields, reflecting the market's pricing of 10-year yields 10 and 20 years from now.

What is striking is the magnitude of the surge in the 20-year forward 10-year yield – as shown in the chart on the right – which stems in part from the Bank of Japan’s attempts to divest from its massive government debt holdings. This sharp rise in forward yields is all the more striking given the Bank of Japan’s limited progress in this area.

Some might argue that if the reduction of its central bank's balance sheet causes yields to soar, the Bank of Japan could simply hold its current holdings. However, the issue is more complex. In recent years, as global interest rates have risen, the yen has depreciated by 25% against the dollar. The Bank of Japan faces pressure to follow the rise in global yields, fearing it could plunge the yen into a new downward spiral.

Crucially, Japan's exceptionally high government debt has placed it in a dilemma: if it maintains a low-interest rate policy, it risks further depreciating the yen and causing runaway inflation; but if it stabilizes the yen by allowing yields to rise further, it could jeopardize the sustainability of Japan's debt . This dilemma means that Japan is closer to a debt crisis than people think.

Of course, a debt crisis is not inevitable. A US recession could drive down global yields, buying Japan time. Ultimately, however, the only sustainable way out of this predicament is through spending cuts or tax increases (or both). For Japanese citizens to accept such an approach, either a further significant rise in Japanese yields or a deeper depreciation of the yen would likely be necessary.

Analysis of potential impact on USD/JPY

Expectations of a growing Japanese debt crisis are weighing on the yen's creditworthiness. While high debt levels are not new, rising global yields raise serious questions about the sustainability of Japan's debt. If market concerns about the creditworthiness of Japanese bonds intensify, international capital could flow out of yen assets, dragging down the yen's exchange rate.

Long-term yields in Japan have risen significantly, with forward rates in particular rising sharply, reflecting a market repricing of long-term inflation and debt risks. While rising yields could theoretically attract capital inflows and support the yen, the current drivers, primarily debt concerns and expectations of a Bank of Japan balance sheet reduction, have instead highlighted fundamental vulnerabilities and weakened the yen's appeal.

Whether Japan can avoid a debt crisis depends on the progress of its fiscal consolidation and the global interest rate environment. However, in the absence of effective fiscal reforms, market concerns about debt sustainability are likely to persist, keeping the yen weak. Upside risks to the USD/JPY pair remain higher than downside risks, and whether it breaks through key levels will depend on the Bank of Japan's policy decisions and global bond market trends.

At 9:57 Beijing time, the US dollar was trading at 147.33/34 against the Japanese yen.

- Risk Warning and Disclaimer

- The market involves risk, and trading may not be suitable for all investors. This article is for reference only and does not constitute personal investment advice, nor does it take into account certain users’ specific investment objectives, financial situation, or other needs. Any investment decisions made based on this information are at your own risk.